Answered step by step

Verified Expert Solution

Question

1 Approved Answer

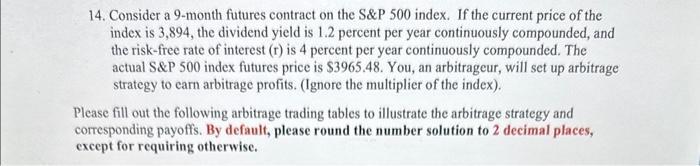

14. Consider a 9-month futures contract on the S&P 500 index. If the current price of the index is 3,894, the dividend yield is

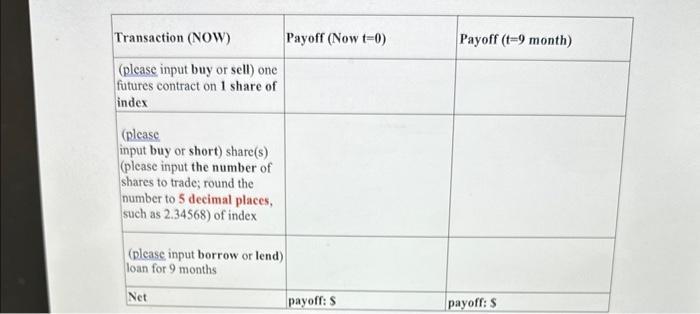

14. Consider a 9-month futures contract on the S&P 500 index. If the current price of the index is 3,894, the dividend yield is 1.2 percent per year continuously compounded, and the risk-free rate of interest (r) is 4 percent per year continuously compounded. The actual S&P 500 index futures price is $3965.48. You, an arbitrageur, will set up arbitrage strategy to earn arbitrage profits. (Ignore the multiplier of the index). Please fill out the following arbitrage trading tables to illustrate the arbitrage strategy and corresponding payoffs. By default, please round the number solution to 2 decimal places, except for requiring otherwise. Transaction (NOW) (please input buy or sell) one futures contract on 1 share of index (please input buy or short) share(s) (please input the number of shares to trade; round the number to 5 decimal places, such as 2.34568) of index (please input borrow or lend) loan for 9 months Net Payoff (Now t-0) payoff: S Payoff (t-9 month) payoff: S

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started