Answered step by step

Verified Expert Solution

Question

1 Approved Answer

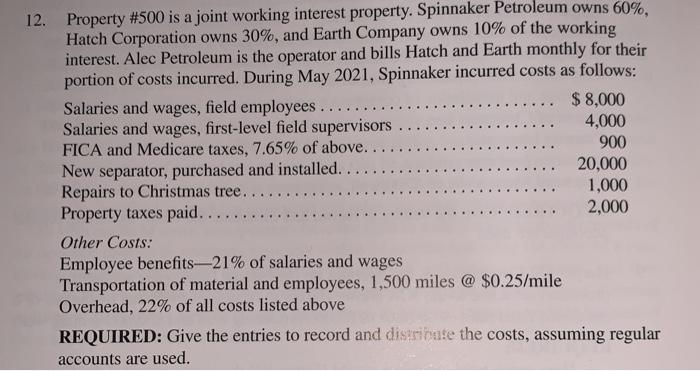

12. Property # 500 is a joint working interest property. Spinnaker Petroleum owns 60%, Hatch Corporation owns 30%, and Earth Company owns 10% of

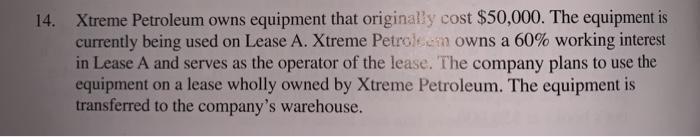

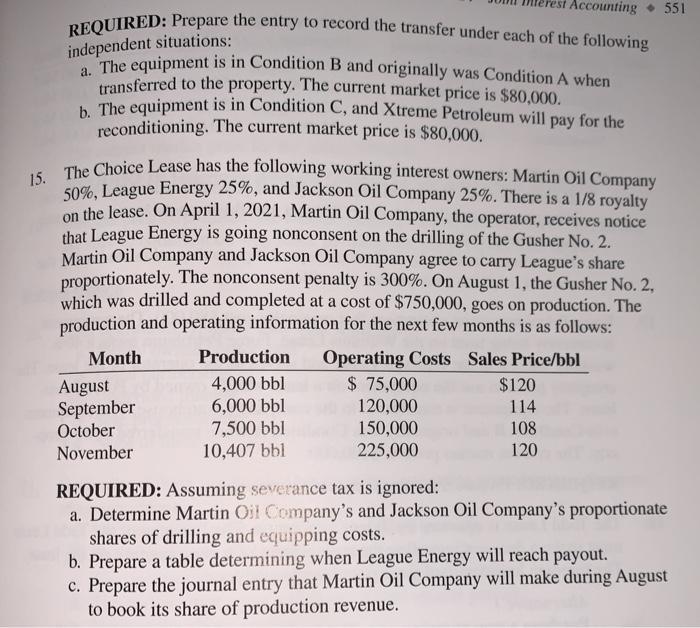

12. Property # 500 is a joint working interest property. Spinnaker Petroleum owns 60%, Hatch Corporation owns 30%, and Earth Company owns 10% of the working interest. Alec Petroleum is the operator and bills Hatch and Earth monthly for their portion of costs incurred. During May 2021, Spinnaker incurred costs as follows: Salaries and wages, field employees.... Salaries and wages, first-level field supervisors ... FICA and Medicare taxes, 7.65% of above... New separator, purchased and installed... Repairs to Christmas tree.. Property taxes paid... .... Other Costs: Employee benefits-21% of salaries and wages Transportation of material and employees, 1,500 miles @ $0.25/mile Overhead, 22% of all costs listed above $ 8,000 4,000 900 20,000 1,000 2,000 REQUIRED: Give the entries to record and distribute the costs, assuming regular accounts are used. 14. Xtreme Petroleum owns equipment that originally cost $50,000. The equipment is currently being used on Lease A. Xtreme Petroleem owns a 60% working interest in Lease A and serves as the operator of the lease. The company plans to use the equipment on a lease wholly owned by Xtreme Petroleum. The equipment is transferred to the company's warehouse. REQUIRED: Prepare the entry to record the transfer under each of the following independent situations: a. The equipment is in Condition B and originally was Condition A when transferred to the property. The current market price is $80,000. b. The equipment is in Condition C, and Xtreme Petroleum will pay for the reconditioning. The current market price is $80,000. 15. The Choice Lease has the following working interest owners: Martin Oil Company 50%, League Energy 25%, and Jackson Oil Company 25%. There is a 1/8 royalty on the lease. On April 1, 2021, Martin Oil Company, the operator, receives notice that League Energy is going nonconsent on the drilling of the Gusher No. 2. Martin Oil Company and Jackson Oil Company agree to carry League's share proportionately. The nonconsent penalty is 300%. On August 1, the Gusher No. 2, which was drilled and completed at a cost of $750,000, goes on production. The production and operating information for the next few months is as follows: Month August September October November Accounting 551 Production 4,000 bbl 6,000 bbl 7,500 bbl 10,407 bbl Operating Costs Sales Price/bbl $ 75,000 120,000 150,000 225,000 $120 114 108 120 REQUIRED: Assuming severance tax is ignored: a. Determine Martin Oil Company's and Jackson Oil Company's proportionate shares of drilling and equipping costs. b. Prepare a table determining when League Energy will reach payout. c. Prepare the journal entry that Martin Oil Company will make during August to book its share of production revenue.

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

12 1 Spinnaker Petroleum would record the following entry Debit Credit Work in Progress 8000 Account...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started