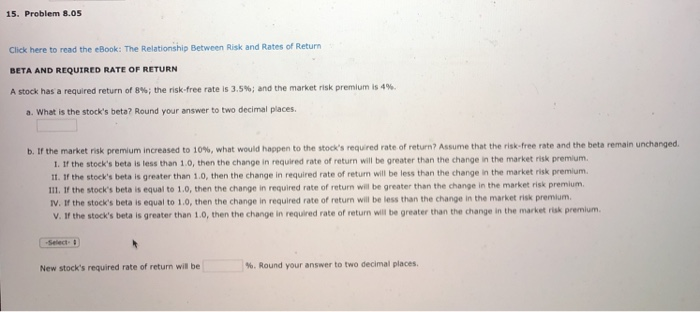

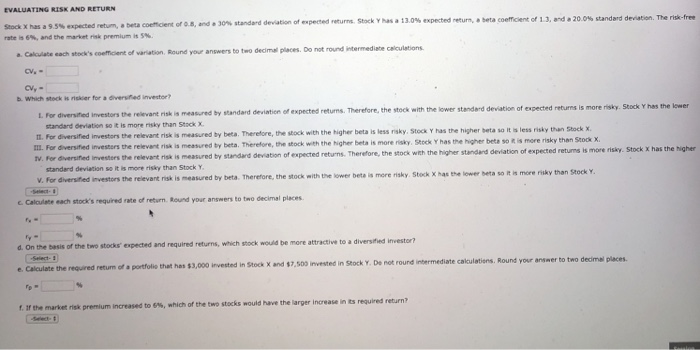

15. Problem 8.0S Click here to read the eBook: The Relationship Between Risk and Rates of Return BETA AND REQUIRED RATE OF RETURN A stock has a required return of 8%; the risk-free rate is 3.5%; and the market risk premium is 4%. a. What is the stock's beta? Round your answer to two decimal places. b. If the market risk pre mium increased to 10% what would happen to the stock's required rate of return? Assume that the risk-free rate and the beta remain unchanged. I. If the stock's beta is less than 1.0, then the change in required rate of return will be greater than the change in the market risk premium. It. I1 the stock's beta is greater than 1.0, then the change in required rate of return will be less than the change in the market risk premium. III. If the stock's beta is equal to 1.0, then the change in required rate of return will be greater than the change in the market risk premium V. If the stock's beta is equal to 1.0, then the change in required rate of return will be less than the change in the market risk premium. V. If the stock's beta is greater than 1.0, then the change in required rate of return will be greater than the change in the market risk premium. Select New stock's required rate of return will be %. Round your answer to two decimal places. t 20 O% standard devato The risk-free coencent of8, and . 30% standard deviation of expected reums, stock Y has a 13.0% expected return, , beta coemoent of L3, and t is 6m, and the market nsk premium is 5%. to two decimal places. Oo not round intermediate calculations a. Calculate each stock's coefficient of variation. Round your answers b. Which stock ih risker for a diversified investor? investors the relevant risk is measured by standard devlation of expected retuns. Therefore, the stock with the lower stenderd devation of expected returns is more risky. Stock Y has the lewer standard on ation so t is more nsky than Stock x. 1n. m. For dversted investers the relevant risk is measured by beta. Therefore, the .tock with the higher beta is more nsky, Steck Y has me heer beta soa mere nsky than Seo X. ry. For rtifed ivesters the relevant nsk is measured by s less nay than Stock x. nvestors the relevant risk is measured by beta. Therefore, the stock with the higher beta is less raky. Stoa Y has the higher beta so t standard dev ation of expected returns. Therefore, the stock with the higher standad deviation of expected retums is more risky. Stock X has the Nghe standard deviation so it is more risky than Stock Y V. For diversifted investors the r relevant risk is measured by beta. Therefore, the stock with the lower beta is more risky. Stock X has the lower beta so it is more risky than Stock Y .Calciate each stock's required rate of ret m Round your answer, to two decimal places iversitfied investor? d. On the besis of the two stocks' expected and required returns, which stock would be more attractive to a di ound intermediate cakculations.Round your answer to two dedimal places e. Calculate the required returm of a portfolis that has $3,000 invested in Stock X and $7,500 invested in Stock Y. De notr the two stocks would have the larger increase ts required return, r. If the market risk premium increased to 6%, which of