Answered step by step

Verified Expert Solution

Question

1 Approved Answer

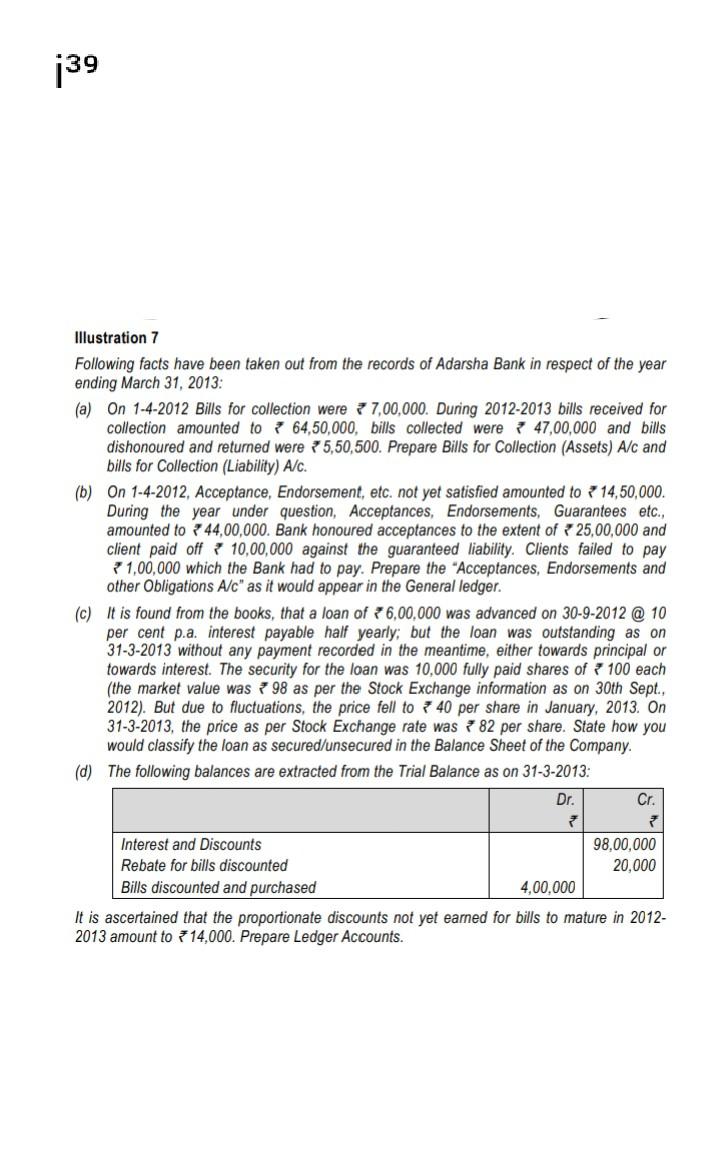

139 Illustration 7 Following facts have been taken out from the records of Adarsha Bank in respect of the year ending March 31, 2013: (a)

139 Illustration 7 Following facts have been taken out from the records of Adarsha Bank in respect of the year ending March 31, 2013: (a) On 1-4-2012 Bills for collection were 7,00,000. During 2012-2013 bills received for collection amounted to 64,50,000, bills collected were 47,00,000 and bills dishonoured and returned were 75,50,500. Prepare Bills for Collection (Assets) A/c and bills for Collection (Liability) A/C. (b) On 1-4-2012, Acceptance, Endorsement, etc. not yet satisfied amounted to 14,50,000. During the year under question, Acceptances, Endorsements, Guarantees etc., amounted to 44,00,000. Bank honoured acceptances to the extent of 25,00,000 and client paid off 10,00,000 against the guaranteed liability. Clients failed to pay 31,00,000 which the Bank had to pay. Prepare the "Acceptances, Endorsements and other Obligations A/c" as it would appear in the General ledger. (c) It is found from the books, that a loan of 76,00,000 was advanced on 30-9-2012 @ 10 per cent p.a. interest payable half yearly; but the loan was outstanding as on 31-3-2013 without any payment recorded in the meantime, either towards principal or towards interest. The security for the loan was 10,000 fully paid shares of 100 each (the market value was 798 as per the Stock Exchange information as on 30th Sept., 2012). But due to fluctuations, the price fell to 40 per share in January, 2013. On 31-3-2013, the price as per Stock Exchange rate was 782 per share. State how you would classify the loan as secured/unsecured in the Balance Sheet of the Company. (d) The following balances are extracted from the Trial Balance as on 31-3-2013: Dr. Cr. Interest and Discounts 98,00,000 Rebate for bills discounted 20,000 Bills discounted and purchased 4,00.000 It is ascertained that the proportionate discounts not yet earned for bills to mature in 2012- 2013 amount to 14,000. Prepare Ledger Accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started