Question

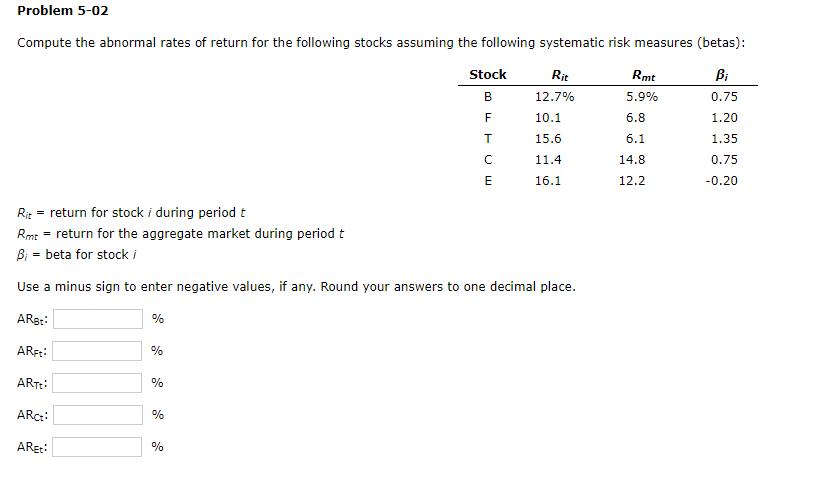

Problem 5-02 Compute the abnormal rates of return for the following stocks assuming the following systematic risk measures (betas): Bi 0.75 % Rit =

Problem 5-02 Compute the abnormal rates of return for the following stocks assuming the following systematic risk measures (betas): Bi 0.75 % Rit = return for stock i during period t Rmt = return for the aggregate market during period t B; = beta for stock i Use a minus sign to enter negative values, if any. Round your answers to one decimal place. ARst: ARFt: ARTt: ARct: ARET: % % % Stock B F T C E % Rit 12.7% 10.1 15.6 11.4 16.1 Rmt 5.9% 6.8 6.1 14.8 12.2 1.20 1.35 0.75 -0.20

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Stocks B F T E R it a R mt b ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting: A Business Process Approach

Authors: Jane L. Reimers

3rd edition

978-013611539, 136115276, 013611539X, 978-0136115274

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App