Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13-17 thx Airlines just announced that its annual dividend for thi dividends are expected to increa s coming year of 13. Gamma 2.5% annually. if

13-17 thx

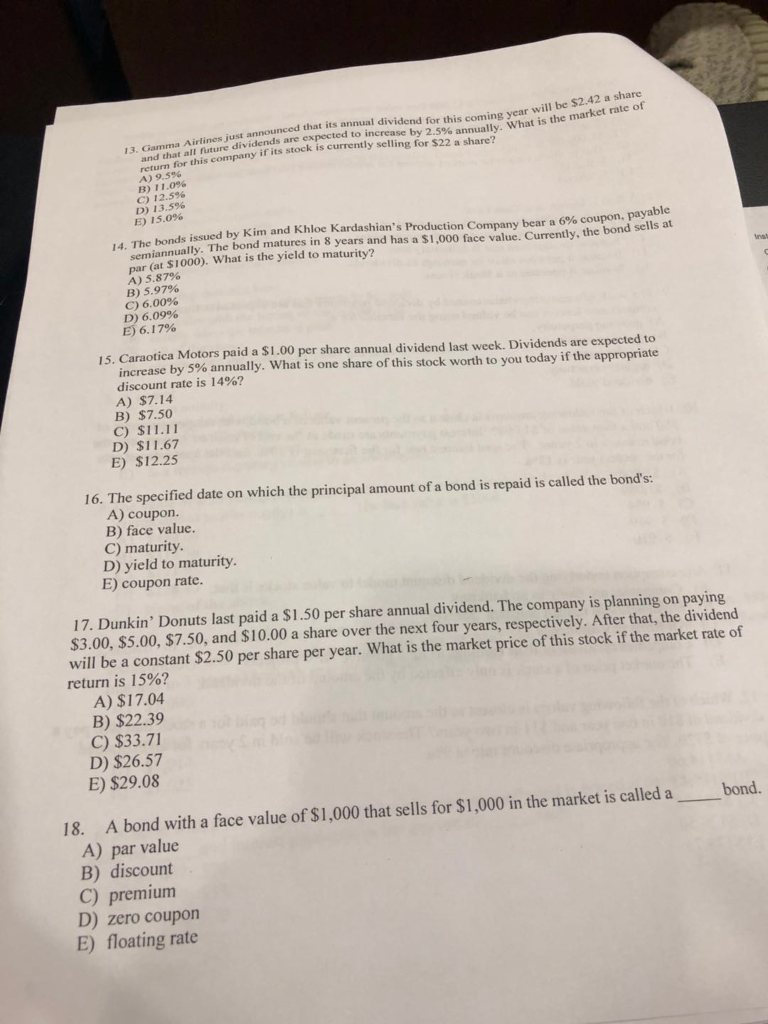

Airlines just announced that its annual dividend for thi dividends are expected to increa s coming year of 13. Gamma 2.5% annually. if its stock is currently selling for $22 a share? and that all future for this company A) 9.5% B) 11.0% C) 12.5% D) 13.5% E) 15.0% bonds issued by Kim and Khloe Kardashian's Production Company bear a 6% coupon, payable iannually. The bond matures in 8 years and has a $1,000 face value. Currently, the bond sells at 14. The semi par (at $1000). What is the yield to maturity? A) 5.87% B) 5.97% C) 6.00% D) 6.09% inst E96.17% 15. Caraotica Motors paid a $1.00 per share annual dividend last week. Dividends are expected to increase by 5% annually. What is one share of this stock worth to you today if the appropriate discount rate is 14%? A) $7.14 B) $7.50 C) $11.11 D) $11.67 E) S12.25 16. The specified date on which the principal amount of a bond is repaid is called the bond's A) coupon. B) face value. C) maturity. D) yield to maturity. E) coupon rate. 17. Dunkin' Donuts last paid a $1.50 per share annual dividend. The company is planning on paying $3.00, $5.00, $7.50, and $10.00 a share over the next four years, respectively. After that, the dividend will be a constant $2.50 per share per year. What is the market price of this stock if the market rate of return is 15%? A) $17.04 B) $22.39 C) $33.71 D) $26.57 E) $29.08 18. A bond with a face value of S1,000 that sells for $1,000 in the market is called a bond. A) par value B) discount C) premium D) zero coupon E) floating rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started