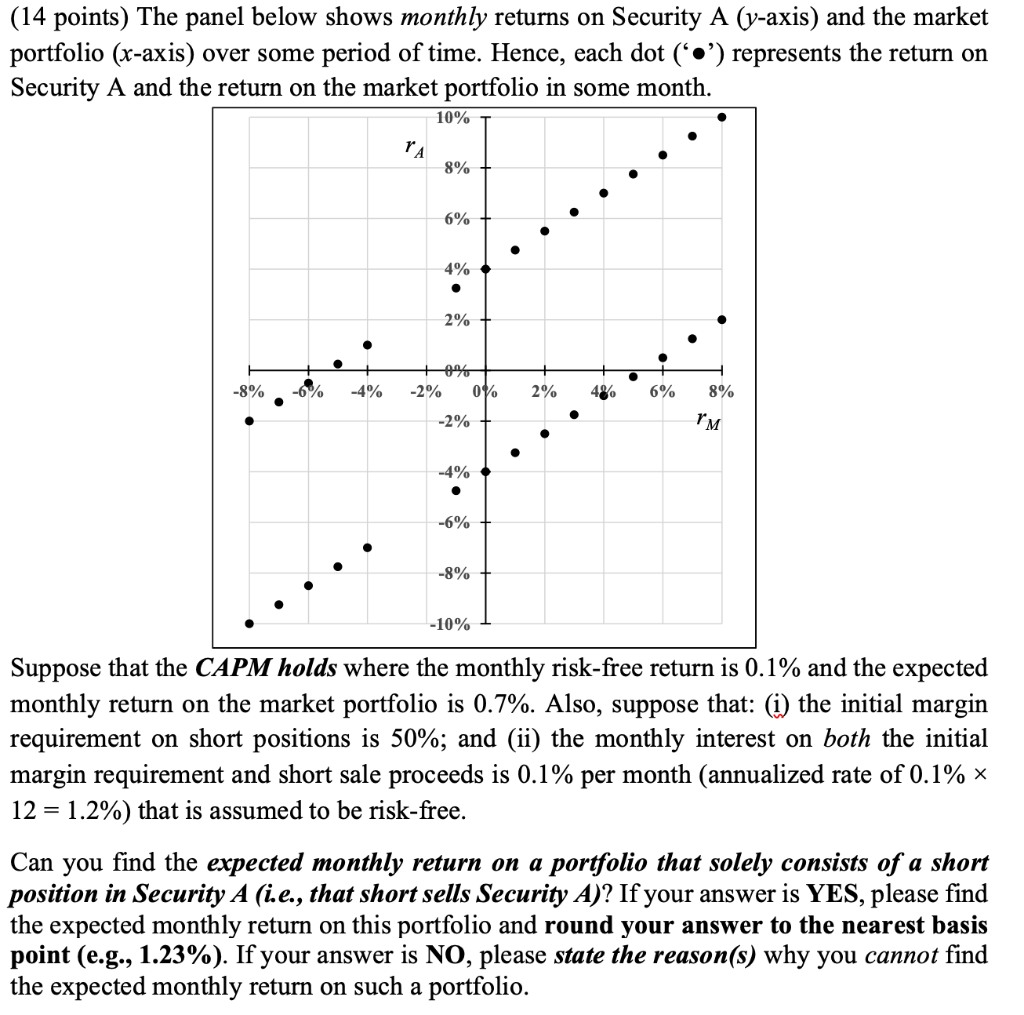

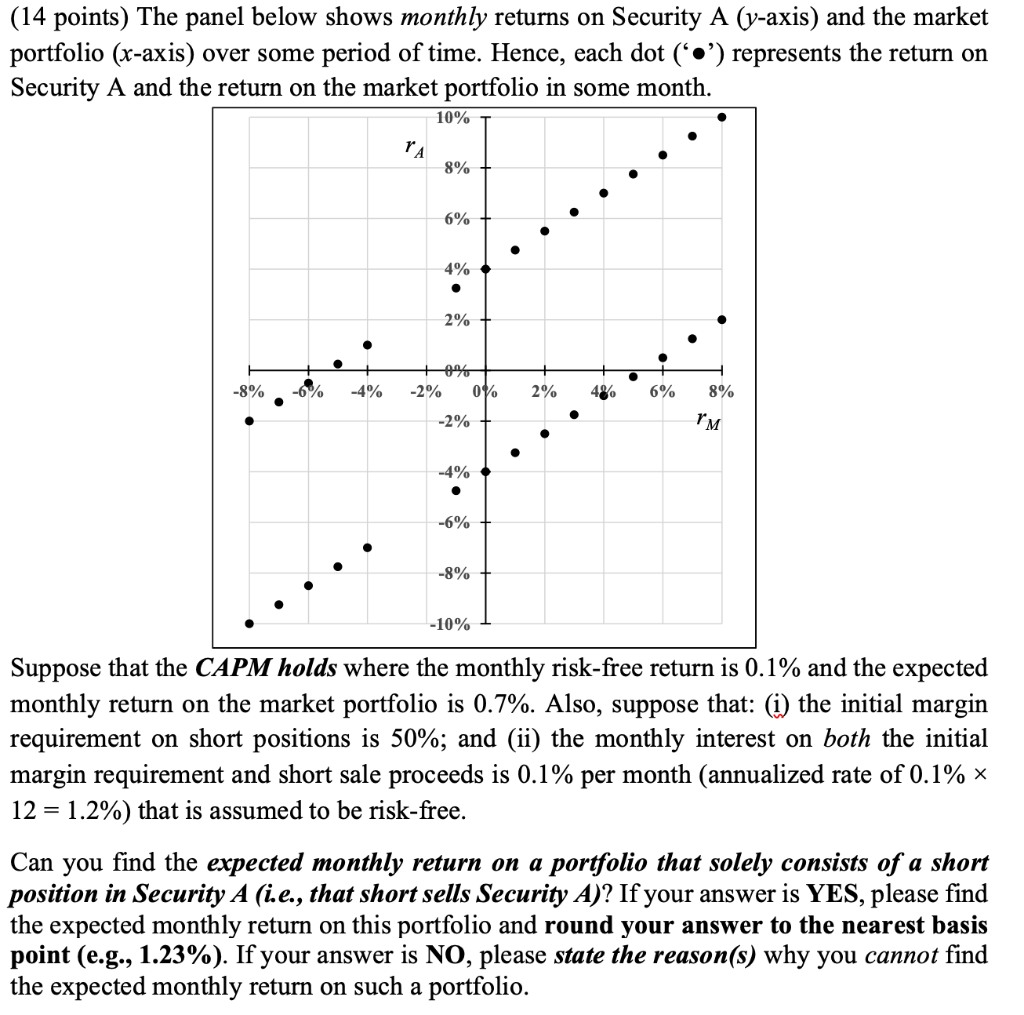

(14 points) The panel below shows monthly returns on Security A (y-axis) and the market portfolio (x-axis) over some period of time. Hence, each dot (*') represents the return on Security A and the return on the market portfolio in some month. 10% PA 8% 6% 4% 2% -8% -4% -2% OV 2% 6% 8% -2% PM -4% -6% -8% -10% Suppose that the CAPM holds where the monthly risk-free return is 0.1% and the expected monthly return on the market portfolio is 0.7%. Also, suppose that: (i) the initial margin requirement on short positions is 50%; and (ii) the monthly interest on both the initial margin requirement and short sale proceeds is 0.1% per month (annualized rate of 0.1% x 12 = 1.2%) that is assumed to be risk-free. Can you find the expected monthly return on a portfolio that solely consists of a short position in Security A (i.e., that short sells Security A)? If your answer is YES, please find the expected monthly return on this portfolio and round your answer to the nearest basis point (e.g., 1.23%). If your answer is NO, please state the reason(s) why you cannot find the expected monthly return on such a portfolio. (14 points) The panel below shows monthly returns on Security A (y-axis) and the market portfolio (x-axis) over some period of time. Hence, each dot (*') represents the return on Security A and the return on the market portfolio in some month. 10% PA 8% 6% 4% 2% -8% -4% -2% OV 2% 6% 8% -2% PM -4% -6% -8% -10% Suppose that the CAPM holds where the monthly risk-free return is 0.1% and the expected monthly return on the market portfolio is 0.7%. Also, suppose that: (i) the initial margin requirement on short positions is 50%; and (ii) the monthly interest on both the initial margin requirement and short sale proceeds is 0.1% per month (annualized rate of 0.1% x 12 = 1.2%) that is assumed to be risk-free. Can you find the expected monthly return on a portfolio that solely consists of a short position in Security A (i.e., that short sells Security A)? If your answer is YES, please find the expected monthly return on this portfolio and round your answer to the nearest basis point (e.g., 1.23%). If your answer is NO, please state the reason(s) why you cannot find the expected monthly return on such a portfolio