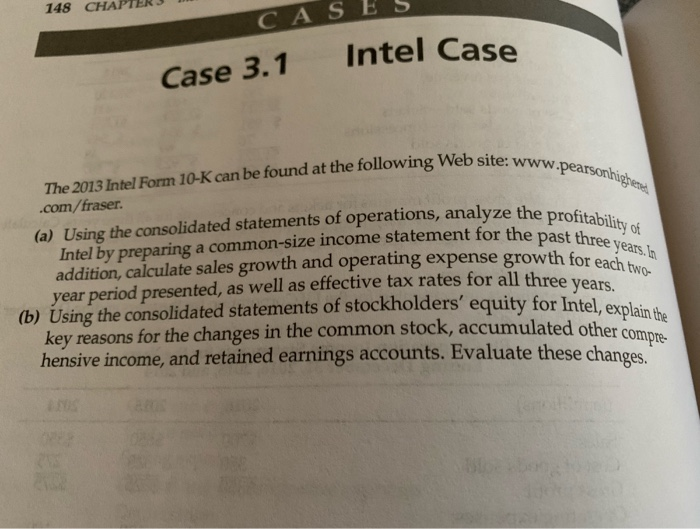

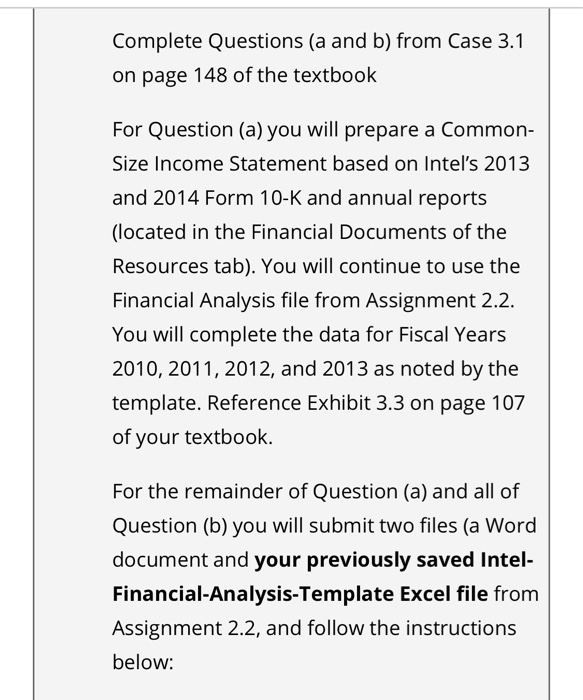

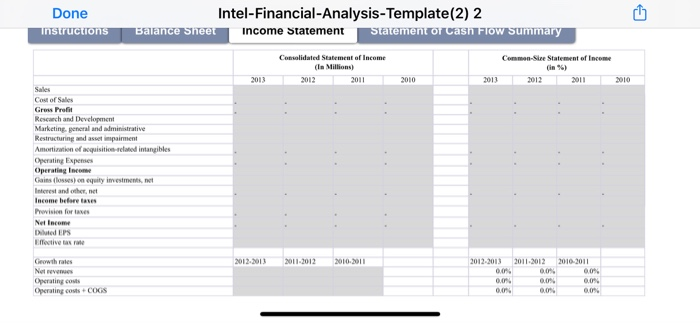

148 CHAPTER CASES Case 3.1 Intel Case www.pearsonhigher e the profitability of for the past three years. In owth for each two- The 2013 Intel Form 10-K can be found at the following Web site: www .com/fraser. (a) Using the consolidated statements of operations, analyze the pro Intel by preparing a common-size income statement for the pas addition, calculate sales growth and operating expense growth for year period presented, as well as effective tax rates for all three ve (b) Using the consolidated statements of stockholders' equity for Inta key reasons for the changes in the common stock, accumulated other hensive income, and retained earnings accounts. Evaluate these chano ders' equity for Intel, explain the mulated other compre- Complete Questions (a and b) from Case 3.1 on page 148 of the textbook For Question (a) you will prepare a Common- Size Income Statement based on Intel's 2013 and 2014 Form 10-K and annual reports (located in the Financial Documents of the Resources tab). You will continue to use the Financial Analysis file from Assignment 2.2. You will complete the data for Fiscal Years 2010, 2011, 2012, and 2013 as noted by the template. Reference Exhibit 3.3 on page 107 of your textbook. For the remainder of Question (a) and all of Question (b) you will submit two files (a Word document and your previously saved Intel- Financial Analysis-Template Excel file from Assignment 2.2, and follow the instructions below: Done instructions Intel-Financial Analysis-Template(2) 2 Balance Sheet Income Statement Statement of Cash FiOW Summary Commen-Stee Statement of Income Consolidated Statement of Income (in Millions) 2012 2011 2013 2010 2013 2012 2011 2010 Cost of Sales Grow Profit Research and Development Marketing, meral and ministrative Restructuring and asset impairment Amortization of acquisiti intangibles Operating Expenses Operating Income Gains (losses) on equity investments, net Interest and other net Income before tres Provision for taxes Net Income Diluted EPS Effective taxe 2012-2013 2011-2012 2010-2011 2010-2011 2011 2012 00 Geowth rates Net Operating costs Operating co 2012-2013 0. 0 0.0 0.0% . COGS 0.0% 0.0% 148 CHAPTER CASES Case 3.1 Intel Case www.pearsonhigher e the profitability of for the past three years. In owth for each two- The 2013 Intel Form 10-K can be found at the following Web site: www .com/fraser. (a) Using the consolidated statements of operations, analyze the pro Intel by preparing a common-size income statement for the pas addition, calculate sales growth and operating expense growth for year period presented, as well as effective tax rates for all three ve (b) Using the consolidated statements of stockholders' equity for Inta key reasons for the changes in the common stock, accumulated other hensive income, and retained earnings accounts. Evaluate these chano ders' equity for Intel, explain the mulated other compre- Complete Questions (a and b) from Case 3.1 on page 148 of the textbook For Question (a) you will prepare a Common- Size Income Statement based on Intel's 2013 and 2014 Form 10-K and annual reports (located in the Financial Documents of the Resources tab). You will continue to use the Financial Analysis file from Assignment 2.2. You will complete the data for Fiscal Years 2010, 2011, 2012, and 2013 as noted by the template. Reference Exhibit 3.3 on page 107 of your textbook. For the remainder of Question (a) and all of Question (b) you will submit two files (a Word document and your previously saved Intel- Financial Analysis-Template Excel file from Assignment 2.2, and follow the instructions below: Done instructions Intel-Financial Analysis-Template(2) 2 Balance Sheet Income Statement Statement of Cash FiOW Summary Commen-Stee Statement of Income Consolidated Statement of Income (in Millions) 2012 2011 2013 2010 2013 2012 2011 2010 Cost of Sales Grow Profit Research and Development Marketing, meral and ministrative Restructuring and asset impairment Amortization of acquisiti intangibles Operating Expenses Operating Income Gains (losses) on equity investments, net Interest and other net Income before tres Provision for taxes Net Income Diluted EPS Effective taxe 2012-2013 2011-2012 2010-2011 2010-2011 2011 2012 00 Geowth rates Net Operating costs Operating co 2012-2013 0. 0 0.0 0.0% . COGS 0.0% 0.0%