Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15 A bank has just sold 500,000 European call options on AICO stock (assume each option is on one share). The call options have an

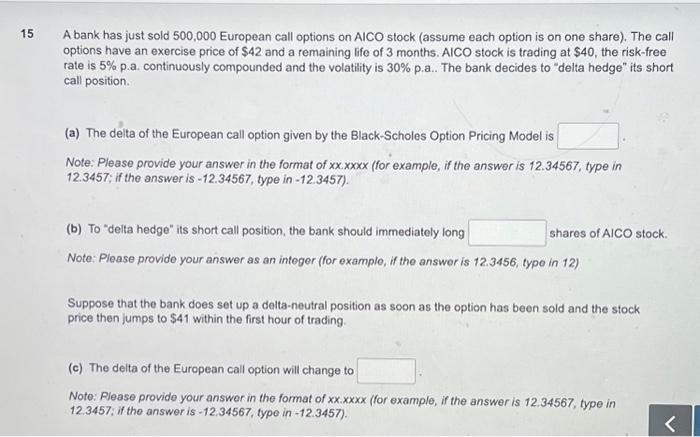

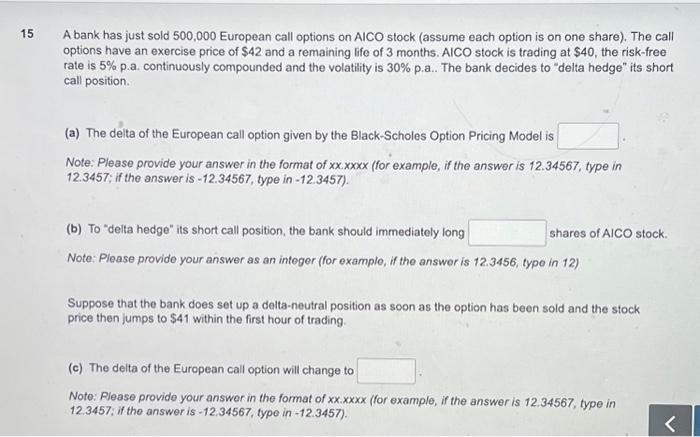

15 A bank has just sold 500,000 European call options on AICO stock (assume each option is on one share). The call options have an exercise price of $42 and a remaining life of 3 months. AICO stock is trading at $40, the risk-free rate is 5% p.a. continuously compounded and the volatility is 30% p.a.. The bank decides to "delta hedge" its short call position. (a) The delta of the European call option given by the Black-Scholes Option Pricing Model is Note: Please provide your answer in the format of xx.xxxx (for example, if the answer is 12.34567, type in 12.3457; if the answer is -12.34567, type in -12.3457). (b) To "delta hedge" its short call position, the bank should immediately long Note: Please provide your answer as an integer (for example, if the answer is 12.3456, type in 12) shares of AICO stock. Suppose that the bank does set up a delta-neutral position as soon as the option has been sold and the stock price then jumps to $41 within the first hour of trading. (c) The delta of the European call option will change to Note: Please provide your answer in the format of xx.xxxx (for example, if the answer is 12.34567, type in 12.3457; if the answer is -12.34567, type in -12.3457).

A bank has just sold 500,000 European call options on AICO stock (assume each option is on one share). The call options have an exercise price of $42 and a remaining life of 3 months. AlCO stock is trading at $40, the risk-free rate is 5% p.a. continuously compounded and the volatility is 30% p.a.. The bank decides to "delta hedge" its short call position. (a) The delta of the European call option given by the Black-Scholes Option Pricing Model is Note: Please provide your answer in the format of xx.xxxx (for example, if the answer is 12.34567, type in 12.3457; if the answer is - 12.34567, type in -12.3457). (b) To "delta hedge" its short call position, the bank should immediately long shares of AlCO stock. Note: Please provido your answer as an integer (for example, if the answer is 12.3456, type in 12) Suppose that the bank does set up a delta-neutral position as soon as the option has been sold and the stock price then jumps to $41 within the first hour of trading. (c) The delta of the European call option will change to Note: Please provido your answer in the format of xx.xxxx (for example, if the answer is 12.34567 , type in 12.3457; if the answer is -12.34567, type in -12.3457)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started