Answered step by step

Verified Expert Solution

Question

1 Approved Answer

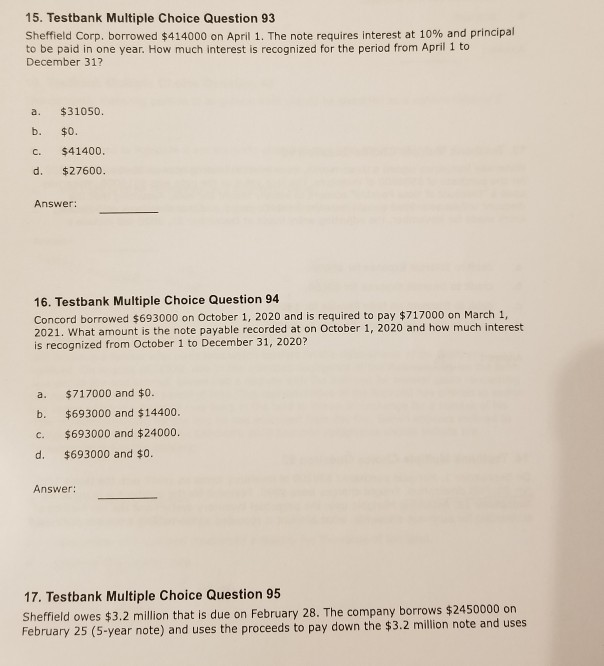

15. Testbank Multiple Choice Question 93 Sheffield Corp. borrowed $414000 on April 1. The note requires interest at 10% and principal to be paid in

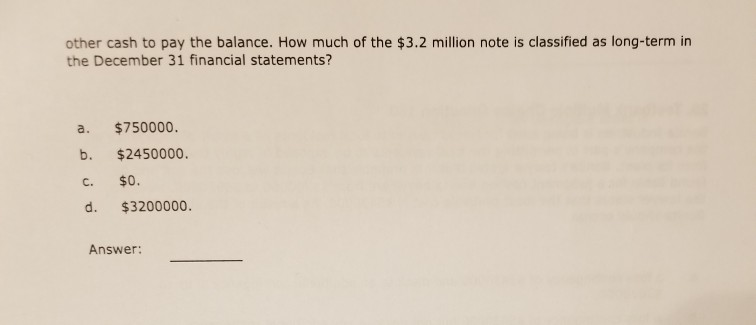

15. Testbank Multiple Choice Question 93 Sheffield Corp. borrowed $414000 on April 1. The note requires interest at 10% and principal to be paid in one year. How much interest is recognized for the period from April 1 to December 317 a. b. C. d. $31050 $0. $41400 $27600 Answer: 16. Testbank Multiple Choice Question 94 Concord borrowed $693000 on October 1, 2020 and is required to pay $717000 on March 1. 2021. What amount is the note payable recorded at on October 1, 2020 and how much interest is recognized from October 1 to December 31, 2020? a. b. c. d. $717000 and $0. $693000 and $14400. $693000 and $24000. $693000 and $0. Answer: 17. Testbank Multiple Choice Question 95 Sheffield owes $3.2 million that is due on February 28. The company borrows $2450000 on February 25 (5-year note) and uses the proceeds to pay down the $3.2 million note and uses other cash to pay the balance. How much of the $3.2 million note is classified as long-term in the December 31 financial statements? b. $750000. $2450000 $0. $3200000. C. d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started