Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14-43 JIT and Manufacturing Cycle Efficiency (MCE) Zodiac Sound Co. manufactures audio systems, both made-to-order and mass-produced systems, that are typically sold to large-scale manufacturers

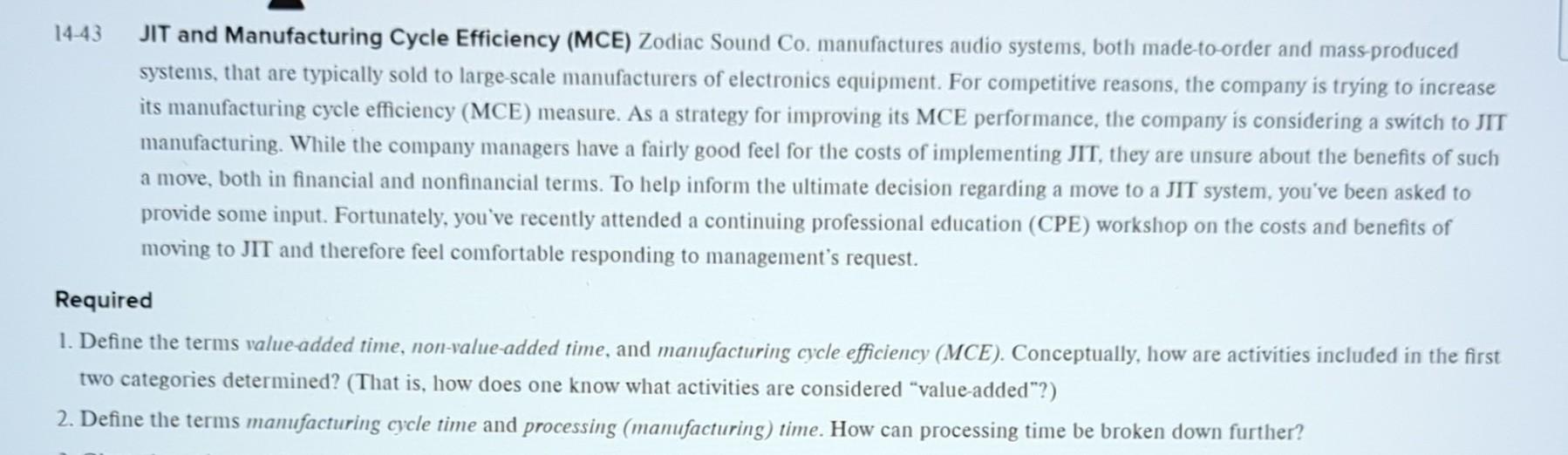

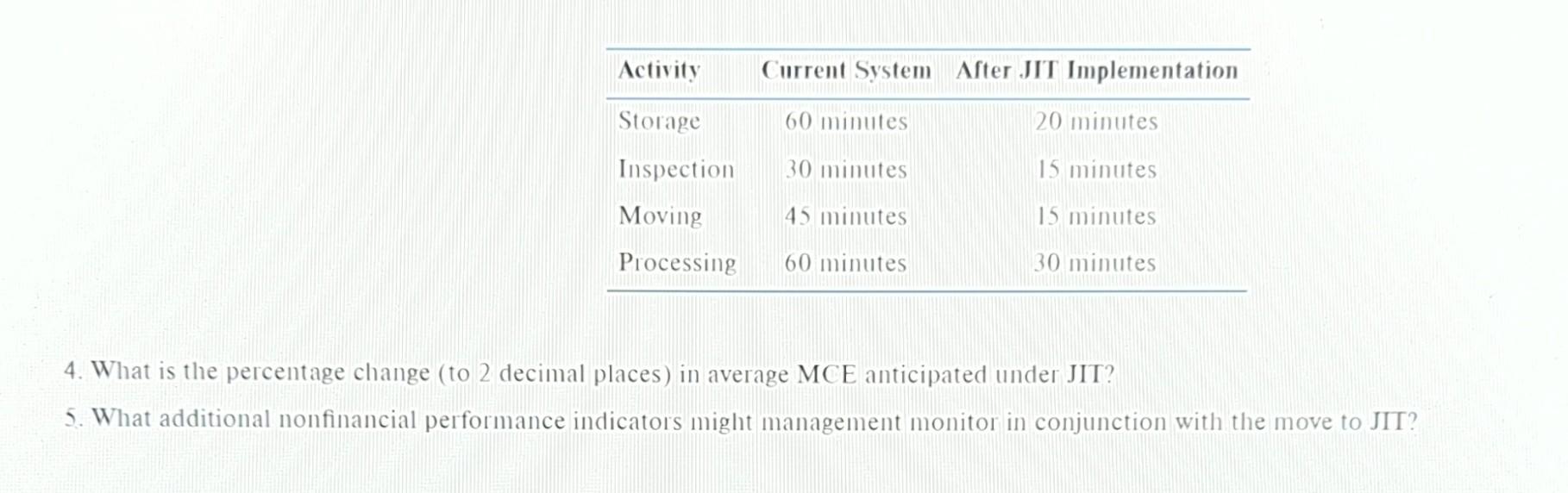

14-43 JIT and Manufacturing Cycle Efficiency (MCE) Zodiac Sound Co. manufactures audio systems, both made-to-order and mass-produced systems, that are typically sold to large-scale manufacturers of electronics equipment. For competitive reasons, the company is trying to increase its manufacturing cycle efficiency (MCE) measure. As a strategy for improving its MCE performance, the company is considering a switch to JIT manufacturing. While the company managers have a fairly good feel for the costs of implementing JIT, they are unsure about the benefits of such a move, both in financial and nonfinancial terms. To help inform the ultimate decision regarding a move to a JIT system, you've been asked to provide some input. Fortunately, you've recently attended a continuing professional education (CPE) workshop on the costs and benefits of moving to JIT and therefore feel comfortable responding to management's request. Required 1. Define the terms value-added time, non-value-added time, and manufacturing cycle efficiency (MCE). Conceptually, how are activities included in the first two categories determined? (That is, how does one know what activities are considered "value-added"?) 2. Define the terms manufacturing cycle time and processing (manufacturing) time. How can processing time be broken down further? 4. What is the percentage change (to 2 decimal places) in average MCE anticipated under JIT? 5. What additional nonfinancial performance indicators might management monitor in conjunction with the move to JIT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started