Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a new used to purchase this property. tiating a new compensation package for the coming year. As he is looking to purchase a Fred

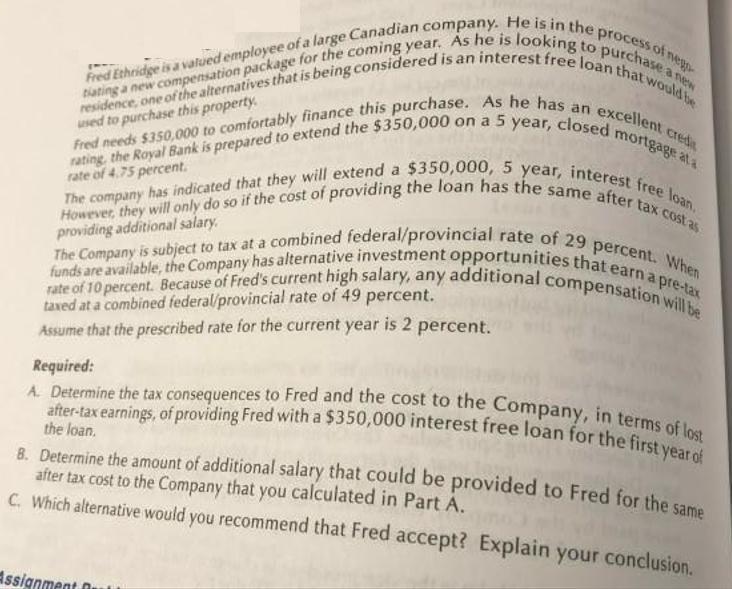

a new used to purchase this property. tiating a new compensation package for the coming year. As he is looking to purchase a Fred Ethridge is a valued employee of a large Canadian company. He is in the process of nego residence, one of the alternatives that is being considered is an interest free loan that would be rating, the Royal Bank is prepared to extend the $350,000 on a 5 year, closed mortgage at a Fred needs $350,000 to comfortably finance this purchase. As he has an excellent creda However, they will only do so if the cost of providing the loan has the same after tax cost as The company has indicated that they will extend a $350,000, 5 year, interest free loan. funds are available, the Company has alternative investment opportunities that earn a pre-tax The Company is subject to tax at a combined federal/provincial rate of 29 percent. When rate of 10 percent. Because of Fred's current high salary, any additional compensation will be rate of 4.75 percent. providing additional salary. taxed at a combined federal/provincial rate of 49 percent. Assume that the prescribed rate for the current year is 2 percent. Required: A. Determine the tax consequences to Fred and the cost to the Company, in terms of lost after-tax earnings, of providing Fred with a $350,000 interest free loan for the first year of the loan. B. Determine the amount of additional salary that could be provided to Fred for the same after tax cost to the Company that you calculated in Part A. C. Which alternative would you recommend that Fred accept? Explain your conclusion. Assignment Gr

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A To determine the tax consequences to Fred and the cost to the Company of providing the 350000 inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started