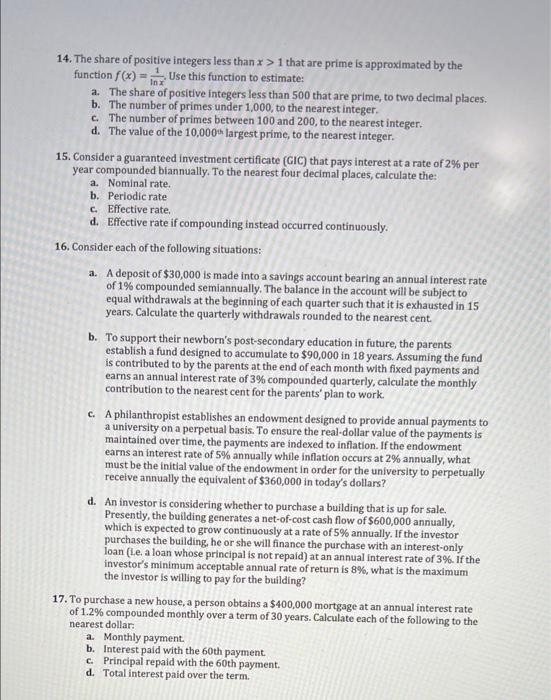

14. The share of positive integers less than x > 1 that are prime is approximated by the function f(x) = 1 Use this function to estimate: a. The share of positive integers less than 500 that are prime, to two decimal places. b. The number of primes under 1,000, to the nearest Integer c. The number of primes between 100 and 200, to the nearest integer. d. The value of the 10,000* largest prime, to the nearest integer. 15. Consider a guaranteed investment certificate (GIC) that pays interest at a rate of 2% per year compounded biannually. To the nearest four decimal places, calculate the: a. Nominal rate. b. Periodic rate c Effective rate d. Effective rate if compounding instead occurred continuously. 16. Consider each of the following situations: a. A deposit of $30,000 is made into a savings account bearing an annual interest rate of 1% compounded semiannually. The balance in the account will be subject to equal withdrawals at the beginning of each quarter such that it is exhausted in 15 years, Calculate the quarterly withdrawals rounded to the nearest cent b. To support their newborn's post-secondary education in future, the parents establish a fund designed to accumulate to $90,000 in 18 years. Assuming the fund is contributed to by the parents at the end of each month with fixed payments and earns an annual interest rate of 3% compounded quarterly, calculate the monthly contribution to the nearest cent for the parents' plan to work. c. A philanthropist establishes an endowment designed to provide annual payments to a university on a perpetual basis. To ensure the real-dollar value of the payments is maintained over time, the payments are indexed to inflation. If the endowment earns an interest rate of 5% annually while inflation occurs at 2% annually, what must be the initial value of the endowment in order for the university to perpetually receive annually the equivalent of $360,000 in today's dollars? d. An investor is considering whether to purchase a building that is up for sale. Presently, the building generates a net-of-cost cash flow of $600,000 annually, which is expected to grow continuously at a rate of 5% annually. If the investor purchases the building, he or she will finance the purchase with an interest-only loan (l.e. a loan whose principal is not repaid) at an annual interest rate of 3%. If the investor's minimum acceptable annual rate of return is 8%, what is the maximum the Investor is willing to pay for the building? 17. To purchase a new house, a person obtains a $400,000 mortgage at an annual interest rate of 1.2% compounded monthly over a term of 30 years. Calculate each of the following to the nearest dollar: a. Monthly payment b. Interest paid with the 60th payment c. Principal repaid with the 60th payment d. Total interest paid over the term