Answered step by step

Verified Expert Solution

Question

1 Approved Answer

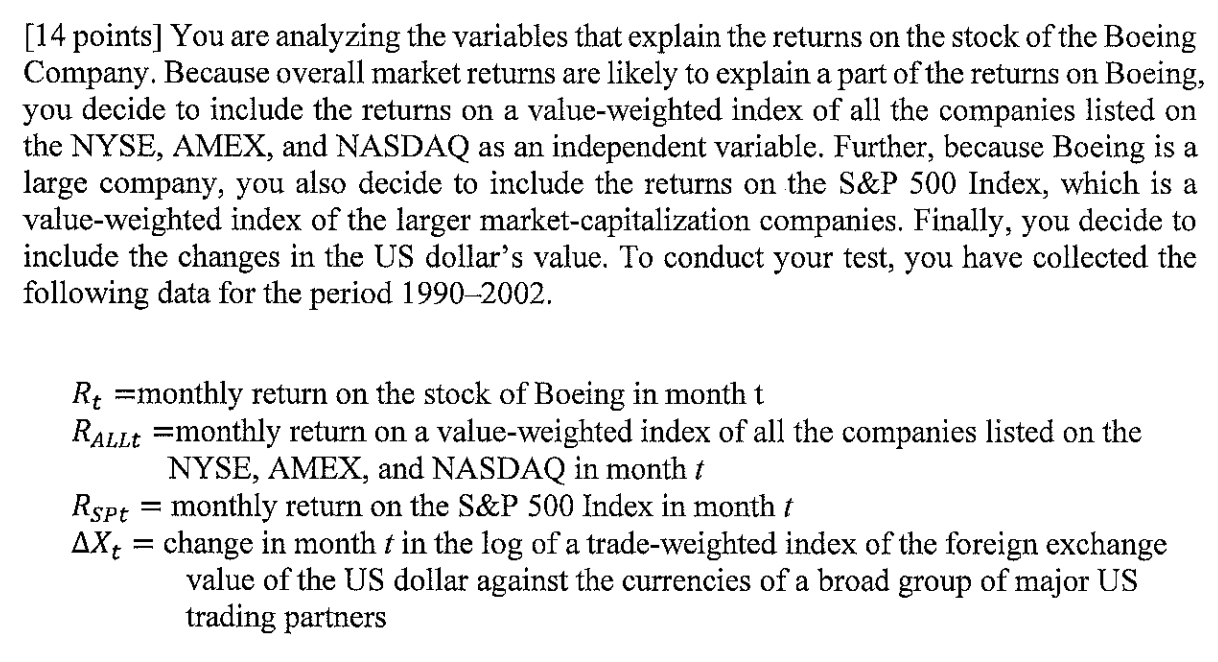

[14 points] You are analyzing the variables that explain the returns on the stock of the Boeing Company. Because overall market returns are likely to

