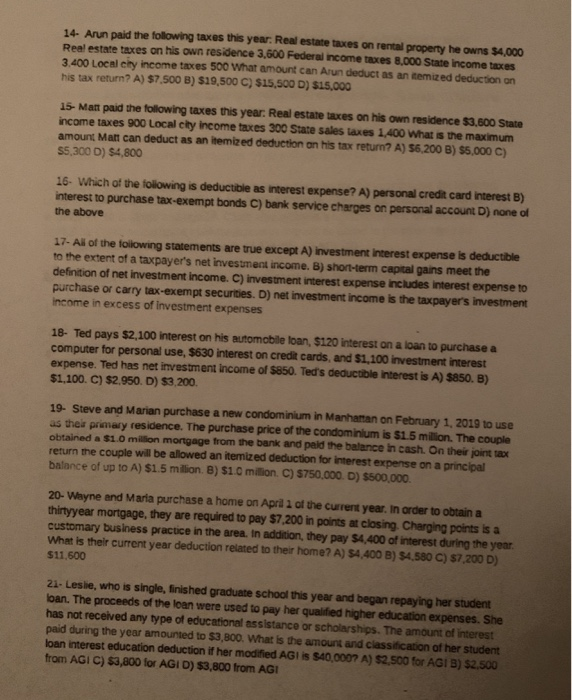

14- Arun paid the following taxes this year. Real estate taxes on rental property he owns $4,000 Real estate taxes on his own residence 3,600 Federal income taxes 8,000 State income taxes 3.400 Local cry income taxes 500 What amount can Arun deduct as an temized deduction on his tax return? A) $7,500 B) $19,500 C) $15,500 D) $15,000 15. Man paid the following taxes this year. Real estate taxes on his own residence $3.500 State income taxes 900 Local city Income taxes 300 State sales taxes 1,400 What is the maximum amount Man can deduct as an itemized deduction on his tax return? A) 56,200 B) $5,000 C) 55,200 D) $4,800 16. Which of the following is deductible as interest expense? A) personal credit card interest B) interest to purchase tax-exempt bonds C) bank service charges on personal account ) none of the above 17- All of the following statements are true except A) investment interest expense is deductible to the extent of a taxpayer's net investment income. B) short-term capital gains meet the definition of net investment income. C) investment interest expense Includes interest expense to purchase or carry tax-exempt securties. D) net investment income is the taxpayer's investment Income in excess of investment expenses 18- Ted pays $2,100 interest on his automobile loan, $120 interest on a loan to purchase a computer for personal use, $630 interest on credit cards, and $1,100 investment interest expense. Ted has net investment income of $850. Ted's deductible interest is A) $850. B) $1,100. C) $2.950. D) $3,200 19. Steve and Marian purchase a new condominium in Manhaan on February 1, 2019 to use as the primary residence. The purchase price of the condominium is $1.5 milion. The couple obtained a $1.0 million mortgage from the bank and paid the balance in cash. On their joint tax return the couple will be allowed an itemized deduction for interest expense on a principal balance of up to A) $1.5 million. B) $1.0 milion C) 5750.000. D) $500,000 20- Wayne and Maria purchase a home on April 1 of the current year. In order to obtain a thirtyyear mortgage, they are required to pay $7,200 in points at closing. Charging points is a customary business practice in the area. In addition, they pay $4,400 of interest during the year. What is their current year deduction related to their home? A) $4,400 B) $4.580 C) 57,200 D) $11.600 21- Leslie, who is single, finished graduate school this year and began repaying her student loan. The proceeds of the loan were used to pay her qualified higher education expenses. She has not received any type of educational assistance or scholarships. The amount of interest paid during the year amounted to $3,800. What is the amount and classification of her student loan interest education deduction if her modified AGI is $40,000? A) $2,500 for AGI B) $2,500 from AGI C) $3,800 for AGI D) $3,800 from AGI