Answered step by step

Verified Expert Solution

Question

1 Approved Answer

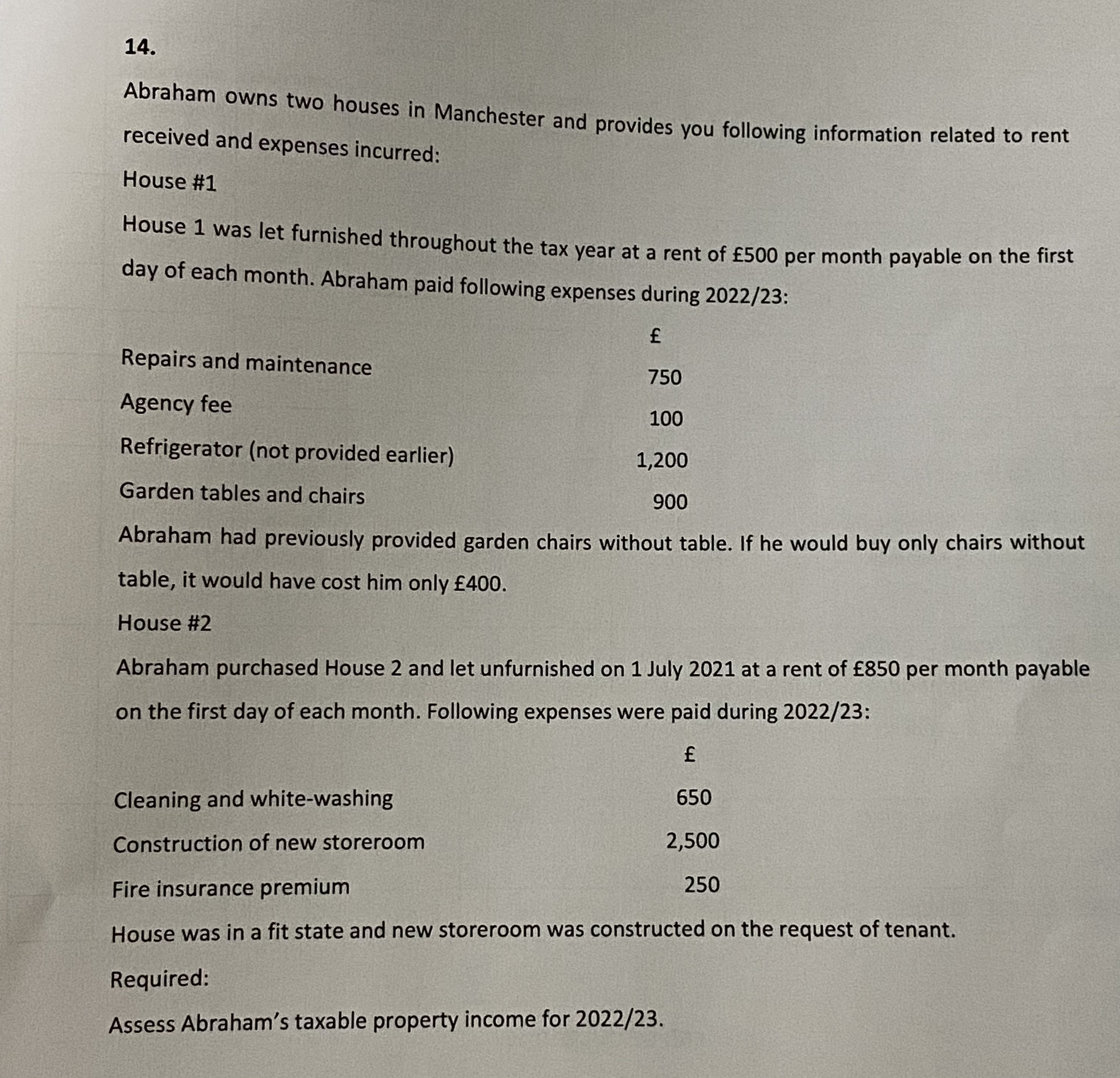

14. Abraham owns two houses in Manchester and provides you following information related to rent received and expenses incurred: House #1 House 1 was

14. Abraham owns two houses in Manchester and provides you following information related to rent received and expenses incurred: House #1 House 1 was let furnished throughout the tax year at a rent of 500 per month payable on the first day of each month. Abraham paid following expenses during 2022/23: Repairs and maintenance Agency fee Refrigerator (not provided earlier) Garden tables and chairs 750 100 1,200 900 Abraham had previously provided garden chairs without table. If he would buy only chairs without table, it would have cost him only 400. House #2 Abraham purchased House 2 and let unfurnished on 1 July 2021 at a rent of 850 per month payable on the first day of each month. Following expenses were paid during 2022/23: Cleaning and white-washing Construction of new storeroom Fire insurance premium 650 2,500 250 House was in a fit state and new storeroom was constructed on the request of tenant. Required: Assess Abraham's taxable property income for 2022/23.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started