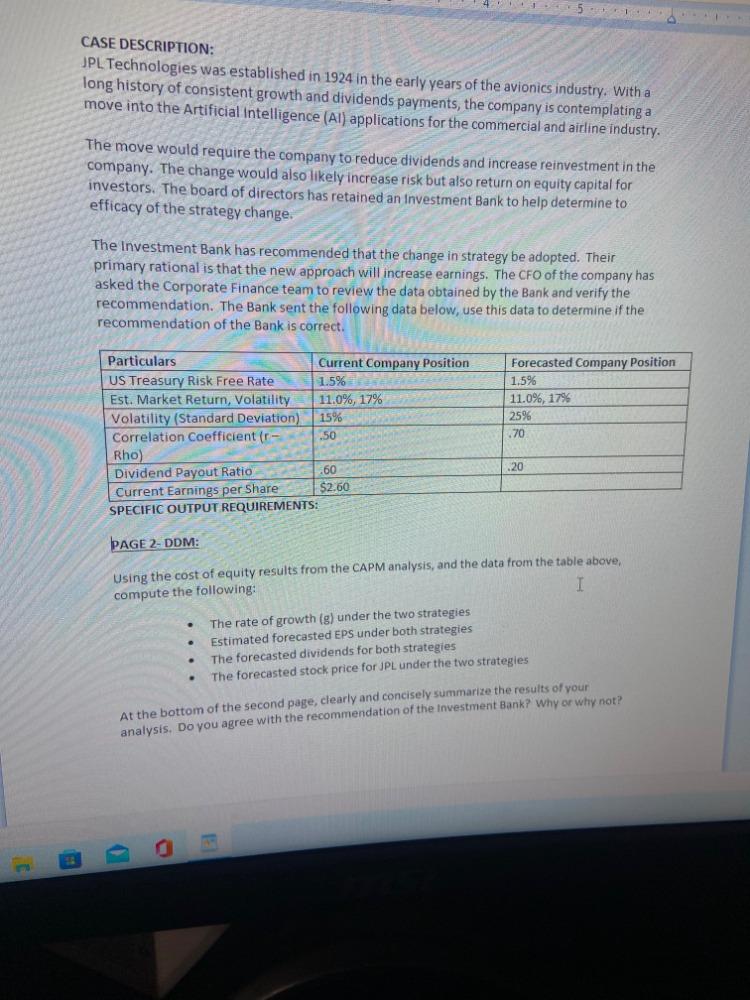

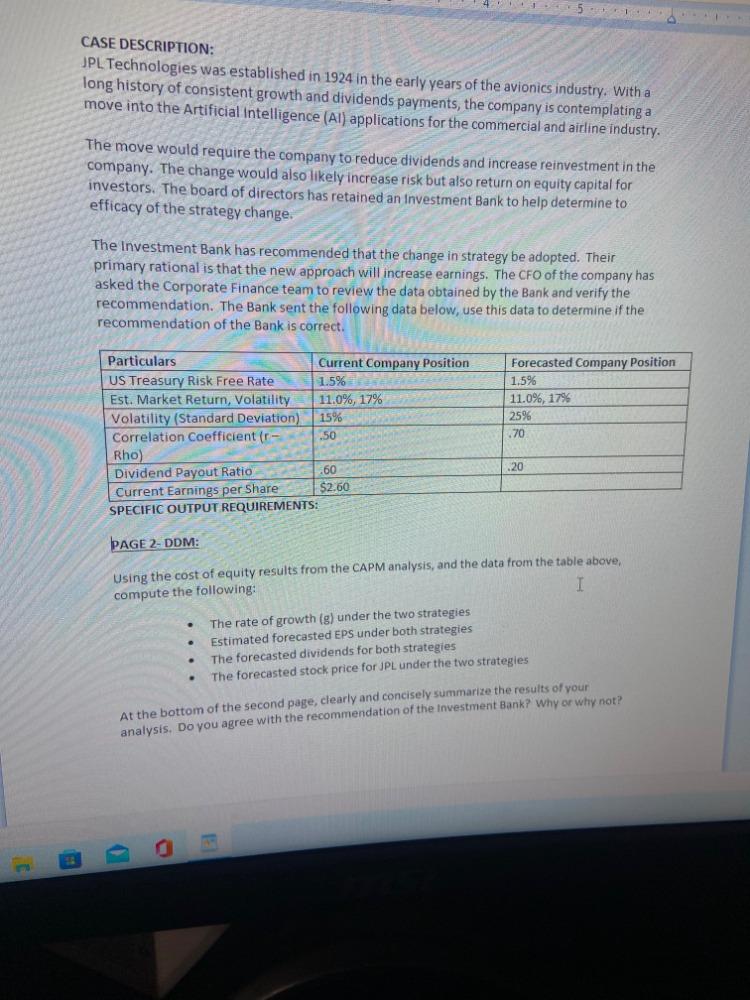

15 CASE DESCRIPTION: JPL Technologies was established in 1924 in the early years of the avionics industry. With a long history of consistent growth and dividends payments, the company is contemplating a move into the Artificial Intelligence (AI) applications for the commercial and airline industry. The move would require the company to reduce dividends and increase reinvestment in the company. The change would also likely increase risk but also return on equity capital for investors. The board of directors has retained an investment Bank to help determine to efficacy of the strategy change. The Investment Bank has recommended that the change in strategy be adopted. Their primary rational is that the new approach will increase earnings. The CFO of the company has asked the Corporate Finance team to review the data obtained by the Bank and verify the recommendation. The Bank sent the following data below, use this data to determine if the recommendation of the Bank is correct. Particulars Current Company Position US Treasury Risk Free Rate 1.5% Est. Market Return, Volatility 11.0%, 17% Volatility (Standard Deviation) 15% Correlation coefficient ir- .50 Rho) Dividend Payout Ratio 60 Current Earnings per Share $2.50 SPECIFIC OUTPUT REQUIREMENTS: Forecasted Company Position 1.5% 11.0%, 17% 25% 170 .20 PAGE 2- DDM: Using the cost of equity results from the CAPM analysis, and the data from the table above, compute the following: I The rate of growth (g) under the two strategies Estimated forecasted EPS under both strategies The forecasted dividends for both strategies The forecasted stock price for JPL under the two strategies At the bottom of the second page, clearly and concisely summarize the results of your analysis. Do you agree with the recommendation