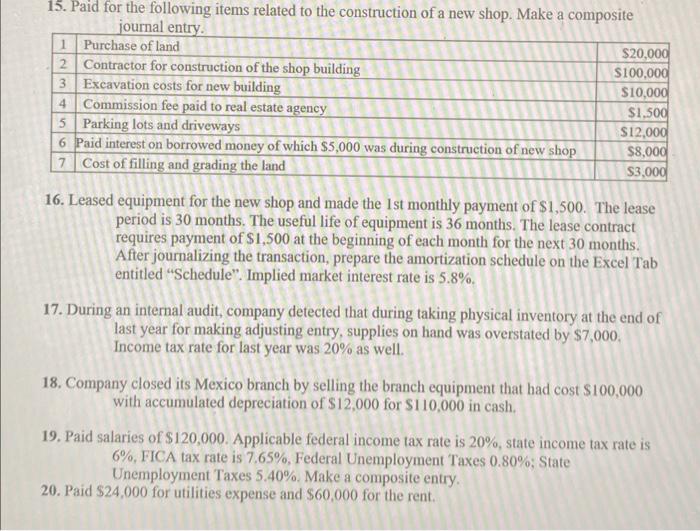

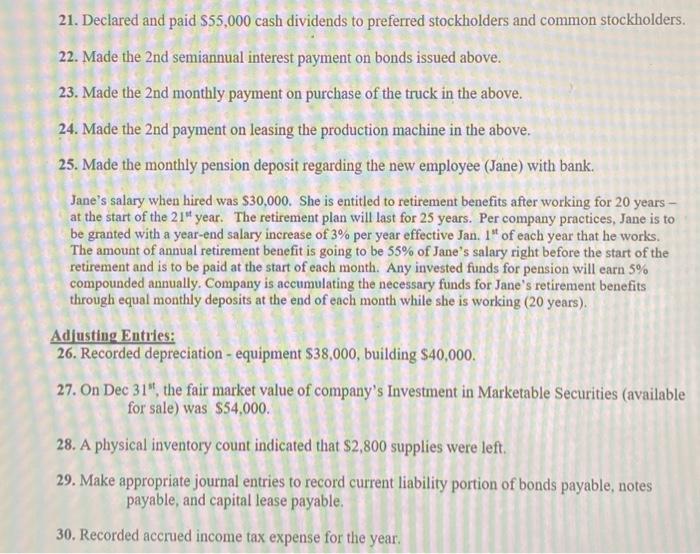

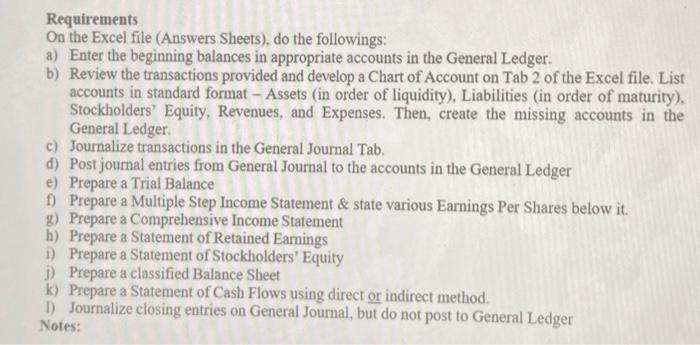

15. Paid for the following items related to the construction of a new shop. Make a composite iournal entrv. 16. Leased equipment for the new shop and made the 1st monthly payment of $1,500. The lease period is 30 months. The useful life of equipment is 36 months. The lease contract requires payment of $1,500 at the beginning of each month for the next 30 months. After journalizing the transaction, prepare the amortization schedule on the Excel Tab entitled "Schedule". Implied market interest rate is 5.8%. 17. During an internal audit, company detected that during taking physical inventory at the end of last year for making adjusting entry, supplies on hand was overstated by $7,000. Income tax rate for last year was 20% as well. 18. Company closed its Mexico branch by selling the branch equipment that had cost $100,000 with accumulated depreciation of $12,000 for $110,000 in cash. 19. Paid salaries of $120,000. Applicable federal income tax rate is 20%, state income tax rate is 6%, FICA tax rate is 7.65%, Federal Unemployment Taxes 0.80%; State Unemployment Taxes 5.40%. Make a composite entry. 21. Declared and paid $55,000 cash dividends to preferred stockholders and common stockholders. 22. Made the 2nd semiannual interest payment on bonds issued above. 23. Made the 2nd monthly payment on purchase of the truck in the above. 24. Made the 2nd payment on leasing the production machine in the above. 25. Made the monthly pension deposit regarding the new employee (Jane) with bank. Jane's salary when hired was $30,000. She is entitled to retirement benefits after working for 20 years at the start of the 211t year. The retirement plan will last for 25 years. Per company practices, Jane is to be granted with a year-end salary increase of 3% per year effective Jan. 1st of each year that he works. The amount of annual retirement benefit is going to be 55% of Jane's salary right before the start of the retirement and is to be paid at the start of each month. Any invested funds for pension will earn 5\% compounded annually. Company is accumulating the necessary funds for Jane's retirement benefits through equal monthly deposits at the end of each month while she is working ( 20 years). Adlusting Entrites: 26. Recorded depreciation - equipment $38,000, building $40,000. 27. On Dec 31tt, the fair market value of company's Investment in Marketable Securities (available for sale) was $54,000. 28. A physical inventory count indicated that $2,800 supplies were left. 29. Make appropriate journal entries to record current liability portion of bonds payable, notes payable, and capital lease payable. 30. Recorded accrued income tax expense for the year. Requirements On the Excel file (Answers Sheets), do the followings: a) Enter the beginning balances in appropriate accounts in the General Ledger. b) Review the transactions provided and develop a Chart of Account on Tab 2 of the Excel file. List accounts in standard format - Assets (in order of liquidity), Liabilities (in order of maturity), Stockholders' Equity, Revenues, and Expenses. Then, create the missing accounts in the General Ledger. c) Journalize transactions in the General Journal Tab. d) Post journal entries from General Journal to the accounts in the General Ledger e) Prepare a Triat Balance f) Prepare a Multiple Step Income Statement \& state various Earnings Per Shares below it. g) Prepare a Comprehensive Income Statement h) Prepare a Statement of Retained Eamings i) Prepare a Statement of Stockholders' Equity j) Prepare a classified Balance Sheet k) Prepare a Statement of Cash Flows using direct or indirect method. I) Journalize closing entries on General Journal, but do not post to General Ledger Notes