Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1-5 a. 1. In 2021, Costello Company performs work for a customer and bills the customer $10,000; Costello also pays expenses of $3,000. The customer

1-5

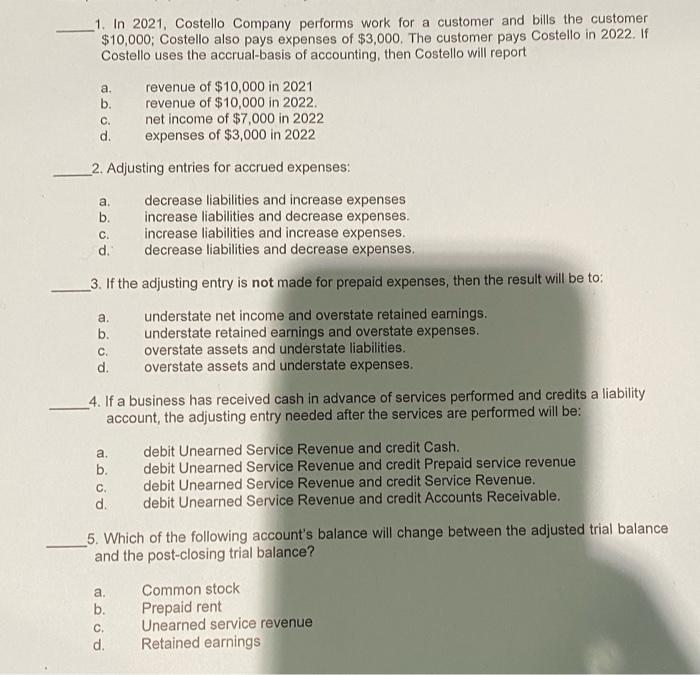

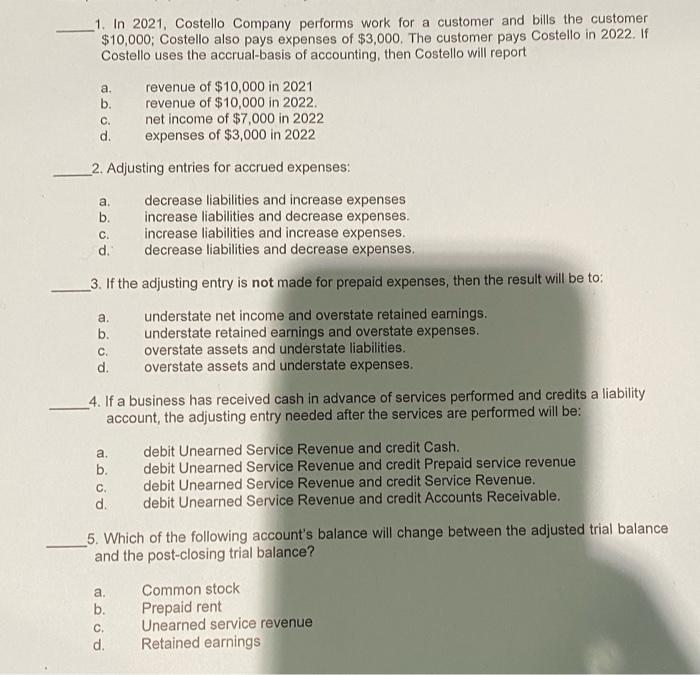

a. 1. In 2021, Costello Company performs work for a customer and bills the customer $10,000; Costello also pays expenses of $3,000. The customer pays Costello in 2022. If Costello uses the accrual-basis of accounting, then Costello will report revenue of $10,000 in 2021 b. revenue of $10,000 in 2022. net income of $7,000 in 2022 d. expenses of $3,000 in 2022 _2. Adjusting entries for accrued expenses: C. a b. C. d. decrease liabilities and increase expenses increase liabilities and decrease expenses. increase liabilities and increase expenses. decrease liabilities and decrease expenses, 3. If the adjusting entry is not made for prepaid expenses, then the result will be to: a understate net income and overstate retained eamings. b. understate retained earnings and overstate expenses. C overstate assets and understate liabilities. d. overstate assets and understate expenses. _4. If a business has received cash in advance of services performed and credits a liability account, the adjusting entry needed after the services are performed will be: a debit Unearned Service Revenue and credit Cash. debit Unearned Service Revenue and credit Prepaid service revenue debit Unearned Service Revenue and credit Service Revenue. debit Unearned Service Revenue and credit Accounts Receivable. C. d. 5. Which of the following account's balance will change between the adjusted trial balance and the post-closing trial balance? Common stock b Prepaid rent C Unearned service revenue d Retained earnings a. coDoo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started