Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14. A payroll deduction program can be set up by an employer to provide employees with pretax individual retirement accounts: 401(k) for private agencies

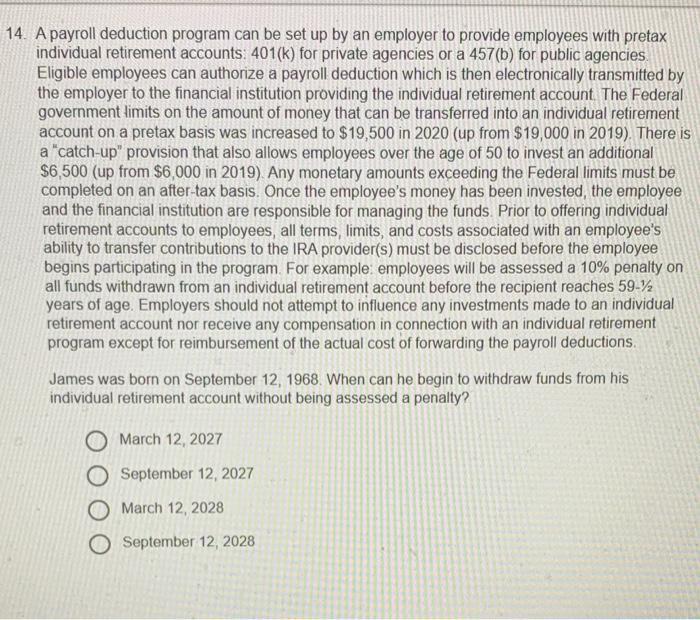

14. A payroll deduction program can be set up by an employer to provide employees with pretax individual retirement accounts: 401(k) for private agencies or a 457(b) for public agencies. Eligible employees can authorize a payroll deduction which is then electronically transmitted by the employer to the financial institution providing the individual retirement account. The Federal government limits on the amount of money that can be transferred into an individual retirement account on a pretax basis was increased to $19,500 in 2020 (up from $19,000 in 2019). There is a "catch-up" provision that also allows employees over the age of 50 to invest an additional $6,500 (up from $6,000 in 2019). Any monetary amounts exceeding the Federal limits must be completed on an after-tax basis. Once the employee's money has been invested, the employee and the financial institution are responsible for managing the funds. Prior to offering individual retirement accounts to employees, all terms, limits, and costs associated with an employee's ability to transfer contributions to the IRA provider(s) must be disclosed before the employee begins participating in the program. For example: employees will be assessed a 10% penalty on all funds withdrawn from an individual retirement account before the recipient reaches 59-% years of age. Employers should not attempt to influence any investments made to an individual retirement account nor receive any compensation in connection with an individual retirement program except for reimbursement of the actual cost of forwarding the payroll deductions. James was born on September 12, 1968. When can he begin to withdraw funds from his individual retirement account without being assessed a penalty? March 12, 2027 September 12, 2027 March 12, 2028 September 12, 2028

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To determine when James can begin to withdraw funds from his individual retirement ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started