Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14. HSU Inc., is currently an all-equity company. Its shares price is $50. Number of share outstanding are 15,000 . The firm has decided to

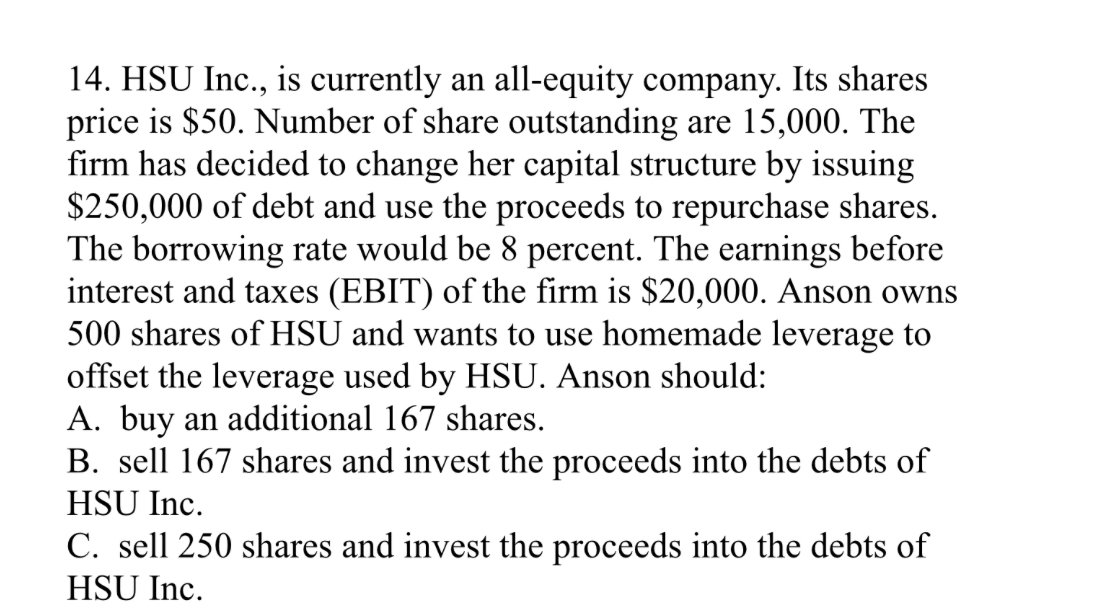

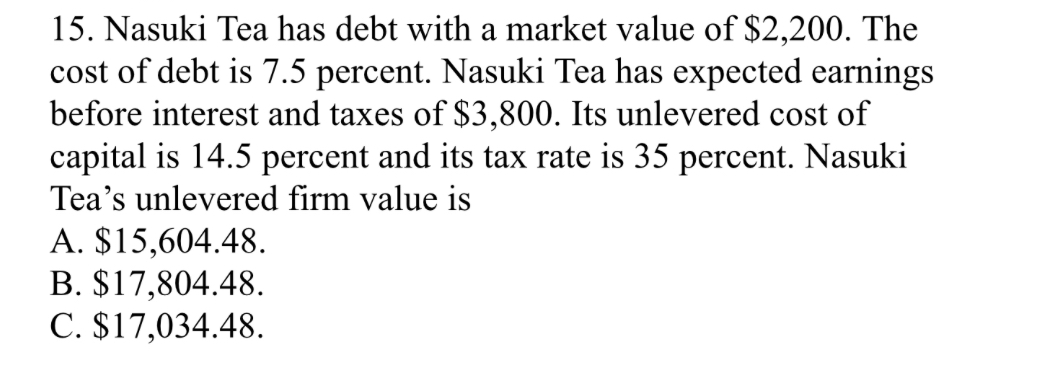

14. HSU Inc., is currently an all-equity company. Its shares price is $50. Number of share outstanding are 15,000 . The firm has decided to change her capital structure by issuing $250,000 of debt and use the proceeds to repurchase shares. The borrowing rate would be 8 percent. The earnings before interest and taxes (EBIT) of the firm is $20,000. Anson owns 500 shares of HSU and wants to use homemade leverage to offset the leverage used by HSU. Anson should: A. buy an additional 167 shares. B. sell 167 shares and invest the proceeds into the debts of HSU Inc. C. sell 250 shares and invest the proceeds into the debts of HSU Inc. 15. Nasuki Tea has debt with a market value of $2,200. The cost of debt is 7.5 percent. Nasuki Tea has expected earnings before interest and taxes of $3,800. Its unlevered cost of capital is 14.5 percent and its tax rate is 35 percent. Nasuki Tea's unlevered firm value is A. $15,604.48. B. $17,804.48. C. $17,034.48

14. HSU Inc., is currently an all-equity company. Its shares price is $50. Number of share outstanding are 15,000 . The firm has decided to change her capital structure by issuing $250,000 of debt and use the proceeds to repurchase shares. The borrowing rate would be 8 percent. The earnings before interest and taxes (EBIT) of the firm is $20,000. Anson owns 500 shares of HSU and wants to use homemade leverage to offset the leverage used by HSU. Anson should: A. buy an additional 167 shares. B. sell 167 shares and invest the proceeds into the debts of HSU Inc. C. sell 250 shares and invest the proceeds into the debts of HSU Inc. 15. Nasuki Tea has debt with a market value of $2,200. The cost of debt is 7.5 percent. Nasuki Tea has expected earnings before interest and taxes of $3,800. Its unlevered cost of capital is 14.5 percent and its tax rate is 35 percent. Nasuki Tea's unlevered firm value is A. $15,604.48. B. $17,804.48. C. $17,034.48 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started