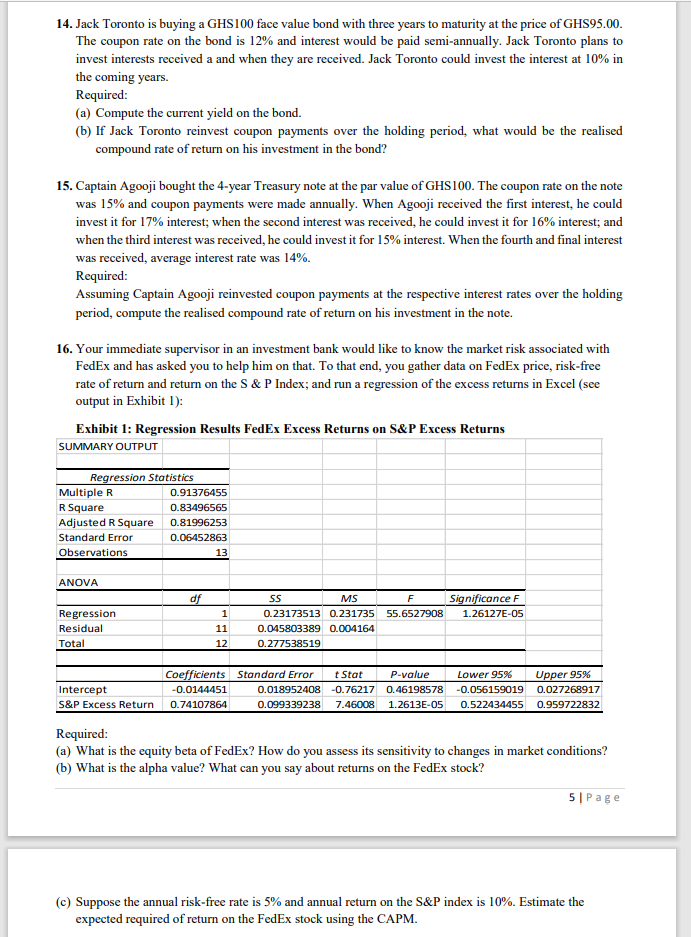

14. Jack Toronto is buying a GHS100 face value bond with three years to maturity at the price of GHS95.00. The coupon rate on the bond is 12% and interest would be paid semi-annually. Jack Toronto plans to invest interests received a and when they are received. Jack Toronto could invest the interest at 10% in the coming years. Required: (a) Compute the current yield on the bond. (b) If Jack Toronto reinvest coupon payments over the holding period, what would be the realised compound rate of return on his investment in the bond? 15. Captain Agooji bought the 4-year Treasury note at the par value of GHS100. The coupon rate on the note was 15% and coupon payments were made annually. When Agooji received the first interest, he could invest it for 17% interest; when the second interest was received, he could invest it for 16% interest; and when the third interest was received, he could invest it for 15% interest. When the fourth and final interest was received, average interest rate was 14%. Required: Assuming Captain Agooji reinvested coupon payments at the respective interest rates over the holding period, compute the realised compound rate of return on his investment in the note. 16. Your immediate supervisor in an investment bank would like to know the market risk associated with FedEx and has asked you to help him on that. To that end, you gather data on FedEx price, risk-free rate of return and return on the S & P Index; and run a regression of the excess returns in Excel (see output in Exhibit 1): Exhibit 1: Regression Results FedEx Excess Returns on S&P Excess Returns SUMMARY OUTPUT Regression Statistics Multiple R 0.91376455 R Square 0.83496565 Adjusted R Square 0.81996253 Standard Error 0.06452863 Observations 13 ANOVA df Significance F 1.26127E-05 Regression Residual Total 1 11 12 SS MS F 0.23173513 0.231735 55.6527908 0.045803389 0.004164 0.277538519 Intercept S&P Excess Return Coefficients Standard Error -0.0144451 0.018952408 0.74107864 0.099339238 t Stat P-value -0.76217 0.46198578 7.46008 1.2613E-05 Lower 95% -0.056159019 0.522434455 Upper 95% 0.027268917 0.959722832 Required: (a) What is the equity beta of FedEx? How do you assess its sensitivity to changes in market conditions? (b) What is the alpha value? What can you say about returns on the FedEx stock? 5 Page (c) Suppose the annual risk-free rate is 5% and annual return on the S&P index is 10%. Estimate the expected required of return on the FedEx stock using the CAPM