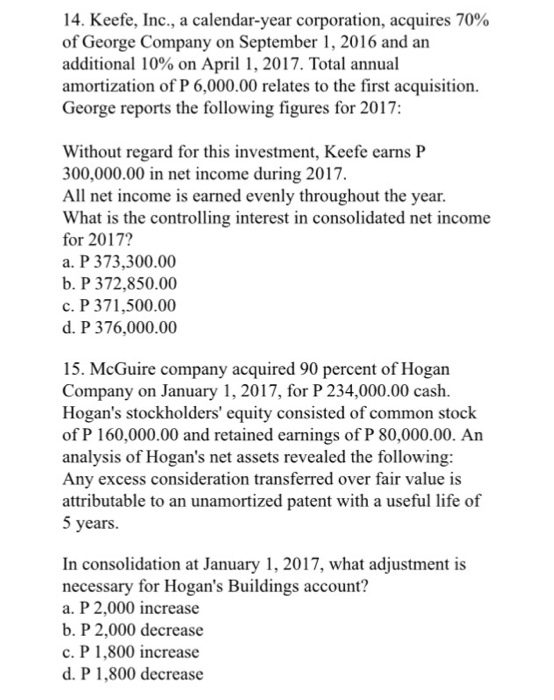

14. Keefe, Inc., a calendar-year corporation, acquires 70% of George Company on September 1, 2016 and an additional 10% on April 1, 2017, Total annual amortization of P 6,000.00 relates to the first acquisition. George reports the following figures for 2017: Without regard for this investment, Keefe earns P 300,000.00 in net income during 2017. All net income is earned evenly throughout the year What is the controlling interest in consolidated net income for 2017 a. P 373.300.00 b. P 372,850.00 c. P 371,500.00 d. P 376,000.00 15. McGuire company acquired 90 percent of Hogan Company on January 1, 2017, for P 234,000.00 cash Hogan's stockholders' equity consisted of common stock of P 160,000.00 and retained earnings of P 80,000.00. An analysis of Hogan's net assets revealed the following: Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years. In consolidation at January 1, 2017, what adjustment is necessary for Hogan's Buildings account? a. P 2,000 increase b. P 2,000 decrease c. P 1800 increase d. P 1,800 decrease 14. Keefe, Inc., a calendar-year corporation, acquires 70% of George Company on September 1, 2016 and an additional 10% on April 1, 2017, Total annual amortization of P 6,000.00 relates to the first acquisition. George reports the following figures for 2017: Without regard for this investment, Keefe earns P 300,000.00 in net income during 2017. All net income is earned evenly throughout the year What is the controlling interest in consolidated net income for 2017 a. P 373.300.00 b. P 372,850.00 c. P 371,500.00 d. P 376,000.00 15. McGuire company acquired 90 percent of Hogan Company on January 1, 2017, for P 234,000.00 cash Hogan's stockholders' equity consisted of common stock of P 160,000.00 and retained earnings of P 80,000.00. An analysis of Hogan's net assets revealed the following: Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years. In consolidation at January 1, 2017, what adjustment is necessary for Hogan's Buildings account? a. P 2,000 increase b. P 2,000 decrease c. P 1800 increase d. P 1,800 decrease