Answered step by step

Verified Expert Solution

Question

1 Approved Answer

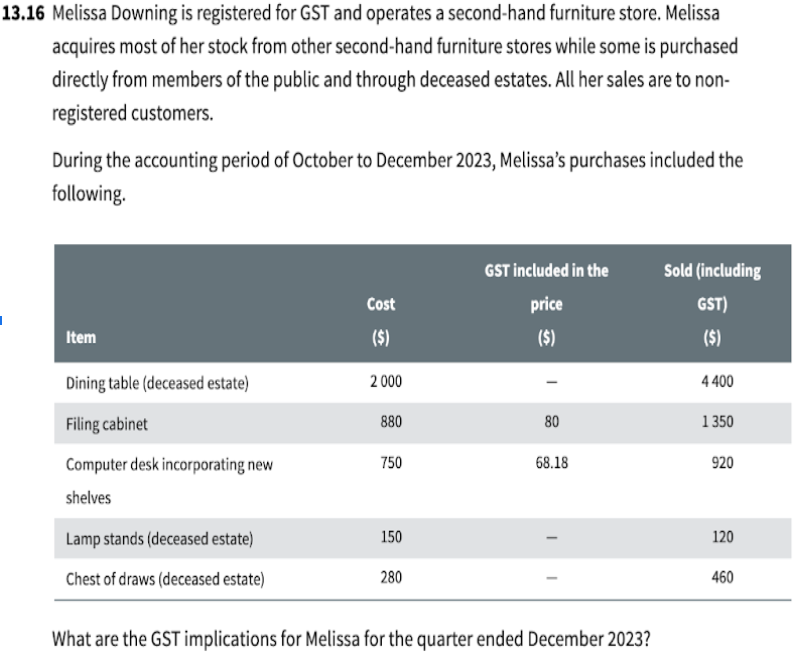

13.16 Melissa Downing is registered for GST and operates a second-hand furniture store. Melissa acquires most of her stock from other second-hand furniture stores

13.16 Melissa Downing is registered for GST and operates a second-hand furniture store. Melissa acquires most of her stock from other second-hand furniture stores while some is purchased directly from members of the public and through deceased estates. All her sales are to non- registered customers. During the accounting period of October to December 2023, Melissa's purchases included the following. GST included in the Sold (including Cost price GST) Item ($) ($) Dining table (deceased estate) 2000 ($) 4400 Filing cabinet 880 80 1350 Computer desk incorporating new shelves 750 68.18 920 Lamp stands (deceased estate) 150 280 120 460 Chest of draws (deceased estate) What are the GST implications for Melissa for the quarter ended December 2023?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started