Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14. William and Smith formed a partnership with Scott who contributed ( $ 100,000 ), William who contributed ( $ 30,000 ), and Smith who

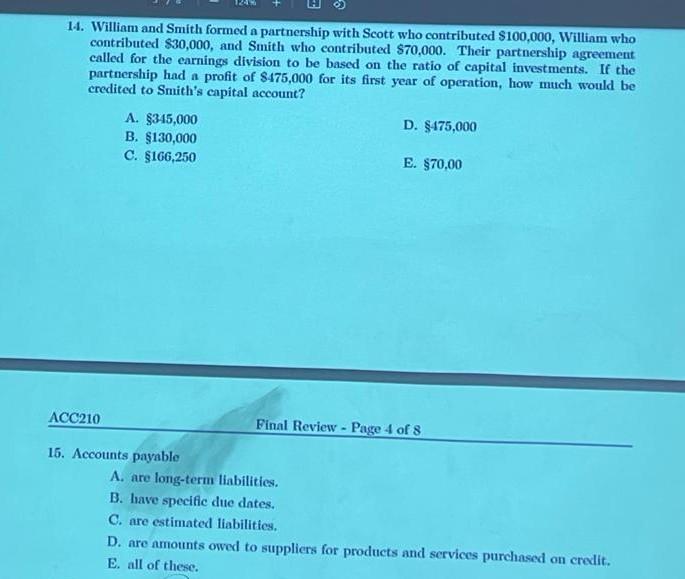

14. William and Smith formed a partnership with Scott who contributed \\( \\$ 100,000 \\), William who contributed \\( \\$ 30,000 \\), and Smith who contributed \\( \\$ 70,000 \\). Their partnership agreement called for the earnings division to be based on the ratio of capital investments. If the partnership had a profit of \\( \\$ 475,000 \\) for its first year of operation, how much would be credited to Smith's capital account? A. \\( \\$ 345,000 \\) B. \\( \\$ 130,000 \\) D. \\( \\$ 475,000 \\) C. \\( \\$ 166,250 \\) E. \\( \\$ 70,00 \\) \\( \\Lambda \\mathrm{CC} 210 \\) Final Review - Page 4 of 8 15. Accounts payable A. are long-term liabilities. B. have specific due dates. C. are estimated liabilities, D. are amounts owed to suppliers for products and services purchased on credit. E. all of these

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started