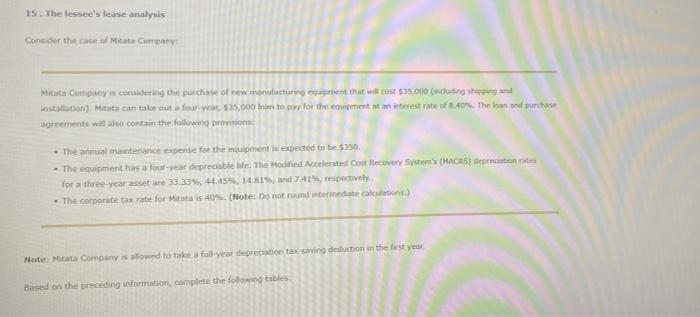

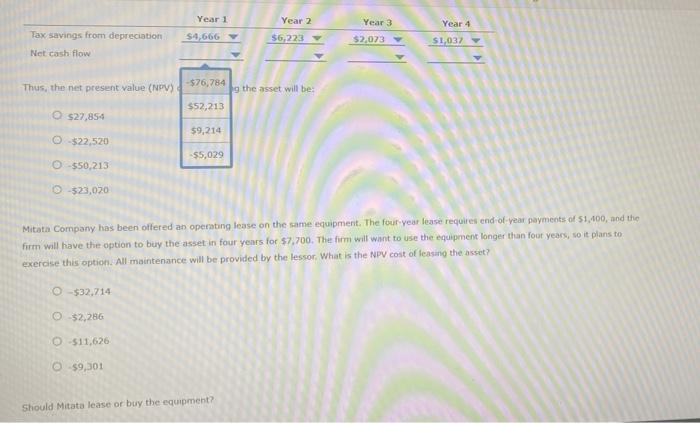

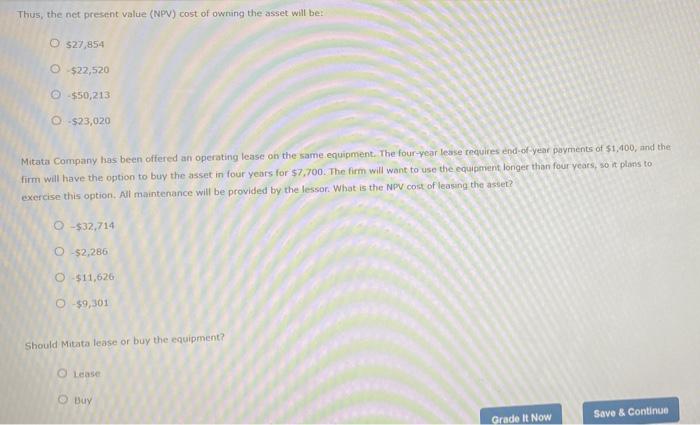

15. The lessee's lease analysis Consider the case of Mtata Cuerpany Mitata Company is considering the purchase of new manufacturing pret that will cost $35.000 (coding shipping and Installation). Mtata can take out a four-year $35.000 loan to pay for the equipment at an interest rate of 8.40%. The loan sed purchase agreement will also contain the following provisions The annual maintenance expense for the equipment is expected to be $350. - The equipment has a four-year deprecable life. The Modified Accelerated Cost Recovery System's (MACR5) deceecastion et for a three-year asset are 33.33%, 44.45 14.815, and 7415, respectively The corporate tax rate for Mata is 40%. (Note: Do not round intermediate actions) Note: Mtata Company lowed to take a full year depreciation tax saving deduction in the first year Based on the preceding information, complete the following tables Year 1 Year 2 Year 3 Year 4 Tax savings from depreciation $4,666 56,223 $2,073 S1,037 Net cash flow Thus, the net present value (NPV) -$76,784 g the asset will be $52,213 $27,854 59,214 $22.520 $5,029 550,213 $23,020 Mitata Company has been offered an operating lease on the same equipment. The four year lease requires end of year payments of $1,400, and the firm will have the option to buy the asset in four years for $7,700. The firm will want to use the equipment longer than four years, so it plans to exercise this option. All maintenance will be provided by the lessor, What is the NPU cost of leasing the asset? O $32,714 O $2,286 O $11,626 $9,301 Should Mitata lease or buy the equipment? Thus, the net present value (NPV) cost of owning the asset will be O $27,854 O $22,520 $50,213 $23,020 Mitata Company has been offered an operating lease on the same equipment. The four-year lease requires end of year payments of $1,400, and the firm will have the option to buy the asset in four years for $7,700. The firm will want to use the equipment longer than four years, so it plans to exercise this option. All maintenance will be provided by the lessor. What is the NPV cost of leasing the asset? -$32,714 52,286 O $11,626 $9,301 Should Mitata lease or buy the equipment? Buy Save & Continue Grade It Now