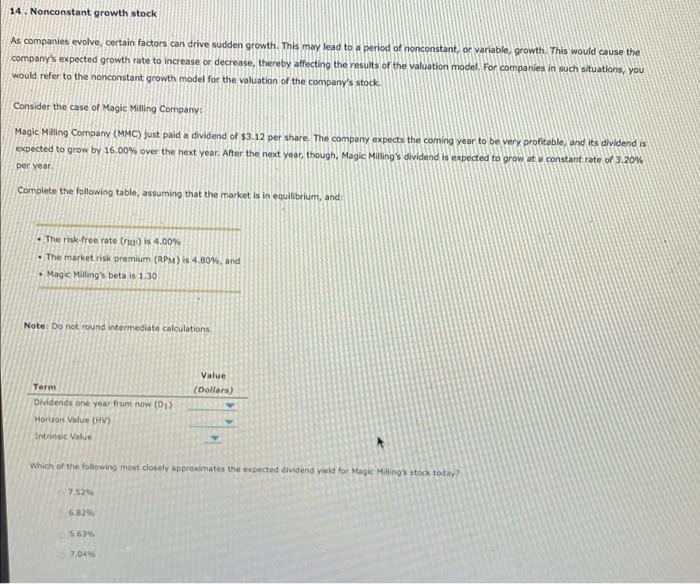

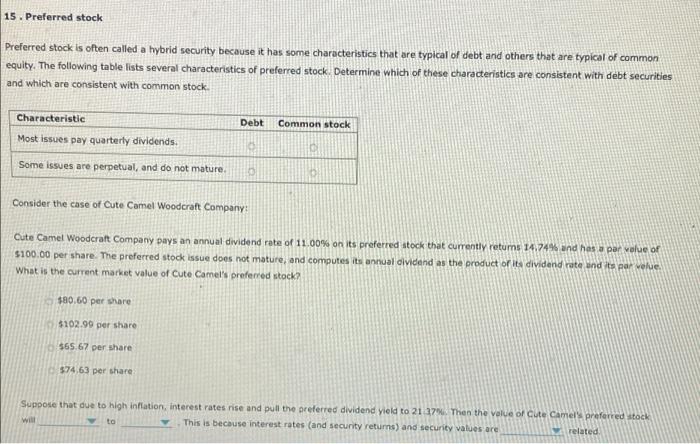

14. Nonconstant growth stock As companies evolve, certain factors can drive sudden growth. This may lead to a period of nonconstant or variable growth. This would cause the company's expected growth rate to increase or decrease, thereby affecting the results of the valuation model. For companies in such situations, you would refer to the nonconstant growth model for the valuation of the company's stock Consider the case of Magic Milling Company: Magic Milling Company (MMC) just paid a dividend of $3.12 per share. The company expects the coming year to be very profitable, and its dividend is expected to grow by 16.00% over the next year. After the next year, though, Magic Miling's dividend is expected to grow at a constant rate of 3.20% per year Complete the following table, assuming that the market is in equilibrium, and The risk-free rate (ru) is 4.00% The market risk premium (RPM) : 4.80% and Magic Milling's beta is 1.30 Note: Do not round intermediate calculations Value (Dollars) Term Dividends one year from now (0) Horizon Value (HV) Intrinsic Value Which of the following most closely approximates the expected dividend yield for Magic Milling stock today? 7:52 6.829 5.634 7.04 15. Preferred stock Preferred stock is often called a hybrid security because it has some characteristics that are typical of debt and others that are typical of common equity. The following table lists several characteristics of preferred stock. Determine which of these characteristics are consistent with debt securities and which are consistent with common stock. Debt Common stock Characteristic Most issues pay quarterly dividends. Some issues are perpetual, and do not mature. Consider the case of Cute Camel Woodcraft Company: Cute Camel Woodcraft Company pays an annual dividend rate of 11.00% on its preferred stock that currently returns 14,74% and has a par value of $100.00 per share. The preferred stock issue does not mature, and computes its annual dividend as the product or its dividend rate and its par le What is the current market value of Cute Camel's preferred stock $80.60 per share $102.99 per share $65.67 per share $74,63 per share Suppose that due to high inflation, interest rates rise and pull the preferred dividend yield to 21 27%. Then the value of cute Camel's preferred stock will to This is because interest rates (and security returns) and security values are related