Answered step by step

Verified Expert Solution

Question

1 Approved Answer

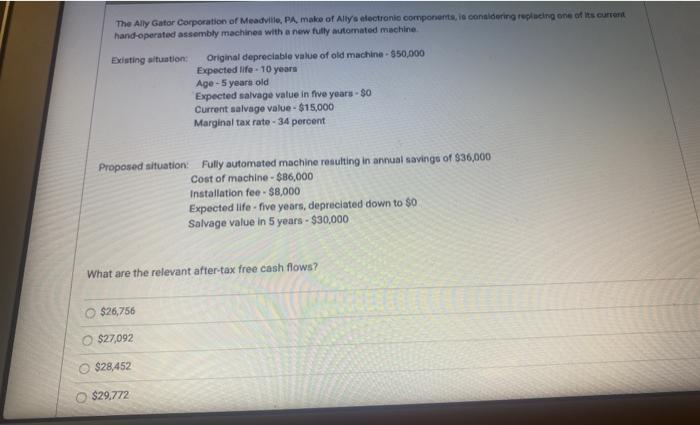

15 please show work thank you. The Ally Gator Corporation of Meadville, PA make of Ally's electronic components, is considering replacing one of its current

15 please show work thank you.

The Ally Gator Corporation of Meadville, PA make of Ally's electronic components, is considering replacing one of its current hand-operated assembly machines with a new fully automated machine Existing situation Original depreciable value of old machine - $50,000 Expected life-10 years Age-5 years old Expected salvage value in five years - $0 Current salvage value - $15,000 Marginal tax rate - 34 percent Proposed situation: fully automated machine resulting in annual savings of 836,000 Cost of machine - $86,000 Installation fee - $8,000 Expected life-five years, depreciated down to $0 Salvage value in 5 years - $30,000 What are the relevant after-tax free cash flows? $26,756 $27,092 $28,452 $29.772

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started