Answered step by step

Verified Expert Solution

Question

1 Approved Answer

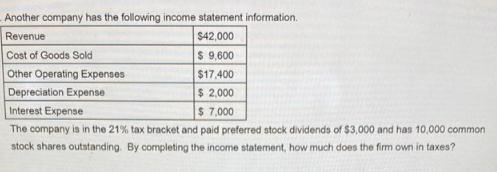

Another company has the following income statement information. Revenue $42,000 $ 9,600 $17.400 Depreciation Expense $ 2,000 Interest Expense $ 7,000 The company is

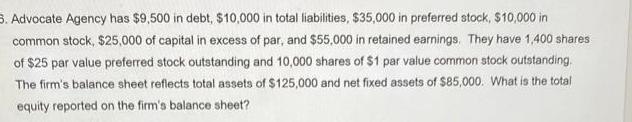

Another company has the following income statement information. Revenue $42,000 $ 9,600 $17.400 Depreciation Expense $ 2,000 Interest Expense $ 7,000 The company is in the 21% tax bracket and paid preferred stock dividends of $3,000 and has 10,000 common stock shares outstanding. By completing the income statement, how much does the firm own in taxes? Cost of Goods Sold Other Operating Expenses 3. Advocate Agency has $9,500 in debt, $10,000 in total liabilities, $35,000 in preferred stock, $10,000 in common stock, $25,000 of capital in excess of par, and $55,000 in retained earnings. They have 1,400 shares of $25 par value preferred stock outstanding and 10,000 shares of $1 par value common stock outstanding. The firm's balance sheet reflects total assets of $125,000 and net fixed assets of $85,000. What is the total equity reported on the firm's balance sheet?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started