Question

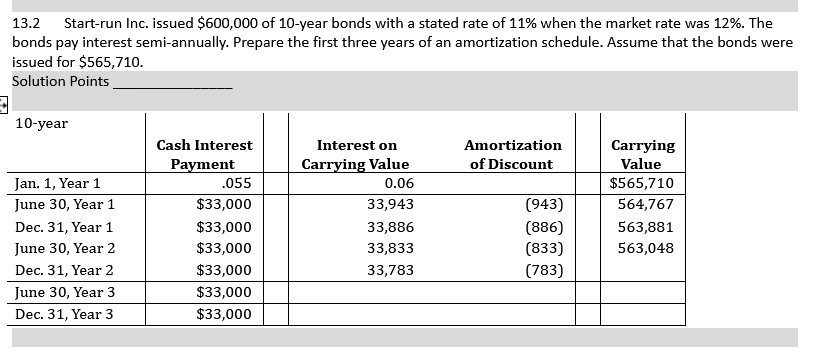

13.2 Start-run Inc. issued $600,000 of 10-year bonds with a stated rate of 11% when the market rate was 12%. The bonds pay interest

13.2 Start-run Inc. issued $600,000 of 10-year bonds with a stated rate of 11% when the market rate was 12%. The bonds pay interest semi-annually. Prepare the first three years of an amortization schedule. Assume that the bonds were issued for $565,710. Solution Points 10-year Cash Interest Payment Interest on Carrying Value Amortization Carrying of Discount Value Jan. 1, Year 1 .055 0.06 $565,710 June 30, Year 1 $33,000 33,943 (943) 564,767 Dec. 31, Year 1 $33,000 33,886 (886) 563,881 June 30, Year 2 $33,000 33,833 (833) 563,048 Dec. 31, Year 2 $33,000 33,783 (783) June 30, Year 3 $33,000 Dec. 31, Year 3 $33,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Accounting Volume 1 Financial Accounting

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

1st Edition

1593995946, 978-1593995942

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App