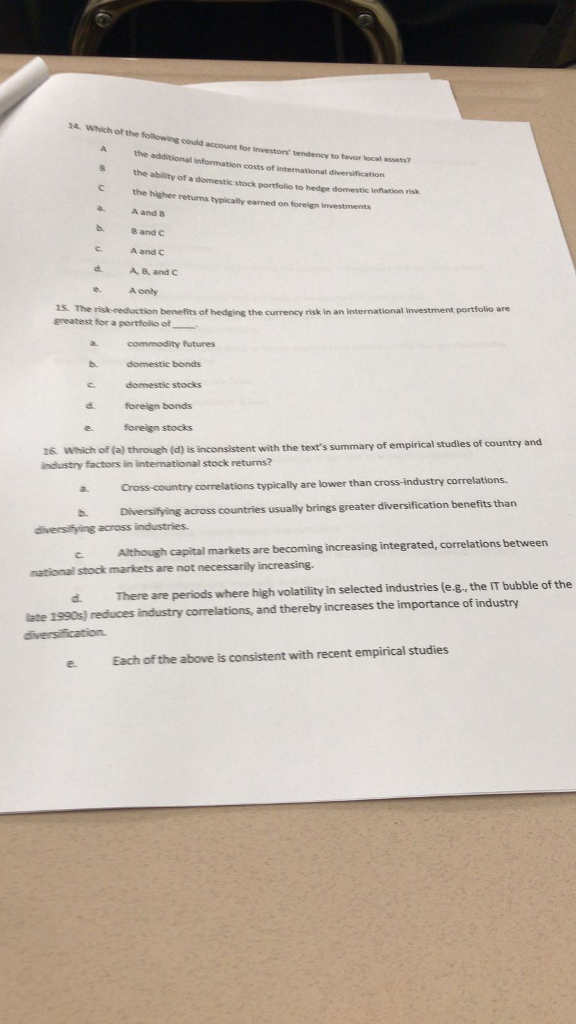

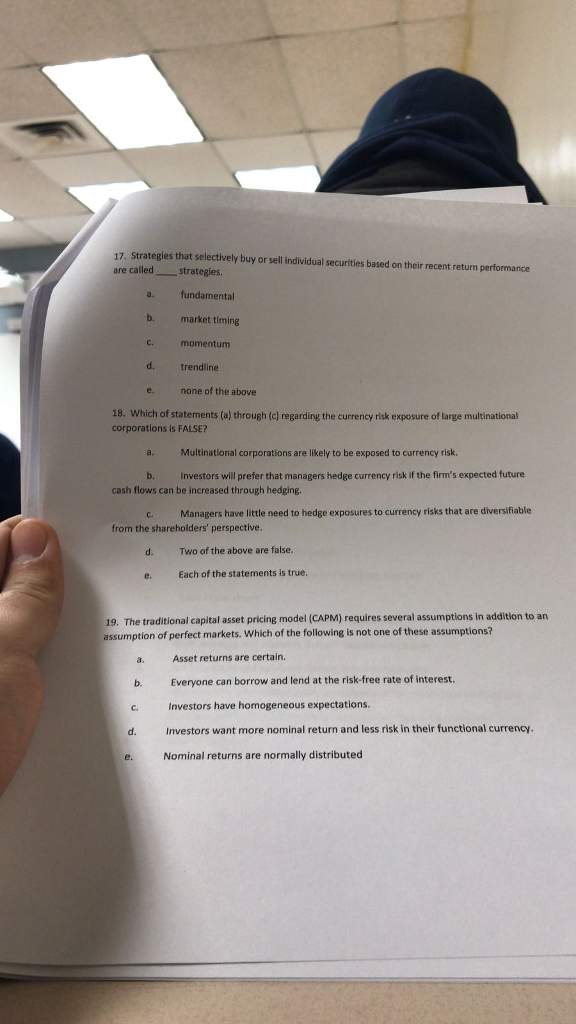

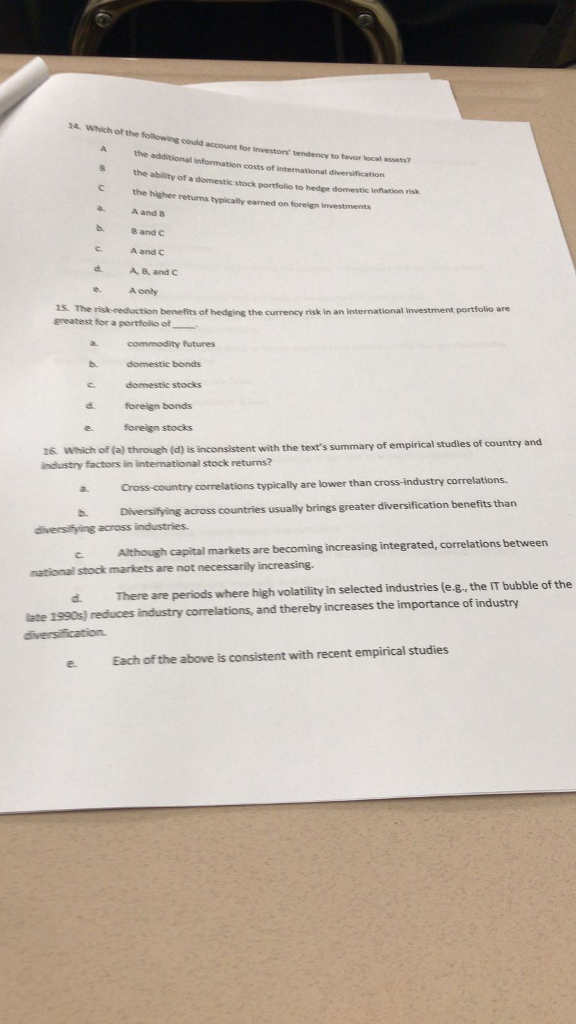

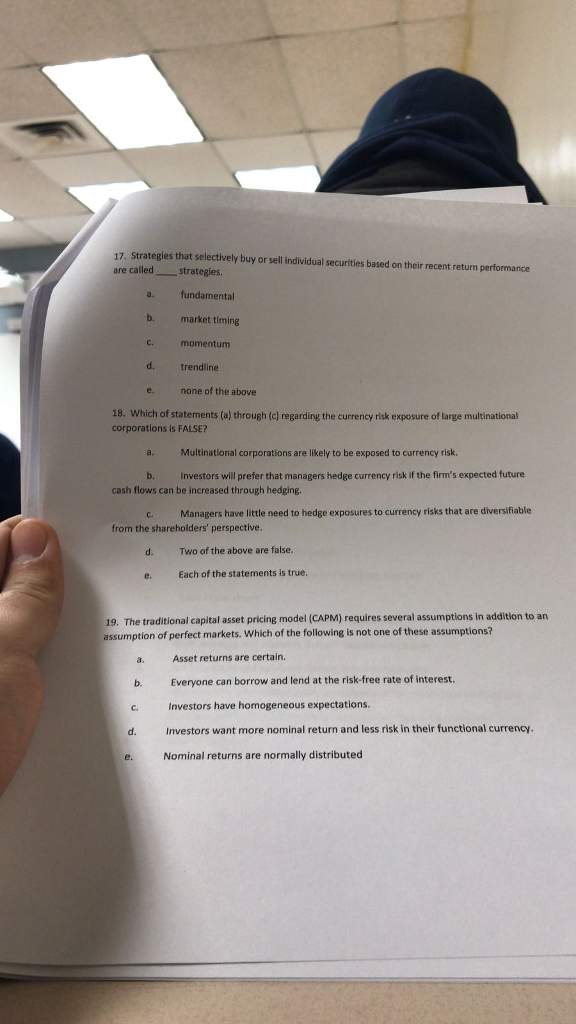

14. Which of the following could account for investors' tendency to favor local assets? additional the ability of a domestic stock portfolio to hedge domestic the higher returns typically earned on foreign A and s Band C Aand C A,B,and C inflation risk investments e. A only 1s. The risk-reduction benefits of hedging the currency risk in an international investment portfolio ane greatest for a portfolio of commodity futures domestic bonds C domestic stocks d foreign bonds e foreign stocks 16 Which of (a) through (d) is inconsistent with the text's summary of industry factors in international stock returns? empirical studles of country and y correlations typically are lower than cross-industry correlations. b. Diversifying across countries usually brings greater diversification benefits than diversifying across industries c Although capital markets are becoming increasing integrated, correlations between national stock markets are not necessarily increasing d. There are periods where high volatility in selected industries (e-g, the IT bubble of the late 1990s) reduces industry correlations, and thereby increases the importance of industry e Each of the above is consistent with recent empirical studies 17. Strategies that selectively buy or sell ndividual securities based on their recent return performance are called _strategies. a. fundamental b. market timing C. momentum d. trendline e. none of the above 18. Which of statements (a) through (c) regarding the currency risk exposure of large multinational corporations is FALSE? a. Multinational corporations are likely to be exposed to currency risk. b. Investors will prefer that managers hedge currency risk if the firm's expected future cash flows can be increased through hedging. c. Managers have little need to hedge exposures to currency risks that are diversifiable from the shareholders' perspective d. Two of the above are false. e. Each of the statements is true. 19. The traditional capital asset pricing model (CAPM) requires several assumptions in addition to arn assumption of perfect markets. Which of the following is not one of these assumptions? a. Asset returns are certain. b. Everyone can borrow and lend at the risk-free rate of interest. c. Investors have homogeneous expectations. d. e. Nominal returns are normally distributed Investors want more nominal return and less risk in their functional currency