Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14) A company plans to raise funds by offering its shares to the public, and it intends to use an offer for sale at

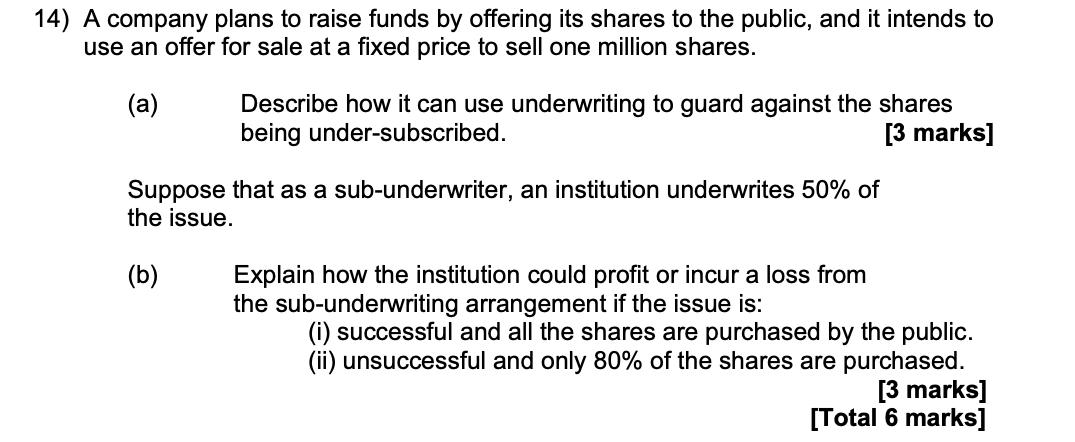

14) A company plans to raise funds by offering its shares to the public, and it intends to use an offer for sale at a fixed price to sell one million shares. (a) Describe how it can use underwriting to guard against the shares being under-subscribed. [3 marks] Suppose that as a sub-underwriter, an institution underwrites 50% of the issue. (b) Explain how the institution could profit or incur a loss from the sub-underwriting arrangement if the issue is: (i) successful and all the shares are purchased by the public. (ii) unsuccessful and only 80% of the shares are purchased. [3 marks] [Total 6 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

14 A When the company will be planning to raise the money from the public it can use the underwriters to guard against shares being an unsubscribed as underwriters will provide them with the guarantee that in case the shares are not subscribed by the general Public then underwriters will be making up for those unsubscribed shares and they will be subscribing those shares in case they are not be subscribed by the public so it will help the company in getting assurance that the issue will be fully subscribed B I if the issuance is fully subscribed by the general public then it will mean that underwriter ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started