Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15 52 ints Word Problem 9-28 (Static) [LU 9-2 (2)] Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions

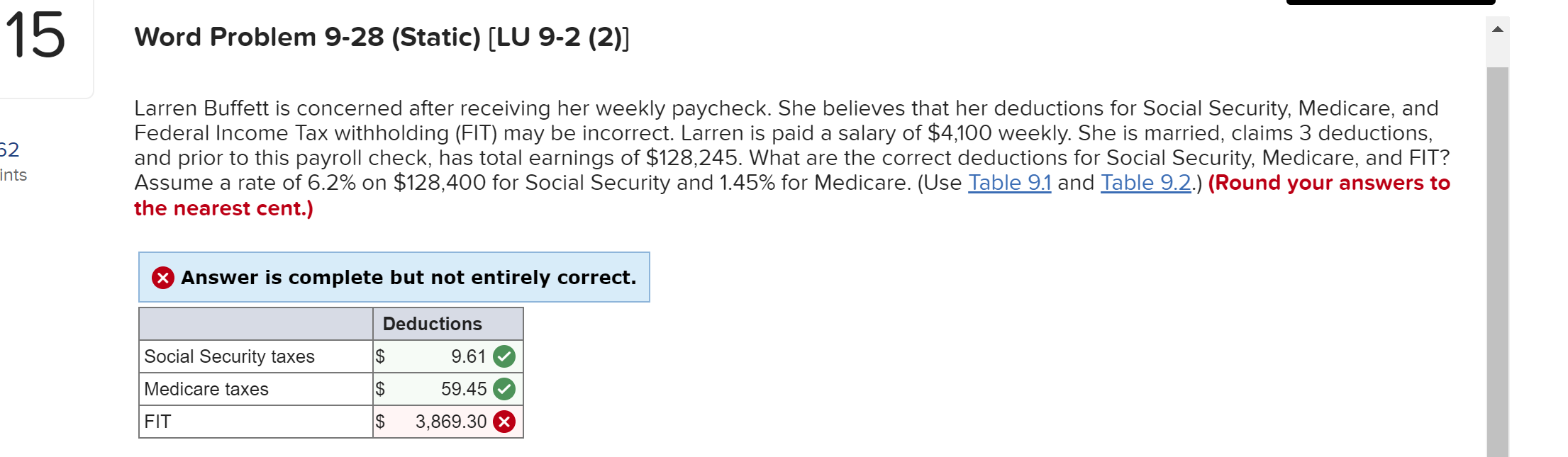

15 52 ints Word Problem 9-28 (Static) [LU 9-2 (2)] Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is paid a salary of $4,100 weekly. She is married, claims 3 deductions, and prior to this payroll check, has total earnings of $128,245. What are the correct deductions for Social Security, Medicare, and FIT? Assume a rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare. (Use Table 9.1 and Table 9.2.) (Round your answers to the nearest cent.) Answer is complete but not entirely correct. Deductions Social Security taxes $ 9.61 Medicare taxes $ 59.45 FIT $ 3,869.30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started