Answered step by step

Verified Expert Solution

Question

1 Approved Answer

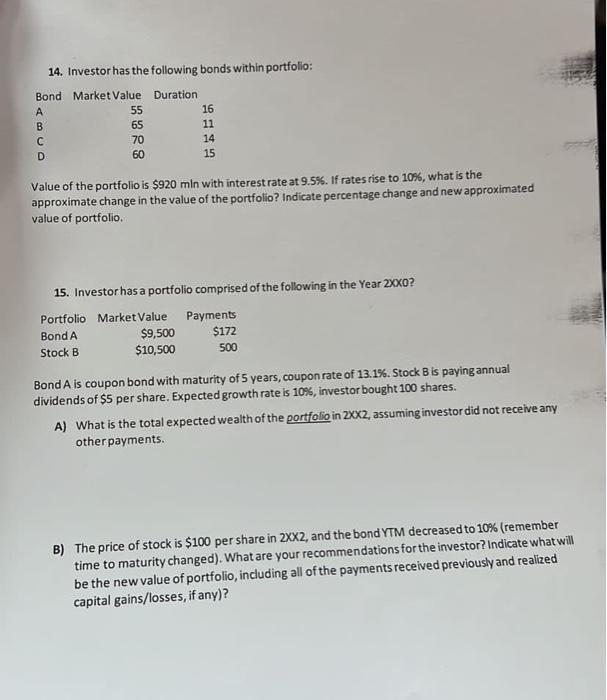

14. Investor has the following bonds within portfolio: Bond Market Value Duration ABCO 55 16 65 11 70 14 60 15 D Value of

14. Investor has the following bonds within portfolio: Bond Market Value Duration ABCO 55 16 65 11 70 14 60 15 D Value of the portfolio is $920 mln with interest rate at 9.5%. If rates rise to 10%, what is the approximate change in the value of the portfolio? Indicate percentage change and new approximated value of portfolio. 15. Investor has a portfolio comprised of the following in the Year 2XX0? Portfolio Market Value Bond A Stock B $9,500 $10,500 Payments $172 500 Bond A is coupon bond with maturity of 5 years, coupon rate of 13.1%. Stock B is paying annual dividends of $5 per share. Expected growth rate is 10%, investor bought 100 shares. A) What is the total expected wealth of the portfolio in 2XX2, assuming investor did not receive any other payments. B) The price of stock is $100 per share in 2XX2, and the bond YTM decreased to 10% (remember time to maturity changed). What are your recommendations for the investor? Indicate what will be the new value of portfolio, including all of the payments received previously and realized capital gains/losses, if any)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started