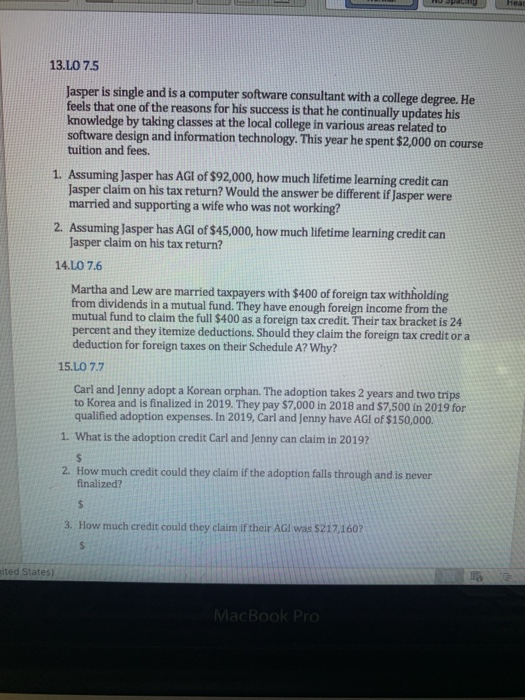

13.LO 7.5 Jasper is single and is a computer software consultant with a college degree. He feels that one of the reasons for his success is that he continually updates his knowledge by taking classes at the local college in various areas related to software design and information technology. This year he spent $2,000 on course tuition and fees. 1. Assuming Jasper has AGI of $92,000, how much lifetime learning credit can Jasper claim on his tax return? Would the answer be different if Jasper were married and supporting a wife who was not working? 2. Assuming Jasper has AGI of $45,000, how much lifetime learning credit can Jasper claim on his tax return? 14.LO 7.6 Martha and Lew are married taxpayers with $400 of foreign tax withholding from dividends in a mutual fund. They have enough foreign income from the mutual fund to claim the full $400 as a foreign tax credit. Their tax bracket is 24 percent and they itemize deductions. Should they claim the foreign tax creditor a deduction for foreign taxes on their Schedule A? Why? 15.LO 7.7 Carl and Jenny adopt a Korean orphan. The adoption takes 2 years and two trips to Korea and is finalized in 2019. They pay $7,000 in 2018 and $7,500 in 2019 for qualified adoption expenses. In 2019, Carl and Jenny have AGI of $150,000. 1. What is the adoption credit Carl and Jenny can claim in 2019? 2. How much credit could they claim if the adoption falls through and is never finalized? 3. How much credit could they claim if their AGI was $217.1602 nited States) MacBook Pro 13.LO 7.5 Jasper is single and is a computer software consultant with a college degree. He feels that one of the reasons for his success is that he continually updates his knowledge by taking classes at the local college in various areas related to software design and information technology. This year he spent $2,000 on course tuition and fees. 1. Assuming Jasper has AGI of $92,000, how much lifetime learning credit can Jasper claim on his tax return? Would the answer be different if Jasper were married and supporting a wife who was not working? 2. Assuming Jasper has AGI of $45,000, how much lifetime learning credit can Jasper claim on his tax return? 14.LO 7.6 Martha and Lew are married taxpayers with $400 of foreign tax withholding from dividends in a mutual fund. They have enough foreign income from the mutual fund to claim the full $400 as a foreign tax credit. Their tax bracket is 24 percent and they itemize deductions. Should they claim the foreign tax creditor a deduction for foreign taxes on their Schedule A? Why? 15.LO 7.7 Carl and Jenny adopt a Korean orphan. The adoption takes 2 years and two trips to Korea and is finalized in 2019. They pay $7,000 in 2018 and $7,500 in 2019 for qualified adoption expenses. In 2019, Carl and Jenny have AGI of $150,000. 1. What is the adoption credit Carl and Jenny can claim in 2019? 2. How much credit could they claim if the adoption falls through and is never finalized? 3. How much credit could they claim if their AGI was $217.1602 nited States) MacBook Pro