\

\

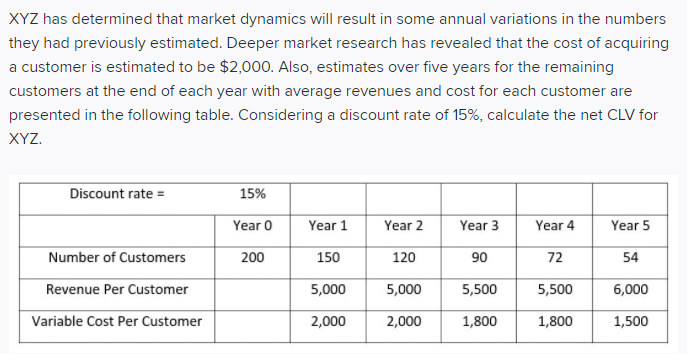

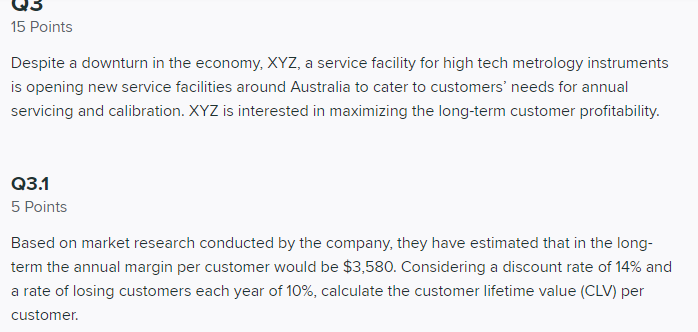

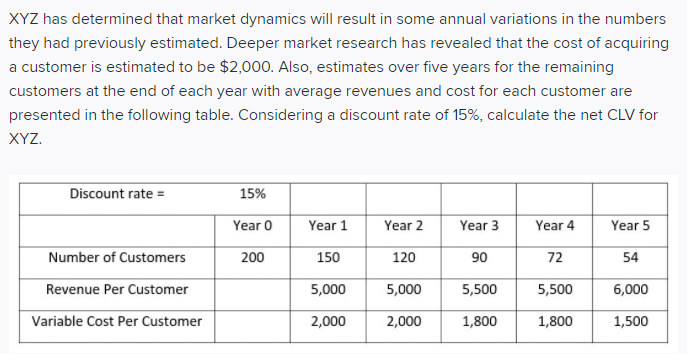

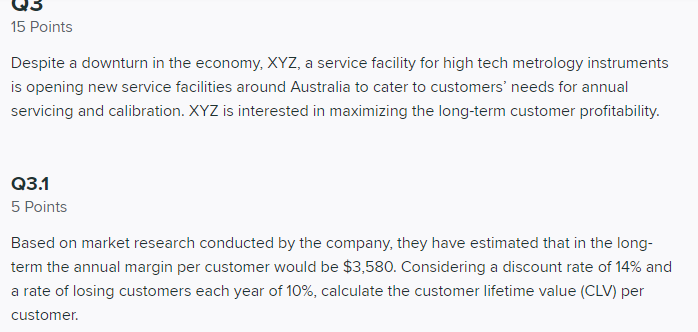

15 Points Despite a downturn in the economy, XYZ, a service facility for high tech metrology instruments is opening new service facilities around Australia to cater to customers' needs for annual servicing and calibration. XYZ is interested in maximizing the long-term customer profitability. Q3.1 5 Points Based on market research conducted by the company, they have estimated that in the long- term the annual margin per customer would be $3,580. Considering a discount rate of 14% and a rate of losing customers each year of 10%, calculate the customer lifetime value (CLV) per customer XYZ has determined that market dynamics will result in some annual variations in the numbers they had previously estimated. Deeper market research has revealed that the cost of acquiring a customer is estimated to be $2,000. Also, estimates over five years for the remaining customers at the end of each year with average revenues and cost for each customer are presented in the following table. Considering a discount rate of 15%, calculate the net CLV for XYZ Discount rate = 15% Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Number of Customers 200 150 120 90 72 54 Revenue Per Customer 5,000 5,000 5,500 5,500 6,000 Variable Cost Per Customer 2,000 2,000 1,800 1,800 1,500 15 Points Despite a downturn in the economy, XYZ, a service facility for high tech metrology instruments is opening new service facilities around Australia to cater to customers' needs for annual servicing and calibration. XYZ is interested in maximizing the long-term customer profitability. Q3.1 5 Points Based on market research conducted by the company, they have estimated that in the long- term the annual margin per customer would be $3,580. Considering a discount rate of 14% and a rate of losing customers each year of 10%, calculate the customer lifetime value (CLV) per customer XYZ has determined that market dynamics will result in some annual variations in the numbers they had previously estimated. Deeper market research has revealed that the cost of acquiring a customer is estimated to be $2,000. Also, estimates over five years for the remaining customers at the end of each year with average revenues and cost for each customer are presented in the following table. Considering a discount rate of 15%, calculate the net CLV for XYZ Discount rate = 15% Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Number of Customers 200 150 120 90 72 54 Revenue Per Customer 5,000 5,000 5,500 5,500 6,000 Variable Cost Per Customer 2,000 2,000 1,800 1,800 1,500

\

\