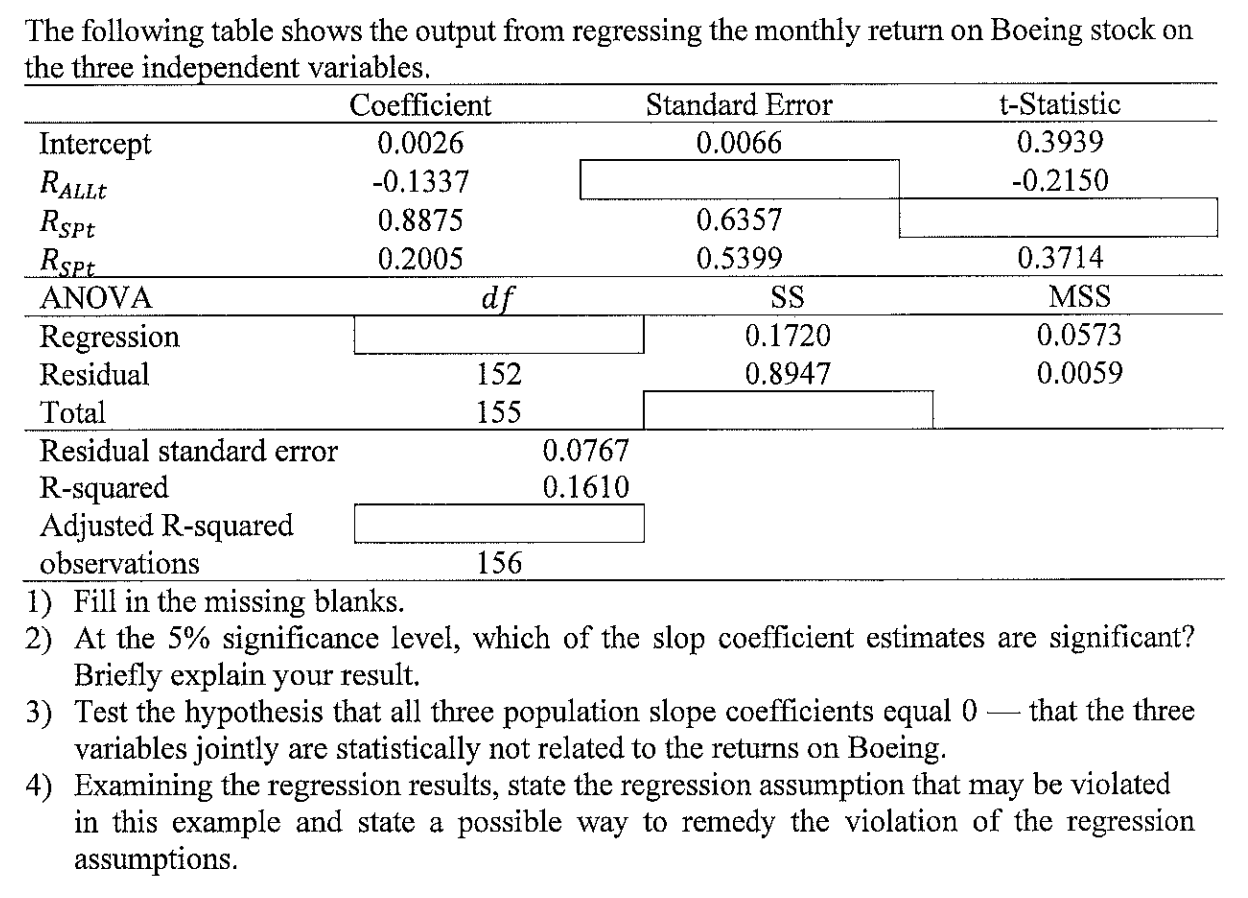

[14 points] You are analyzing the variables that explain the returns on the stock of the Boeing Company. Because overall market returns are likely to explain a part of the returns on Boeing you decide to include the returns on a value-weighted index of all the companies listed on the NYSE, AMEX, and NASDAQ as an independent variable. Further, because Boeing is a large company, you also decide to include the returns on the S\&P 500 Index, which is a value-weighted index of the larger market-capitalization companies. Finally, you decide to include the changes in the US dollar's value. To conduct your test, you have collected the following data for the period 19902002. Rt= monthly return on the stock of Boeing in month t RALLt= monthly return on a value-weighted index of all the companies listed on the NYSE, AMEX, and NASDAQ in month t RSPt= monthly return on the S&P500 Index in month t Xt= change in month t in the log of a trade-weighted index of the foreign exchange value of the US dollar against the currencies of a broad group of major US trading partners The following table shows the output from regressing the monthly return on Boeing stock on 1) Fill in the missing blanks. 2) At the 5\% significance level, which of the slop coefficient estimates are significant? Briefly explain your result. 3) Test the hypothesis that all three population slope coefficients equal 0 - that the three variables jointly are statistically not related to the returns on Boeing. 4) Examining the regression results, state the regression assumption that may be violated in this example and state a possible way to remedy the violation of the regression assumptions

[14 points] You are analyzing the variables that explain the returns on the stock of the Boeing Company. Because overall market returns are likely to explain a part of the returns on Boeing you decide to include the returns on a value-weighted index of all the companies listed on the NYSE, AMEX, and NASDAQ as an independent variable. Further, because Boeing is a large company, you also decide to include the returns on the S\&P 500 Index, which is a value-weighted index of the larger market-capitalization companies. Finally, you decide to include the changes in the US dollar's value. To conduct your test, you have collected the following data for the period 19902002. Rt= monthly return on the stock of Boeing in month t RALLt= monthly return on a value-weighted index of all the companies listed on the NYSE, AMEX, and NASDAQ in month t RSPt= monthly return on the S&P500 Index in month t Xt= change in month t in the log of a trade-weighted index of the foreign exchange value of the US dollar against the currencies of a broad group of major US trading partners The following table shows the output from regressing the monthly return on Boeing stock on 1) Fill in the missing blanks. 2) At the 5\% significance level, which of the slop coefficient estimates are significant? Briefly explain your result. 3) Test the hypothesis that all three population slope coefficients equal 0 - that the three variables jointly are statistically not related to the returns on Boeing. 4) Examining the regression results, state the regression assumption that may be violated in this example and state a possible way to remedy the violation of the regression assumptions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started