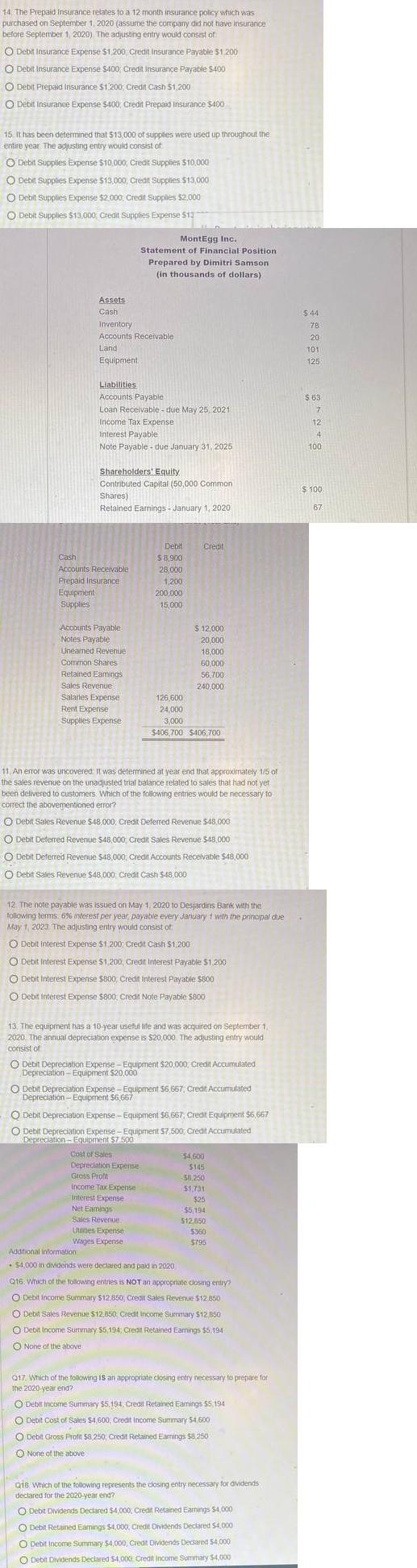

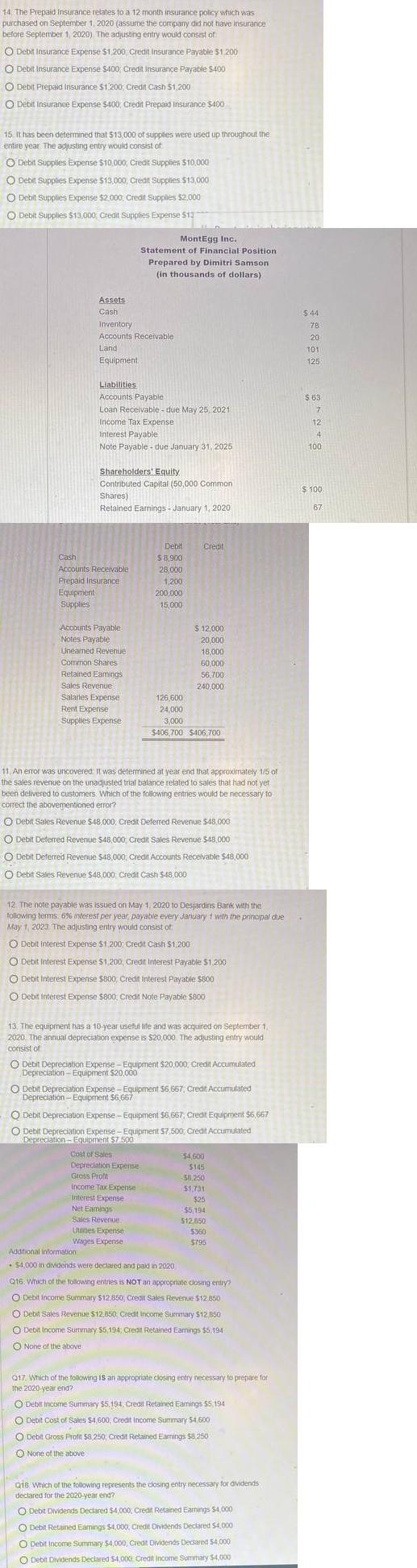

14 The Prepaid Insurance relates to a 12 month insurance policy which was purchased on September 1 2020 (assure the company did not have insurance before September 1 2020) The adjusting entry would consistor O Debit Insurance Expense 51.200 Credit Insurance Payable 51200 Debit Insurance Expense S400 Credit Insurance Payable 5400 O Debit Prepaid Insurance $1.200, Credit Cash $1,200 O Debit Insurance Expense 3400 Credit Prepant Insurance 3400 15. It has been determined that $13,000 of supplies were used up throughout the entire year. The adjusting entry would consist of Debit Supplles Expense 510,000 Credit Supplies 510.000 O Debt Supplies Expense S13,000 Credit Supplies 513,000 O Debit Supplies Expense $2,000 Credit Supplies 52.000 Debit Supplies 513,000 Clear Supplies Expense 513 MontEgg Inc. Statement of Financial Position Prepared by Dimitri Samson (in thousands of dollars) $ 44 78 Assets Cash Inventory Accounts Receivable Land Equipment 20 101 125 Liabilities Accounts Payable Loan Receivable - due May 25 2021 Income Tax Expense Interest Payable Note Payable. due January 31, 2025 $53 7 12 4 100 Shareholders' Equity Contributed Capital (50,000 Common Shares) Retained Earnings - January 1, 2020 $ 100 67 Credit Cash Accounts Receivable Prepaid Insurance Equipment Supplies Debit $ 8.900 28,000 1.200 200.000 15,000 Accounts Payable Notes Payable Linearned Revenue Common Shares Retained Eamings Sales Revenue Salaries Expense Rent Expense Supplies Expense $ 12.000 20,000 18.000 60.000 56.700 240.000 126,600 24,000 3,000 $406,700 $406,700 11 An error was uncovered. It was determined at year end that approximately 1/5 of the sales revenue on the unadjusted trial balance related to sales that had not yet been delivered to customers. Which of the following entries would be necessary 10 correct the abovementioned error? Debit Sales Revenue $48.000 Credit Deferred Revenue $48.000 . O Debit Deterred Revenue $48.000 Credit Sales Revenue 548.000 O Debit Deferred Revenue 548,000. Credit Accounts Receivable $48.000 O Debt Sales Revenue $48.000 Credit Cash $48.000 O 12 The note payable was issued on May 1, 2020 to Desjardins Bank with the following terms 6% interest per year payable every January + With the prinopal de May 1 2023 The adjusting entry would consist of O Debit interest Expense $1.200 Credit Cash 51 200 Debit interest Expense $1.200 Credit Interest Payable 51,200 O Debit Interest Expense SB00, Credit Interest Payable 5800 O Debit interest Expense $800 Credit Note Payable 5800 13. The equipment has a 10-year useful life and was acquired on September 1 2020. The annual depreciation expense is $20,000. The adjusting entry would consistot O Debit Depreciation Expense - Equipment S20,000. Credit Accumulated Depreciation - Equipment $20,000 Debit Depreciation Expense - Equipment 56,667, Credit Accumulated Depreciation - Equipment 56,667 Debt Depreciation Expense - Equipment 56,667. Credit Equipment 56,657 O Debit Depreciation Expense - Equipment 57.500 Credit Accumulated Depreciation - Equipment 57500 Gost of Sales $4600 Depreciation Expenses 5165 Glass Pront 50,250 income Tax Expense 51.731 triterest Expense 523 Net Eaminds 55,194 Sales Revenue 512.850 Utilities Expense $360 Wiges Expense 5795 Additional information $4,000 in dividends were declared and paid in 2020 016. Which of the following entries is NOT an appropriate closing entry Debit income Summary $12 850 Credit Sales Revenue 512 350 Debit Sales Revenue $12.850 Credit Income Surretary $12050 O Debit Income Surnay S5,194 Creon Retained Earings 55,194 None of the above 017. Which of the foowing is an appropriate closing entry necessary to prepare for the 2020 year end? Debit income Summary 55.194. Credit Retained Earings $5 194 O Debit Cost of Sales $4,600 Credit Income Summary 54600 Debit Gross Pro 58 250 Credit Retained Earnings 58250 None of the above 018 Which of the folowing represents the dosing entry necessary for vidends declared for the 2020 year end? O Debit Dividends Declared $4,000. Credit Retained Earnings $4.000 . Debit Retained Earrings $4000. Crede Dividends Declared 54.000 O Debit Income Summary 54,000 Credit Dividends Dedared 54.000 O Debil Dividends Declared 5400X Credit Income Summary 54.000