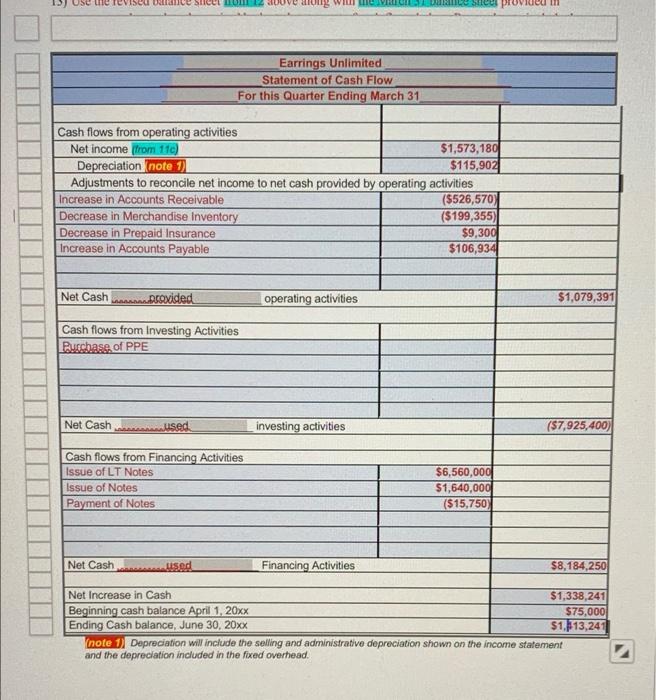

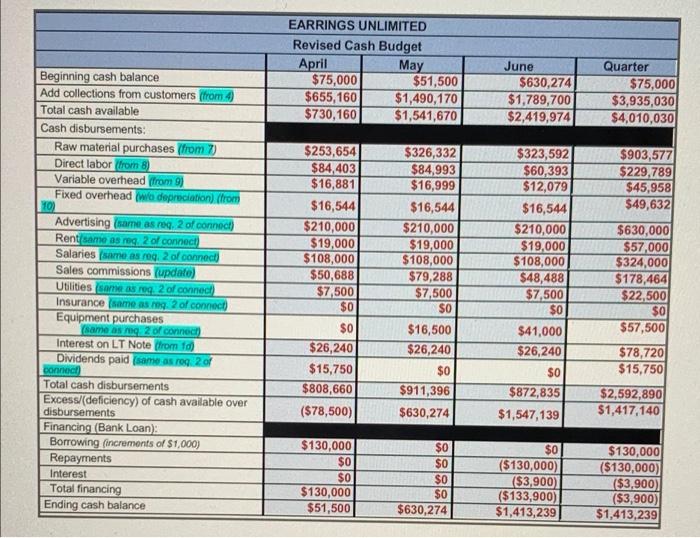

14) Using the revised budgets consider and comment on the following: a) What does the budgeted statement of cash flows tell us that the cash budget doesn't? Do not just list items that are one schedule and not the other. Explain how the information relates differently to the operations and management's concerns at hand. Use complete sentences and 30 to 50 words. b) Do you think preparation of the statement of cash flows was useful for the company's evaluation of the policy/pattern changes? Why or why not? Explain and answer in 30 to 50 words. c) Using the revised budgets, do you think Earrings Unlimited will be able to declare dividends to their stockholders? Assuming the company needs to pay-off the long-term note payable in 5 years, do you think Earrings Unlimited will have enough cash to do so? What information in which budget reports provides you with the information to make this decision. Explain in full sentences using 50 to 80 words. d) Do you think the decision to acquire the manufacturing process from their supplier was a good decision? Was manufacturing earrings cost effective? Explain with full sentences and 50 to 80 words we Tevised Steel love will Earrings Unlimited Statement of Cash Flow For this Quarter Ending March 31 Cash flows from operating activities Net income from 110) $1,573,180 Depreciation note 1) $115,902 Adjustments to reconcile net income to net cash provided by operating activities Increase in Accounts Receivable (5526,570) Decrease in Merchandise Inventory ($199,355) Decrease in Prepaid Insurance $9,300 Increase in Accounts Payable $106,934 Net Cash androvided operating activities $1,079,391 Cash flows from Investing Activities Purchase of PPE Net Cash was used investing activities (57,925,400) Cash flows from Financing Activities Issue of LT Notes Issue of Notes Payment of Notes $6,560,000 $1,640,000 ($15.750 Net Cash used Financing Activities $8,184,250 Net Increase in Cash $1,338,241 Beginning cash balance April 1, 20xx $75,000 Ending Cash balance, June 30, 20xx $1,213,241 note 1) Depreciation will include the selling and administrative depreciation shown on the income statement and the depreciation included in the fixed overhead. EARRINGS UNLIMITED Revised Cash Budget April May $75,000 $51,500 $655,160 $1,490,170 $730,160 $1,541,670 June $630,274 $1,789,700 $2,419,974 Quarter $75,000 $3,935,030 $4,010,030 $903,577 $229,789 $45,958 $49,632 Beginning cash balance Add collections from customers (from Total cash available Cash disbursements: Raw material purchases (from) Direct labor from 8) Variable overhead (from 9) Fixed overhead wo depreciation) (from 10) Advertising (same as reg, 2 of connect) Rent(same as reg, 2 of connect) Salaries same as roq, 2 of connect Sales commissions (update) Utilities same as req2of connec) Insurance same as nog 2 of connect) Equipment purchases (same as q 2 of connect Interest on LT Note (from fd) Dividends paid (same as reg: 20 connect Total cash disbursements Excess/(deficiency) of cash available over disbursements Financing (Bank Loan): Borrowing (increments of $1,000) Repayments Interest Total financing Ending cash balance $253,654 $84,403 $16,881 $16,544 $210,000 $19,000 $108,000 $50,688 $7,500 $0 $0 $26,240 $15,750 $808,660 ($78,500) $326,332 $84,993 $16,999 $16,544 $210,000 $19,000 $108,000 $79,288 $7,500 $0 $16,500 $26,240 $0 $911,396 $630,274 $323,592 $60,393 $12,079 $16,544 $210,000 $19,000 $108,000 $48,488 $7,500 $0 $41,000 $26,240 $630,000 $57,000 $324,000 $178,464 $22,500 $0 $57,500 $78,720 $15.750 $2,592,890 $1,417,140 $0 $872,835 $1,547,139 $130,000 $0 $0 $130,000 $51,500 $0 $0 $0 $0 $630,274 $0 ($130,000) ($3,900) ($133,900) $1,413,239 $130,000 ($130,000) ($3,900) ($3,900) $1,413,239