Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14 ints Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not

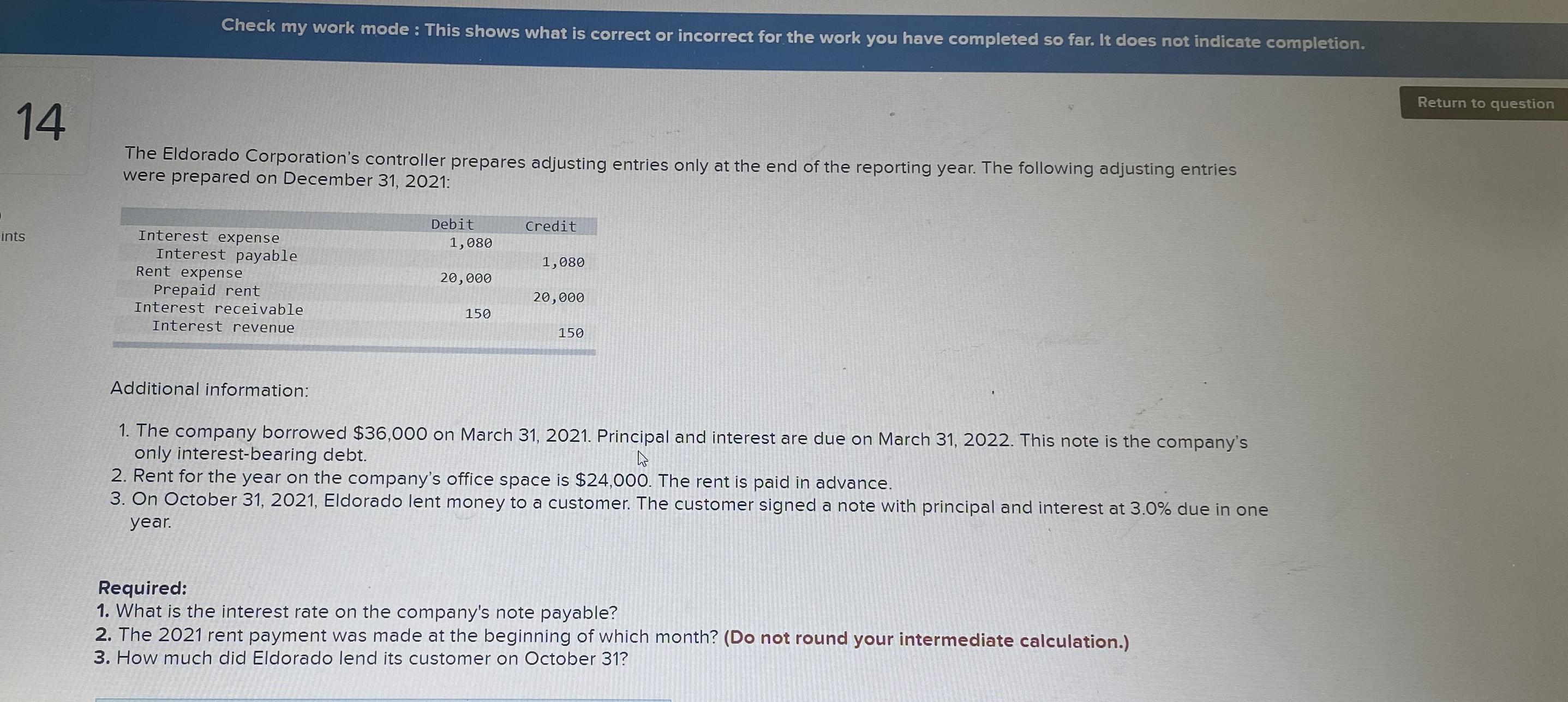

14 ints Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. The Eldorado Corporation's controller prepares adjusting entries only at the end of the reporting year. The following adjusting entries were prepared on December 31, 2021: Interest expense Interest payable Rent expense Prepaid rent Interest receivable Interest revenue Debit 1,080 20,000 150 Credit 1,080 20,000 150 Additional information: 1. The company borrowed $36,000 on March 31, 2021. Principal and interest are due on March 31, 2022. This note is the company's only interest-bearing debt. D 2. Rent for the year on the company's office space is $24,000. The rent is paid in advance. 3. On October 31, 2021, Eldorado lent money to a customer. The customer signed a note with principal and interest at 3.0% due in one year. Required: 1. What is the interest rate on the company's note payable? 2. The 2021 rent payment was made at the beginning of which month? (Do not round your intermediate calculation.) 3. How much did Eldorado lend its customer on October 31? Return to question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you provided shows a question from an accounting exercise that involves calculating interest rates determining the timing of a rent payment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started