of the investment Bank? why or why not? 15 CASE DESCRIPTION: JPL Technologies was established in 1924 in the early years of the avionics industry. With a long history of consistent growth and dividends payments, the company is contemplating a move into the Artificial Intelligence (AI) applications for the commercial and airline industry. The move would require the company to reduce dividends and increase reinvestment in the company. The change would also likely increase risk but also return on equity capital for investors. The board of directors has retained an investment Bank to help determine to efficacy of the strategy change. The Investment Bank has recommended that the change in strategy be adopted. Their primary rational is that the new approach will increase earnings. The CFO of the company has asked the Corporate Finance team to review the data obtained by the Bank and verify the recommendation. The Bank sent the following data below, use this data to determine if the recommendation of the Bank is correct. Particulars Current Company Position US Treasury Risk Free Rate 1.5% Est. Market Return, Volatility 11.0%, 17% Volatility (Standard Deviation) 15% Correlation coefficient ir- .50 Rho) Dividend Payout Ratio 60 Current Earnings per Share $2.50 SPECIFIC OUTPUT REQUIREMENTS: Forecasted Company Position 1.5% 11.0%, 17% 25% 170 .20 PAGE 2- DDM: Using the cost of equity results from the CAPM analysis, and the data from the table above, compute the following: I The rate of growth (g) under the two strategies Estimated forecasted EPS under both strategies The forecasted dividends for both strategies The forecasted stock price for JPL under the two strategies At the bottom of the second page, clearly and concisely summarize the results of your analysis. Do you agree with the recommendation of the investment Bank? why or why not