Question

14.Operating income/loss is best defined as: a.Net sales less cost of goods sold b.Earnings before interest, taxes, depreciation and amortization c.Net income plus depreciation and

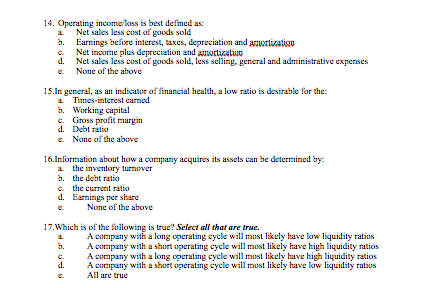

14.Operating income/loss is best defined as: a.Net sales less cost of goods sold b.Earnings before interest, taxes, depreciation and amortization c.Net income plus depreciation and amortization d.Net sales less cost of goods sold, less selling, general and administrative expenses e.None of the above

15.In general, as an indicator of financial health, a low ratio is desirable for the: a. Times-interest earned b. Working capital c. Gross profit margin d. Debt ratio e.None of the above

16.Information about how a company acquires its assets can be determined by: a. the inventory turnover b. the debt ratio c. the current ratio d. Earnings per share e.None of the above

17.Which is of the following is true? Select all that are true. a.A company with a long operating cycle will most likely have low liquidity ratios b.A company with a short operating cycle will most likely have high liquidity ratios c.A company with a long operating cycle will most likely have high liquidity ratios d.A company with a short operating cycle will most likely have low liquidity ratios e.All are true

14. Operating income/loss is best defined as: a Net sales less cost of goods sold b. Earnings before interest, taxes, depreciation and amertization Net income plus depreciation and amortizatiao d. Net sales less cost of goods sold, less selling, general and administrative expenses e None of the above c. 15.In general, as an indicator of financial health, a low ratio is desirable for the: a Times-interest earned b. Working capital e. Gross profit margin d. Debt ratio e None of the above 16.Information about how a company acquires its assets can be determined by: a the inventory turnover b. the debt ratio c. the current ratio d. Earnings per share None of the above e. 17.Which is of the following is true? Select all that are true. A cormpany with a long operating cycle will most likely have low liquidity ratios A company with a short operating cycle will most likely have high liquidity ratios A company with a long operating cycle will most likely have high liquidity ratios A company with a short operating cycle will most likely have low liquidity ratios All are true b. C. dStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started