Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15. ABC purchased a call option on 100 shares of XYZ stock. The strike price is $80. If the current stock price is $92, the

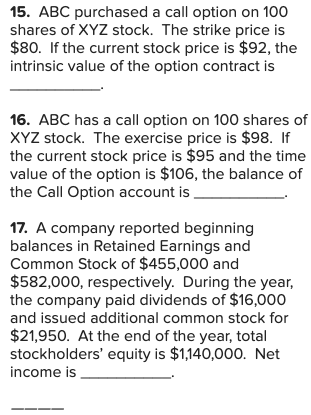

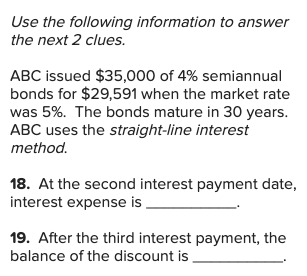

15. ABC purchased a call option on 100 shares of XYZ stock. The strike price is $80. If the current stock price is $92, the intrinsic value of the option contract is 16. ABC has a call option on 100 shares of XYZ stock. The exercise price is $98. If the current stock price is $95 and the time value of the option is $106, the balance of the Call Option account is. 17. A company reported beginning balances in Retained Earnings and Common Stock of $455,000 and $582,000, respectively. During the year, the company paid dividends of $16,000 and issued additional common stock for $21,950. At the end of the year, total stockholders' equity is $1,140,000. Net income is Use the following information to answer the next 2 clues. ABC issued $35,000 of 4% semiannual bonds for $29,591 when the market rate was 5%. The bonds mature in 30 years. ABC uses the straight-line interest method. 18. At the second interest payment date, interest expense is 19. After the third interest payment, the balance of the discount is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started