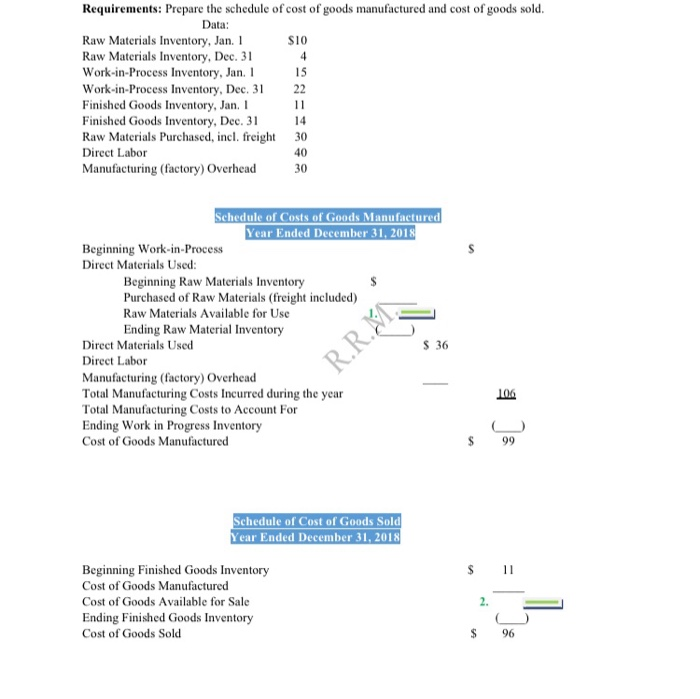

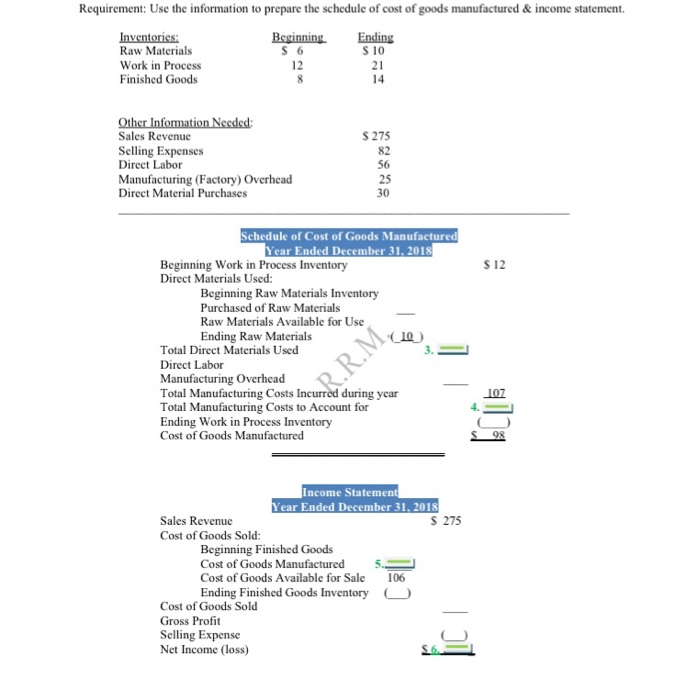

15 Requirements: Prepare the schedule of cost of goods manufactured and cost of goods sold. Data: Raw Materials Inventory, Jan. 1 $10 Raw Materials Inventory, Dec. 31 Work-in-Process Inventory, Jan. 1 Work-in-Process Inventory, Dec. 31 Finished Goods Inventory, Jan. 1 Finished Goods Inventory, Dec. 31 Raw Materials Purchased, incl. freight 30 Direct Labor 40 Manufacturing (factory) Overhead Schedule of Costs of Goods Manufactured Year Ended December 31, 2018 Beginning Work-in-Process Direct Materials Used: Beginning Raw Materials Inventory Purchased of Raw Materials (freight included) Raw Materials Available for Use Ending Raw Material Inventory Direct Materials Used S 36 Direct Labor Manufacturing (factory) Overhead Total Manufacturing Costs Incurred during the year Total Manufacturing Costs to Account For Ending Work in Progress Inventory Cost of Goods Manufactured Schedule of Cost of Goods Sold Year Ended December 31, 2018 $ 11 Beginning Finished Goods Inventory Cost of Goods Manufactured Cost of Goods Available for Sale Ending Finished Goods Inventory Cost of Goods Sold 96 Requirement: Use the information to prepare the schedule of cost of goods manufactured & income statement. Beginning S6 Inventories: Raw Materials Work in Process Finished Goods Ending S 10 21 Other Information Needed: Sales Revenue Selling Expenses Direct Labor Manufacturing (Factory) Overhead Direct Material Purchases Schedule of Cost of Goods Manufactured Year Ended December 31, 2018 Beginning Work in Process Inventory Direct Materials Used: Beginning Raw Materials Inventory Purchased of Raw Materials Raw Materials Available for Use Ending Raw Materials Total Direct Materials Used Direct Labor Manufacturing Overhead Total Manufacturing Costs Incurred during year Total Manufacturing Costs to Account for Ending Work in Process Inventory Cost of Goods Manufactured Income Statement Year Ended December 31, 2018 Sales Revenue S 275 Cost of Goods Sold: Beginning Finished Goods Cost of Goods Manufactured 5. Cost of Goods Available for Sale 106 Ending Finished Goods Inventory O Cost of Goods Sold Gross Profit Selling Expense Net Income (loss)