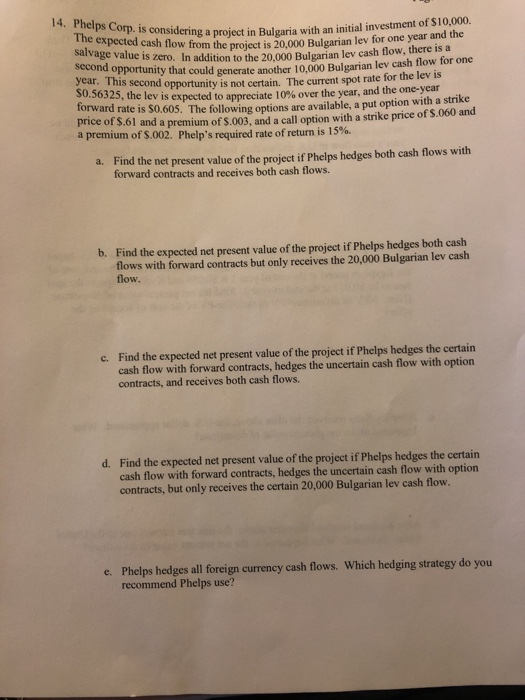

14. Phelps Corp. is considering a project The expected cash salvage value is zero. In a second opportunity that could generate a Corp. is considering a proiect in Bulgaria with an initial investment on cu cash flow from the project is 20.000 Bulgarian lev for one year and the se value is zero. In addition to the 20.000 Bulgarian lev cash flow, there is a pportunity that could generate another 10.000 Bulgarian lev cash flow for one year. This second opportunity is not certain. The current spot rate for the lev 15 0.50325, the lev is expected to appreciate 10% over the year, and the one-year forward rate is $0.605. The following options are available, a put option with a strike price of $.61 and a premium of 5.003. and a call option with a strike price of $.060 and a premium of $.002. Phelp's required rate of return is 15%. a. Find the net present value of the project if Phelps hedges both cash flows with forward contracts and receives both cash flows. b. Find the expected net present value of the project if Phelps hedges both cash flows with forward contracts but only receives the 20,000 Bulgarian lev cash flow. c. Find the expected net present value of the project if Phelps hedges the certain cash flow with forward contracts, hedges the uncertain cash flow with option contracts, and receives both cash flows. d. Find the expected net present value of the project if Phelps hedges the certain cash flow with forward contracts, hedges the uncertain cash flow with option contracts, but only receives the certain 20,000 Bulgarian lev cash flow. e. Phelps hedges all foreign currency cash flows. Which hedging strategy do you recommend Phelps use? 14. Phelps Corp. is considering a project The expected cash salvage value is zero. In a second opportunity that could generate a Corp. is considering a proiect in Bulgaria with an initial investment on cu cash flow from the project is 20.000 Bulgarian lev for one year and the se value is zero. In addition to the 20.000 Bulgarian lev cash flow, there is a pportunity that could generate another 10.000 Bulgarian lev cash flow for one year. This second opportunity is not certain. The current spot rate for the lev 15 0.50325, the lev is expected to appreciate 10% over the year, and the one-year forward rate is $0.605. The following options are available, a put option with a strike price of $.61 and a premium of 5.003. and a call option with a strike price of $.060 and a premium of $.002. Phelp's required rate of return is 15%. a. Find the net present value of the project if Phelps hedges both cash flows with forward contracts and receives both cash flows. b. Find the expected net present value of the project if Phelps hedges both cash flows with forward contracts but only receives the 20,000 Bulgarian lev cash flow. c. Find the expected net present value of the project if Phelps hedges the certain cash flow with forward contracts, hedges the uncertain cash flow with option contracts, and receives both cash flows. d. Find the expected net present value of the project if Phelps hedges the certain cash flow with forward contracts, hedges the uncertain cash flow with option contracts, but only receives the certain 20,000 Bulgarian lev cash flow. e. Phelps hedges all foreign currency cash flows. Which hedging strategy do you recommend Phelps use