Answered step by step

Verified Expert Solution

Question

1 Approved Answer

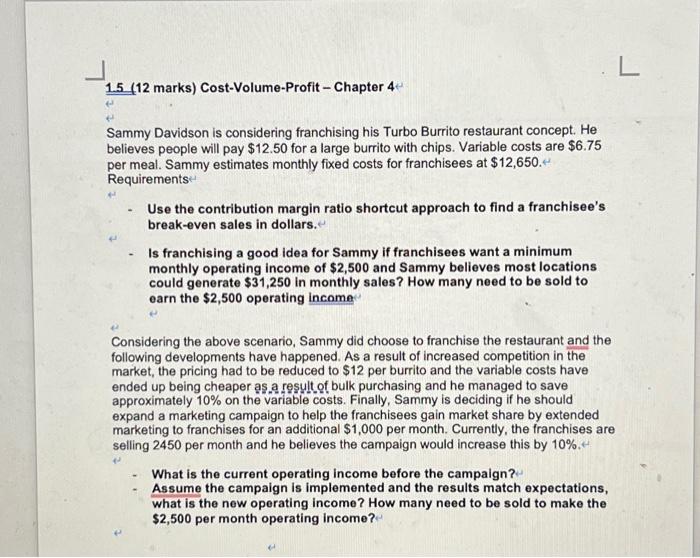

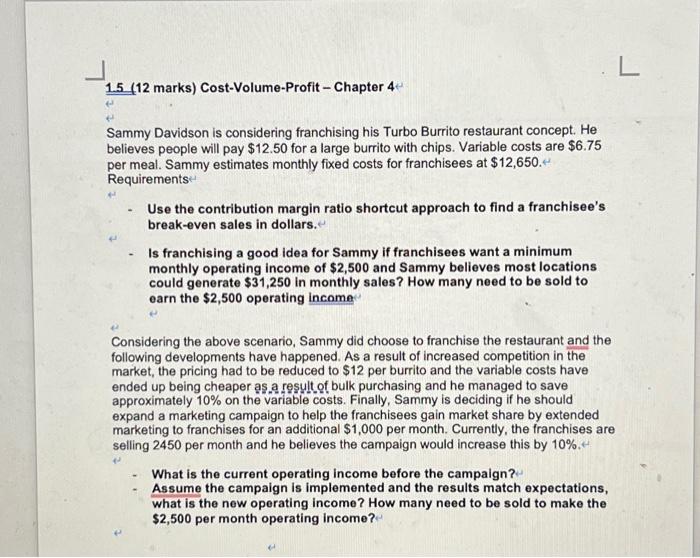

1.5 (12 marks) Cost-Volume-Profit - Chapter 4+ ( Sammy Davidson is considering franchising his Turbo Burrito restaurant concept. He believes people will pay $12.50 for

1.5 (12 marks) Cost-Volume-Profit - Chapter 4+ ( Sammy Davidson is considering franchising his Turbo Burrito restaurant concept. He believes people will pay $12.50 for a large burrito with chips. Variable costs are $6.75 per meal. Sammy estimates monthly fixed costs for franchisees at $12,650. Requirements e Use the contribution margin ratio shortcut approach to find a franchisee's break-even sales in dollars. Is franchising a good idea for Sammy if franchisees want a minimum monthly operating income of $2,500 and Sammy believes most locations could generate $31,250 in monthly sales? How many need to be sold to earn the $2,500 operating income Considering the above scenario, Sammy did choose to franchise the restaurant and the following developments have happened. As a result of increased competition in the market, the pricing had to be reduced to $12 per burrito and the variable costs have ended up being cheaper as a result of bulk purchasing and he managed to save approximately 10% on the variable costs. Finally, Sammy is deciding if he should expand a marketing campaign to help the franchisees gain market share by extended marketing to franchises for an additional $1,000 per month. Currently, the franchises are selling 2450 per month and he believes the campaign would increase this by 10%.

1.5 (12 marks) Cost-Volume-Profit - Chapter 4 Sammy Davidson is considering franchising his Turbo Burrito restaurant concept. He believes people will pay $12.50 for a large burrito with chips. Variable costs are $6.75 per meal. Sammy estimates monthly fixed costs for franchisees at $12,650. Requirements - Use the contribution margin ratio shortcut approach to find a franchisee's break-even sales in dollars. - Is franchising a good idea for Sammy if franchisees want a minimum monthly operating income of $2,500 and Sammy believes most locations could generate $31,250 in monthly sales? How many need to be sold to earn the $2,500 operating income Considering the above scenario, Sammy did choose to franchise the restaurant and the following developments have happened. As a result of increased competition in the market, the pricing had to be reduced to $12 per burrito and the variable costs have ended up being cheaper as a result of bulk purchasing and he managed to save approximately 10% on the variable costs. Finally, Sammy is deciding if he should expand a marketing campaign to help the franchisees gain market share by extended marketing to franchises for an additional $1,000 per month. Currently, the franchises are selling 2450 per month and he believes the campaign would increase this by 10%. - What is the current operating income before the campaign? - Assume the campaign is implemented and the results match expectations, what is the new operating income? How many need to be sold to make the $2,500 per month operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started