Answered step by step

Verified Expert Solution

Question

1 Approved Answer

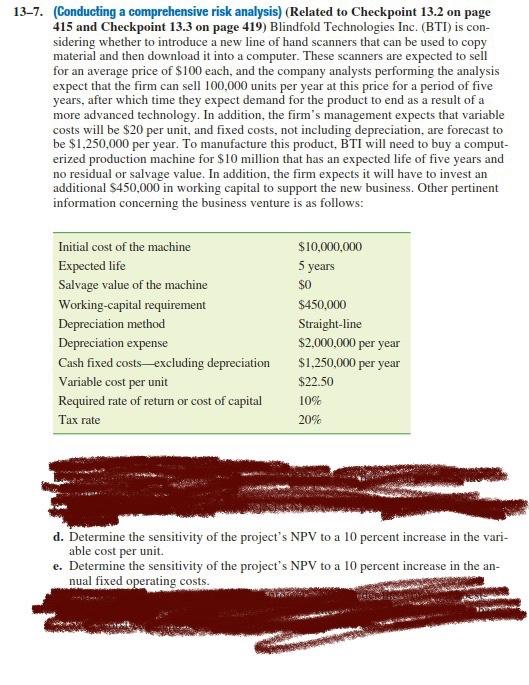

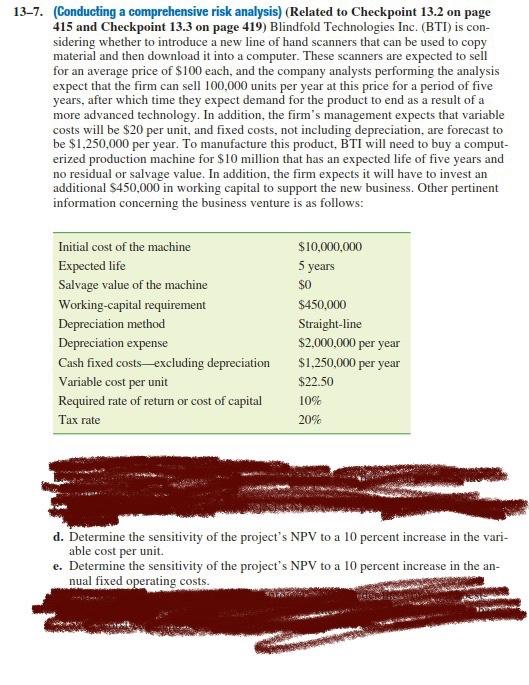

137. (Conducting a comprehensive risk analysis) (Related to Checkpoint 13.2 on page 415 and Checkpoint 13.3 on page 419) Blindfold Technologies Inc. (BTI) is con-

137. (Conducting a comprehensive risk analysis) (Related to Checkpoint 13.2 on page 415 and Checkpoint 13.3 on page 419) Blindfold Technologies Inc. (BTI) is con- sidering whether to introduce a new line of hand scanners that can be used to copy material and then download it into a computer. These scanners are expected to sell for an average price of $100 each, and the company analysts performing the analysis expect that the firm can sell 100,000 units per year at this price for a period of five years, after which time they expect demand for the product to end as a result of a more advanced technology. In addition, the firm's management expects that variable costs will be $20 per unit, and fixed costs, not including depreciation, are forecast to be $1,250,000 per year. To manufacture this product, BTI will need to buy a comput- erized production machine for $10 million that has an expected life of five years and no residual or salvage value. In addition, the firm expects it will have to invest an additional $450,000 in working capital to support the new business. Other pertinent information concerning the business venture is as follows: Initial cost of the machine Expected life Salvage value of the machine Working-capital requirement Depreciation method Depreciation expense Cash fixed costsexcluding depreciation Variable cost per unit Required rate of return or cost of capital Tax rate $10,000,000 5 years $0 $450,000 Straight-line $2,000,000 per year $1,250,000 per year $22.50 10% 20% d. Determine the sensitivity of the project's NPV to a 10 percent increase in the vari- able cost per unit. e. Determine the sensitivity of the project's NPV to a 10 percent increase in the an- nual fixed operating costs

137. (Conducting a comprehensive risk analysis) (Related to Checkpoint 13.2 on page 415 and Checkpoint 13.3 on page 419) Blindfold Technologies Inc. (BTI) is con- sidering whether to introduce a new line of hand scanners that can be used to copy material and then download it into a computer. These scanners are expected to sell for an average price of $100 each, and the company analysts performing the analysis expect that the firm can sell 100,000 units per year at this price for a period of five years, after which time they expect demand for the product to end as a result of a more advanced technology. In addition, the firm's management expects that variable costs will be $20 per unit, and fixed costs, not including depreciation, are forecast to be $1,250,000 per year. To manufacture this product, BTI will need to buy a comput- erized production machine for $10 million that has an expected life of five years and no residual or salvage value. In addition, the firm expects it will have to invest an additional $450,000 in working capital to support the new business. Other pertinent information concerning the business venture is as follows: Initial cost of the machine Expected life Salvage value of the machine Working-capital requirement Depreciation method Depreciation expense Cash fixed costsexcluding depreciation Variable cost per unit Required rate of return or cost of capital Tax rate $10,000,000 5 years $0 $450,000 Straight-line $2,000,000 per year $1,250,000 per year $22.50 10% 20% d. Determine the sensitivity of the project's NPV to a 10 percent increase in the vari- able cost per unit. e. Determine the sensitivity of the project's NPV to a 10 percent increase in the an- nual fixed operating costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started