Answered step by step

Verified Expert Solution

Question

1 Approved Answer

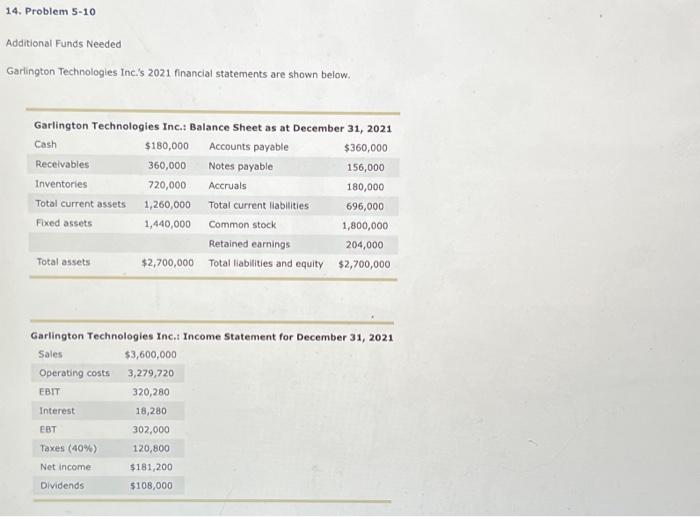

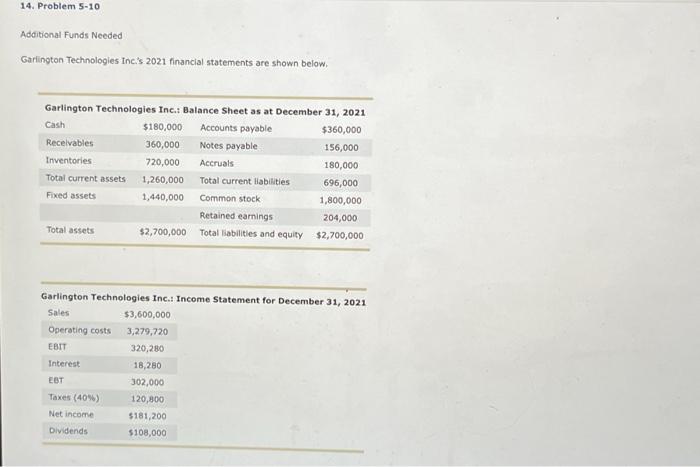

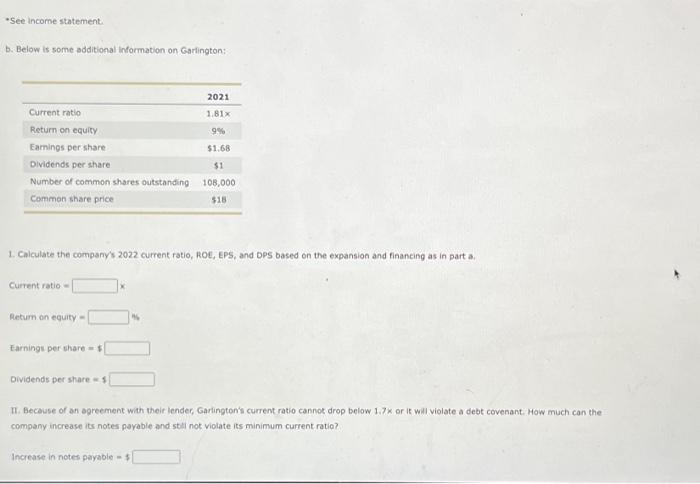

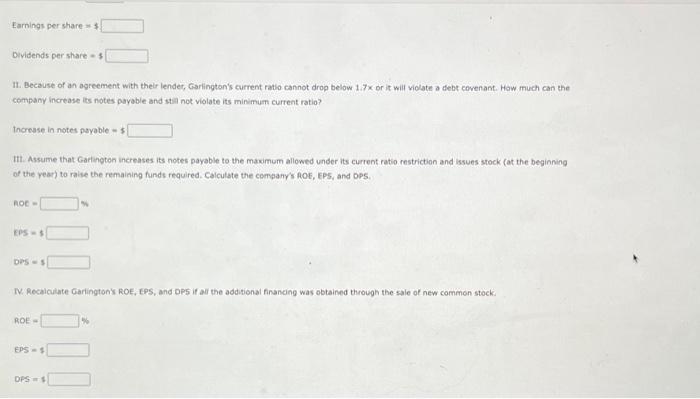

14. Problem 5-10 Additional Funds Needed Garlington Technologies Inc.'s 2021 financial statements are shown below. Garlington Technologies Inc.: Balance Sheet as at December 31, 2021

14. Problem 5-10 Additional Funds Needed Garlington Technologies Inc.'s 2021 financial statements are shown below. Garlington Technologies Inc.: Balance Sheet as at December 31, 2021 $180,000 Accounts payable $360,000 360,000 Notes payable 156,000 720,000 Accruals 180,000 1,260,000 696,000 1,440,000 1,800,000 204,000 $2,700,000 Total liabilities and equity $2,700,000 Cash Receivables Inventories Total current assets Fixed assets Total assets Garlington Technologies Inc.: Income Statement for December 31, 2021 Sales Operating costs EBIT Interest EBT Taxes (40%) Net income Dividends Total current liabilities Common stock Retained earnings $3,600,000 3,279,720 320,280 18,280 302,000 120,800 $181,200 $108,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started