Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14.20 Market Multiples and Reverse Engineering Share Prices. In 2000, Enron enjoyed remarkable success in the capital markets. During that year, Enron's shares increased

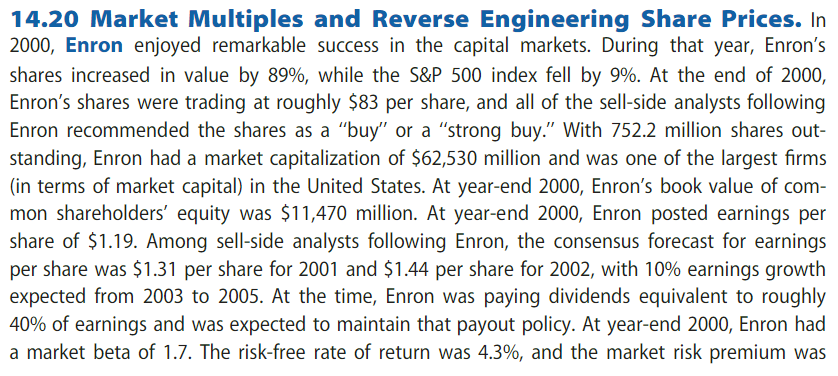

14.20 Market Multiples and Reverse Engineering Share Prices. In 2000, Enron enjoyed remarkable success in the capital markets. During that year, Enron's shares increased in value by 89%, while the S&P 500 index fell by 9%. At the end of 2000, Enron's shares were trading at roughly $83 per share, and all of the sell-side analysts following Enron recommended the shares as a "buy" or a "strong buy." With 752.2 million shares out- standing, Enron had a market capitalization of $62,530 million and was one of the largest firms (in terms of market capital) in the United States. At year-end 2000, Enron's book value of com- mon shareholders' equity was $11,470 million. At year-end 2000, Enron posted earnings per share of $1.19. Among sell-side analysts following Enron, the consensus forecast for earnings per share was $1.31 per share for 2001 and $1.44 per share for 2002, with 10% earnings growth expected from 2003 to 2005. At the time, Enron was paying dividends equivalent to roughly 40% of earnings and was expected to maintain that payout policy. At year-end 2000, Enron had a market beta of 1.7. The risk-free rate of return was 4.3%, and the market risk premium was

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started