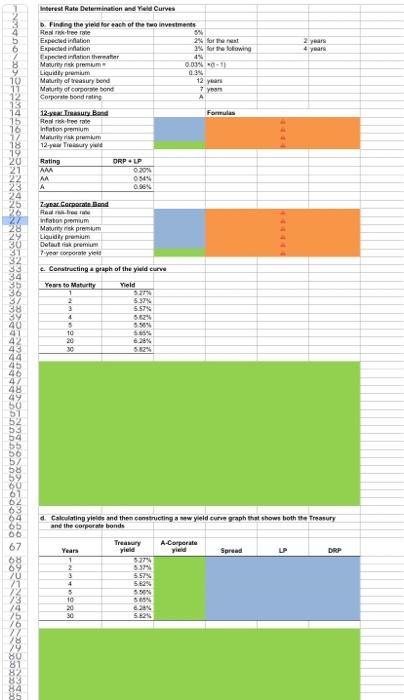

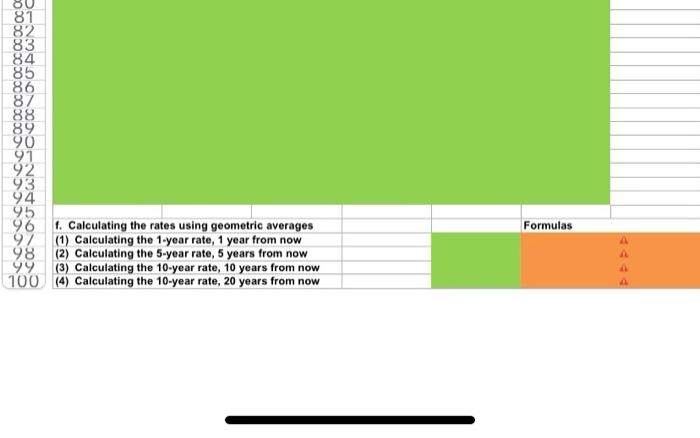

14 20 21 22 23 24 25 29 30 00000000000000000 5 OCNOU DN.CO Interest Rate Determination and Yield Curves b. Finding the yield for each of the two investments Real re-tree rate 5% 2% for the next Expected inflation Expected inflation 3% for the following 4% Expected inflation theater Maturty nek pr k premium Liquitty premium 0.03% -11 0.3% 12 years Maturity of treasury bend Maturty of corporate bond Corporate bond rating 7 year 12-ysa Treasury Band Formulas Real risk-free rane inflation premium Maurity risk premium 12-year Treasury yield Rating AMA 0.20% 054% AA A 0.96% Z-year Corporate Bond Red brore infaton premium Maturty k premum Liquidity premium Detaut rak premium 7-year corporate y c. Constructing a graph of the yield curve Years to Maturity Yield 5.37% 5.37% 3 5.57% A 5.82% 5 5.50% 10 5.85% 20 6.28% 30 5.82% d. Calculating yields and then constructing a new yield curve graph that shows both the Treasury and the corporate bonds Treasury yield A-Corporate yield Years Spread DRP 3 2 2 3 4 + 5 10 20 30 ORP LP 5.37% 6.57% 582% 5.50% 5.85% 6.28% 5.82% 444444 2 years 4 years 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 f. Calculating the rates using geometric averages 9/ (1) Calculating the 1-year rate, 1 year from now 98 (2) Calculating the 5-year rate, 5 years from now (3) Calculating the 10-year rate, 10 years from now 100 (4) Calculating the 10-year rate, 20 years from now Formulas 4444 14 20 21 22 23 24 25 29 30 00000000000000000 5 OCNOU DN.CO Interest Rate Determination and Yield Curves b. Finding the yield for each of the two investments Real re-tree rate 5% 2% for the next Expected inflation Expected inflation 3% for the following 4% Expected inflation theater Maturty nek pr k premium Liquitty premium 0.03% -11 0.3% 12 years Maturity of treasury bend Maturty of corporate bond Corporate bond rating 7 year 12-ysa Treasury Band Formulas Real risk-free rane inflation premium Maurity risk premium 12-year Treasury yield Rating AMA 0.20% 054% AA A 0.96% Z-year Corporate Bond Red brore infaton premium Maturty k premum Liquidity premium Detaut rak premium 7-year corporate y c. Constructing a graph of the yield curve Years to Maturity Yield 5.37% 5.37% 3 5.57% A 5.82% 5 5.50% 10 5.85% 20 6.28% 30 5.82% d. Calculating yields and then constructing a new yield curve graph that shows both the Treasury and the corporate bonds Treasury yield A-Corporate yield Years Spread DRP 3 2 2 3 4 + 5 10 20 30 ORP LP 5.37% 6.57% 582% 5.50% 5.85% 6.28% 5.82% 444444 2 years 4 years 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 f. Calculating the rates using geometric averages 9/ (1) Calculating the 1-year rate, 1 year from now 98 (2) Calculating the 5-year rate, 5 years from now (3) Calculating the 10-year rate, 10 years from now 100 (4) Calculating the 10-year rate, 20 years from now Formulas 4444