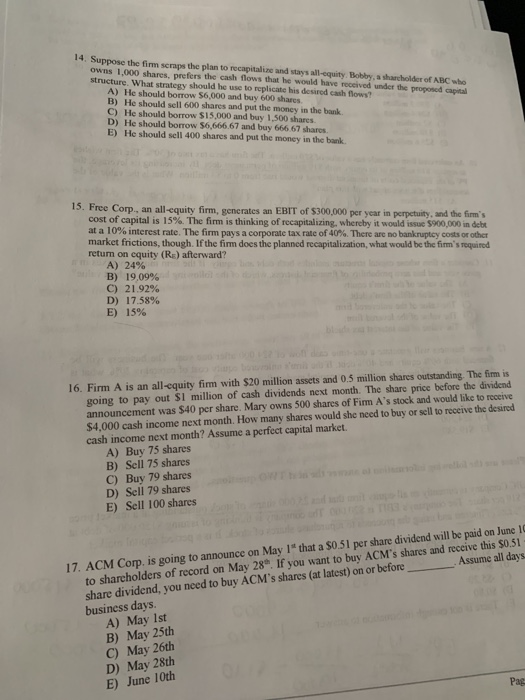

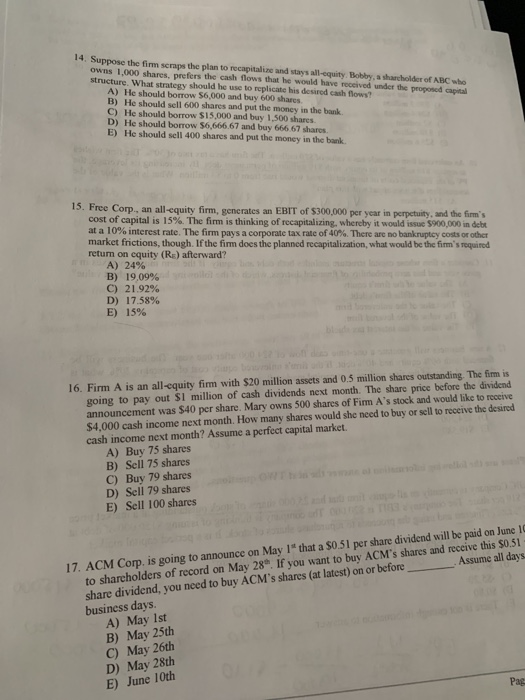

14. Suppose the firm seraps the plan to recapitalize and stays all-equity Bobby, a sharcholder of ABC who owns 1,000 shares, prefers the cash flows that he would have received under the proposed capital structure. What strategy should he use to replicate his desired cash flows? A) He should borrow $6,000 and buy 600 shares B) He should sell 600 shares and put the money in the bank C) He should borrow $15,000 and buy 1,500 shares D) He should borrow $6,666.67 and buy 666 67 shares E) He should sell 400 shares and put the money in the bank. 15. Free Corp, an all-equity firm, generates an EBIT of $300,000 per year in perpetuity, and the firms cost of capital is l 5%. The firm s thinking of recapitalizing whereby it would issue S 0000 in debt at a 10% interest rate. The firm pays a corporate tax rate of 40% There are no bankruptcy costs or oder market frictions, though. If the firm does the planned recapitalization, what would be the firm's required return on equity (RE) afterward? A) 24% ) 19,09% C) 21.92% D) 17.58% E) 15% 16. Firm A is an all-equity firm with $20 million assets and 0.5 million shares outstanding. The firm is going to pay out SI million of cash dividends next month. The share price before the dividend announcement was $40 per share. Mary owns 500 shares of Firm A's stock and would like to receive $4,000 cash income next month. How many shares would she need to buy or sell to receive the desired cash income next month? Assume a perfect capital market. A) Buy 75 shares B) Sell 75 shares C) Buy 79 shares D) Sell 79 shares E) Sell 100 shares 17. ACM Corp. is going to announce on May 1t that a $0.51 per share dividend will be paid on June 10 Assume all days to sharcholders of record on May 28. If you want to buy ACM's shares and receive this $0.51 share dividend, you need to buy ACM's shares (at latest) on or before business days A) May Ist B) May 25th C) May 26th D) May 28th E) June 10th Pag 14. Suppose the firm seraps the plan to recapitalize and stays all-equity Bobby, a sharcholder of ABC who owns 1,000 shares, prefers the cash flows that he would have received under the proposed capital structure. What strategy should he use to replicate his desired cash flows? A) He should borrow $6,000 and buy 600 shares B) He should sell 600 shares and put the money in the bank C) He should borrow $15,000 and buy 1,500 shares D) He should borrow $6,666.67 and buy 666 67 shares E) He should sell 400 shares and put the money in the bank. 15. Free Corp, an all-equity firm, generates an EBIT of $300,000 per year in perpetuity, and the firms cost of capital is l 5%. The firm s thinking of recapitalizing whereby it would issue S 0000 in debt at a 10% interest rate. The firm pays a corporate tax rate of 40% There are no bankruptcy costs or oder market frictions, though. If the firm does the planned recapitalization, what would be the firm's required return on equity (RE) afterward? A) 24% ) 19,09% C) 21.92% D) 17.58% E) 15% 16. Firm A is an all-equity firm with $20 million assets and 0.5 million shares outstanding. The firm is going to pay out SI million of cash dividends next month. The share price before the dividend announcement was $40 per share. Mary owns 500 shares of Firm A's stock and would like to receive $4,000 cash income next month. How many shares would she need to buy or sell to receive the desired cash income next month? Assume a perfect capital market. A) Buy 75 shares B) Sell 75 shares C) Buy 79 shares D) Sell 79 shares E) Sell 100 shares 17. ACM Corp. is going to announce on May 1t that a $0.51 per share dividend will be paid on June 10 Assume all days to sharcholders of record on May 28. If you want to buy ACM's shares and receive this $0.51 share dividend, you need to buy ACM's shares (at latest) on or before business days A) May Ist B) May 25th C) May 26th D) May 28th E) June 10th Pag