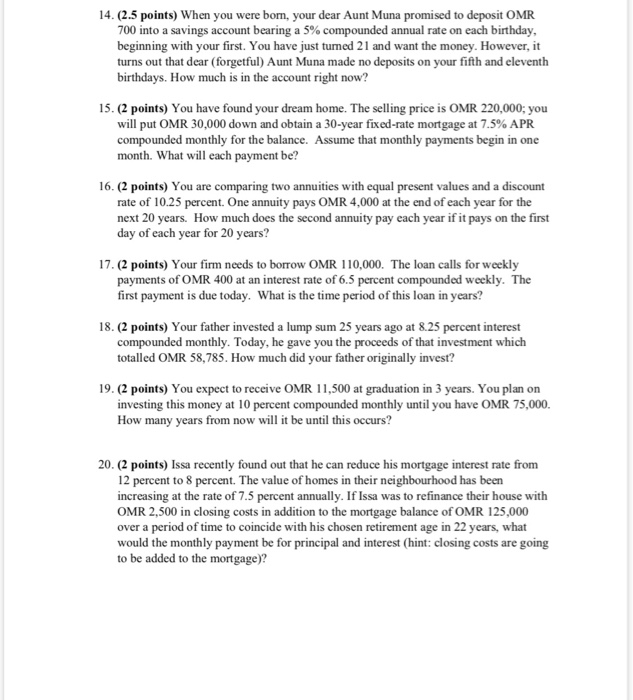

14.(2.5 points) When you were born, your dear Aunt Muna promised to deposit OMR 700 into a savings account bearing a 5% compounded annual rate on each birthday, beginning with your first. You have just turned 21 and want the money. However, it turns out that dear (forgetful) Aunt Muna made no deposits on your fifth and eleventh birthdays. How much is in the account right now? 15. (2 points) You have found your dream home. The selling price is OMR 220,000; you will put OMR 30,000 down and obtain a 30-year fixed-rate mortgage at 7.5% APR compounded monthly for the balance. Assume that monthly payments begin in one month. What will each payment be? 16. (2 points) You are comparing two annuities with equal present values and a discount rate of 10.25 percent. One annuity pays OMR 4,000 at the end of each year for the next 20 years. How much does the second annuity pay each year if it pays on the first day of each year for 20 years? 17. (2 points) Your firm needs to borrow OMR 110,000. The loan calls for weekly payments of OMR 400 at an interest rate of 6.5 percent compounded weekly. The first payment is due today. What is the time period of this loan in years? 18. (2 points) Your father invested a lump sum 25 years ago at 8.25 percent interest compounded monthly. Today, he gave you the proceeds of that investment which totalled OMR 58,785. How much did your father originally invest? 19. (2 points) You expect to receive OMR 11,500 at graduation in 3 years. You plan on investing this money at 10 percent compounded monthly until you have OMR 75,000. How many years from now will it be until this occurs? 20. (2 points) Issa recently found out that he can reduce his mortgage interest rate from 12 percent to 8 percent. The value of homes in their neighbourhood has been increasing at the rate of 7.5 percent annually. If Issa was to refinance their house with OMR 2,500 in closing costs in addition to the mortgage balance of OMR 125,000 over a period of time to coincide with his chosen retirement age in 22 years, what would the monthly payment be for principal and interest (hint: closing costs are going to be added to the mortgage)